Welcome to Chit Chat Money’s Sunday Finds + 3 Thoughts From Last Week. In this newsletter you will find three topics I thought about last week, links to shows we’ve recently released, and links to some interesting articles, podcasts, and tweets. Check out the archive here.

Chit Chat Money Podcasts From Last Week

Chit Chat Money is presented by:

Potentially you! Reach out to our email chitchatmoneypodcast@gmail.com if you are interested in doing a sponsorship on our podcast network. Check out our media kit for more information.

1. Impact of Rising Wages for the 90%

There has been a big change to the labor market since I last wrote:

UPS’ CEO said drivers will average $170,000 in pay and benefits such as health care and pensions at the end of a five-year contract that the delivery giant struck with the Teamsters Union last month, averting a strike.

The tentative agreement covers some 340,000 workers at the package carrier. They are in the middle of a ratification vote that began Thursday and ends Aug. 22.

According to many of our best minds on Twitter, these are poverty-level wages in San Francisco and NYC though…

In all seriousness, 340k workers now getting a guaranteed five-year pay hike ladder to $170k is a huge deal. As Amazon has done by boosting wages for its entry-level warehouse positions (and thereby boosting the “real” minimum wage across the country), UPS could kickstart big-time wage gains for middle-class paying labor positions.

The business/economic impact seems pretty damn simple. The more money that is paid to UPS drivers, Chipotle cooks, and manufacturing workers, the less money is retained by corporations to be distributed to shareholders.

I think this puts companies with huge laborforces at risk of margin compression in the upcoming year unless they have a clear precedent of being able to raise prices to counteract inflation.

But…it will be a clear beneficiary to companies that operate take-rate models on consumer spending. The more money in the pockets of the 90%, the more revenue Visa and Mastercard will generate and the more advertising dollars will be spent on Google and Instagram.

All else equal, I want to avoid companies that have huge wage expense risks and search for companies that are immune or will actually benefit from it.

As usual, Buffett was always right on this one.

2. Uncertainty of GLP-1s on CPG Brands

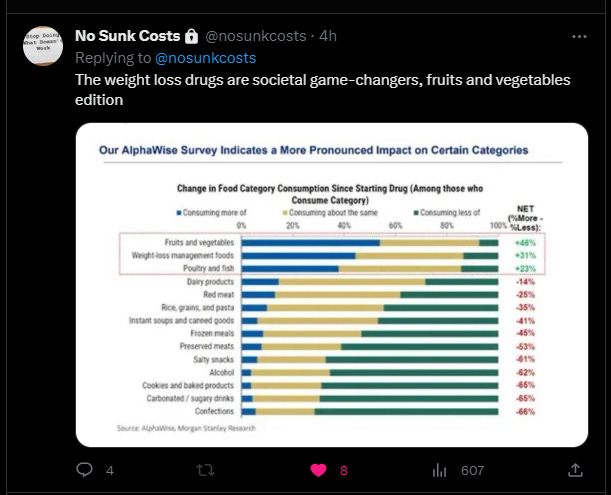

Have to squint to read this, but very interesting survey results:

Always be skeptical with surveys, but these are some crazy results. To be clear, GLP-1s are the weight loss drugs such as Ozempic.

If the hype is real and a huge portion of the population starts using them, we could see a swing in what foods our country consumes.

Candy, alcohol, salty snack, and soda brands could be on the decline, while fruits and vegetables could get a demand tailwind.

This would be terrible news for top CPG stocks such as Hershey, Pepsi, Coca-Cola, etc. If 60% of your core customer base (i.e. the fat people eating too many Reese’s Cups) eat fewer pieces of candy because of these revolutionary drugs, that would obviously hurt sales.

I feel like CPG stocks deserve a huge discount given this new uncertainty. Why would you invest in them over tobacco stocks right now? (both have terribly negative impacts on society, so there can’t be a moral argument here)

3. And…

Nothing much else comes to mind in the business world right now. It’s August. Markets are going to be boring until after Labor Day. Get outside and enjoy some sun.

See you next week,

Brett

***Our fund, Arch Capital, may own securities discussed in this newsletter. Check our holdings page and read our full disclosure to learn more.***

***Want our FREE weekly wrap-up delivered to your inbox each week? Subscribe here***

3 Intriguing Reads

The other significant finding of our test with American is the flights that attempted to avoid creating contrails burned 2% additional fuel. Recent studies show that a small percentage of flights need to be adjusted to avoid the majority of contrail warming. Therefore, the total fuel impact could be as low as 0.3% across an airline’s flights.2

This suggests that contrails could be avoided at scale for around $5-25/ton CO2e (carbon dioxide equivalent) using our existing predictions, making it a cost-effective warming-reduction measure, and further improvements are expected.

1 Good Podcast

Smart, Funny, and Insightful Tweets:

(link)

(link)

(link)