Welcome to Chit Chat Money’s Sunday Finds + 3 Thoughts From Last Week. In this newsletter you will find three topics I thought about last week, links to shows we’ve recently released, and links to some interesting articles, podcasts, and tweets. Check out the archive here.

1. Running on a treadmill vs. floating down a river

Time for another investing analogy, even though everyone is sick of them. This was inspired by us recording some podcasts on companies that have to work really hard to succeed (cough, cough, Poshmark).

When looking for companies to invest in, one question I ask is “What happens if management stops trying to move forward?” This just means trying to figure out what the financials would look like if nobody at the company worked to grow the business, do financial engineering, etc. All they did was keep existing systems running smoothly. A company that is floating down a river does just fine if they stop paddling. Yes, they might not be moving as fast as before, but the environment remains calm and the boat is headed in the right direction. A company that is running on a treadmill (i.e. running to just stay in place) collapses and injures itself if they stop trying to move forward. In fact, they have to put in tons of effort to never actually make tangible progress.

(I don’t use the paddle upstream analogy because 1) when you paddle upstream, you can actually move forward, and 2) if you stop paddling upstream, you move in the wrong direction, but don’t crash and burn. Running on a treadmill captures the type of company I’m trying to avoid more specifically.)

Here are some indicators that a company is running on a treadmill:

High levels of marketing spend vs. revenue growth

Bad working capital dynamics that keep “earnings” from ever turning into cash

Reliance on outside capital to fund investments

Reliance on macroeconomic factors (commodity prices, stuff like that) to succeed financially

I use this company as an example a lot, but Visa is ideal for explaining this floating down a river analogy. Management and employees can consistently paddle to pick up speed (marketing spend, getting into new regions, signing partners), but even if nobody did anything but keep existing systems running, the company would still print money. Why? Because of its ingenious business model and the long-term tailwind that is non-cash payments.

Of course, it is the rare company that actually turns off all growth engines. But even so, I think this exercise can be helpful in determining what a good vs. bad business is.

2. Did Amazon just kill Uber Eats and DoorDash?

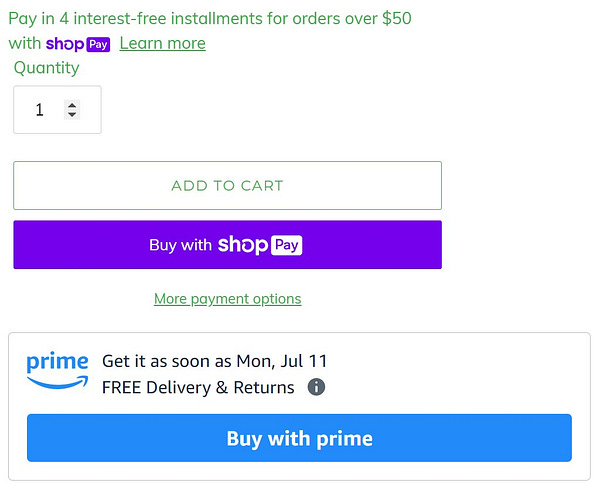

Potentially monumental news dropped this week in the food delivery market:

Now all Prime members in the United States can enjoy the same perks from their favorite restaurants with a free, year-long Grubhub+ membership trial. Starting today, Prime members in the U.S. can sign up for Grubhub+ for free and access unlimited $0 delivery fees from hundreds of thousands of restaurants on Grubhub for one year.

As a member of a Prime household (who isn’t in the United States these days?) I’ve already signed up for my free year-long trial. Over the next year, there is no way I will be using Uber Eats or DoorDash unless they give me that subsidized 50 % off your order offer (yes, they are still doing those).

We all know the unit economics of food delivery are shit, and adding another stakeholder into the mix (Amazon) is just one more mouth to feed while trying to get everyone to positive cash flow. But unlike DoorDash or Uber, Amazon could care less if they burn $1 billion to kill off the rest of the market. I wish it were free Grubhub+ for life, as that would be a fatal blow to Doordash and Uber Eat’s hopes, but I think this will still do the trick. Plus, even if Amazon burns $1 billion through this partnership in the short run, it can win in the long run through the option it was granted to buy a huge stake in Grubhub (owned by Just Eat Takeaway) and by eventually raising Prime prices again.

The only obvious downside is that food delivery seems like a market where it is impossible to make all stakeholders happy. I don’t know if adding Amazon to the mix changes that.

I wonder if Prime will ever get sliced up into modulized tiers? There are so many parts to it that I don’t think anyone enjoys all the benefits, so it could be consumer-friendly (and pricing power friendly) to let people somewhat choose which benefits they want, which will bring cost vs. value in better harmony. Of course, they still will want free shipping and Prime Video to always be included, as that needs economies of scale.

3. It’s bigger than Twitter

As many of you know, Elon Musk is trying to get out of a deal he signed to buy Twitter for $44 billion. Now, Twitter is suing him to close the deal, which I believe will be fought in a Delaware court. I won’t bore you again with the details (here's an update from Bloomberg), but I’ve become intrigued with the Silicon Valley people defending Musk and opposing Twitter:

I don’t think this is surprising, but revealed a few things to me:

A lot of these VC/technology/software people don’t seem to care about shareholders, but only how they look reputationally to the giants of the industry like Musk. The revealing of this mindset should be concerning for anyone looking to invest money in companies where these people are on the executive team or board of directors. If they don’t respect shareholders in this situation, why would they ever respect you? Huge red flag.

Like all of us, when these perceived geniuses start formulating opinions on topics they are not well versed in, we find out that they are not much different than the rest of us intellectually. This is also how a lot of people realize Elon Musk is a charlatan when he starts bullshitting on topics they actaully know a ton about.

The Twitter court case decision will be monumental. If the court sides with Musk, there will be a precedent that signed contracts can be breached with no consequences. As a society that is supposed to be governed by fair rules (well, at least in the business world most of the time), this seems like a huge step backward and could have major negative ramifications long-term. I know this sounds melodramatic, but if you can’t trust a signed contract, then the business world will operate much less optimally than it should.

Elon Musk will probably win here because he always does. The man has broken the law many times with minimal consequences, so why should anyone think this time will be different?

See you next week,

Brett

***Our fund, Arch Capital, may own securities discussed in this newsletter. Check our holdings page and read our full disclosure to learn more.***

***Want our free weekly wrap-up delivered to your inbox each week? Subscribe here***

Catch up on Our Shows From Last Week

3 Good Reads

He Dropped Out to Become a Poet. Now He’s Won a Fields Medal - Quanta Magazine

One might say the same of his path into mathematics itself: that it was characterized by much wandering and a series of small miracles. When he was younger, Huh had no desire to be a mathematician. He was indifferent to the subject, and he dropped out of high school to become a poet. It would take a chance encounter during his university years — and many moments of feeling lost — for him to find that mathematics held what he’d been looking for all along.

Lifestyles - Morgan Housel

Anyone alone at sea for nine months will start to lose their mind, and there’s evidence both Crowhurst and Moitessier were in poor mental states when their decisions were made. Crowhurst’s last diary entries were incoherent ramblings about submitting your soul to the universe; Moitessier wrote about his long conversations with birds and dolphins.

One such person is the 25-year-old Chicago financial adviser, who said he had put “almost my entire life savings” in Voyager, and that the decision to freeze funds had “destroyed” him both financially and emotionally. Since he became unable to access his funds, he said he has had trouble getting out of bed and is barely eating. He had been in the process of moving to another apartment and now doesn’t even have enough money for the deposit.

1 Good Listen

Marc Andreessen - The Joe Rogan Experience

Marc Andreessen is an entrepreneur, investor, and software engineer. He is co-creator of the world's first widely used internet browser, Mosaic, co-founder of the social media network platform Ning, and co-founder and general partner of the venture capital firm Andreessen Horowitz.

Smart and Funny Tweets: