Welcome to Chit Chat Money’s Sunday Finds + 3 Thoughts From Last Week. In this newsletter you will find three topics I thought about last week, links to shows we’ve recently released, and links to some interesting articles, podcasts, and tweets. Check out the archive here.

Chit Chat Money Podcasts From Last Week

P.S. If you want to hear more about Nintendo, check out our recent discussion with 7investing’s Matt Cochrane

Chit Chat Money is presented by:

Potentially you! Reach out to our email chitchatmoneypodcast@gmail.com if you are interested in sponsoring the newsletter, podcast, or both.

1. Disney getting more aggressive with sports streaming?

Disney reported earnings this week. The results seemed to be what people expected (more streaming losses, lower linear TV revenue, theme parks printing money).

But there was a leak from the company that may be the most important development for the business in some time:

Disney is actively preparing to launch a standalone ESPN streaming service, according to a new report from The Wall Street Journal. The report indicates that ESPN is planning to sell its channel directly to cable cord-cutters as a subscription-streaming service in the coming years. It’s unknown when Disney plans to launch the service.

For anyone who pays attention to the streaming TV transition, you know that sports (and especially American Football) is the key asset keeping a lot of people subscribing to the cable bundle. For a lot of sports games like the NBA Finals, you can only watch by subscribing to a traditional bundle like Comcast or a virtual provider like YouTube TV. Either way, right now it costs a pretty penny if you are a sports fan in the United States, especially a younger one that may not watch anything else from the cable bundle.

ESPN — as the most popular collection of sports channels — is a vital piece of this puzzle. When they decide to quit linear TV and make the move to direct-to-consumer, it could send shock waves across the linear TV market and accelerate the cord-cutting transition.

Is it the right move for Disney to let people stream all their sports content now? I think it is. The technology is there, users understand (generally) how it works, and they’ve already succeeded with a soft launch at ESPN+. Making the transition and going DTC with ESPN could hurt profits in the linear TV segment for Disney over the next five years, but getting a little aggressive and ripping the bandaid off will likely set them up for more success over the long haul.

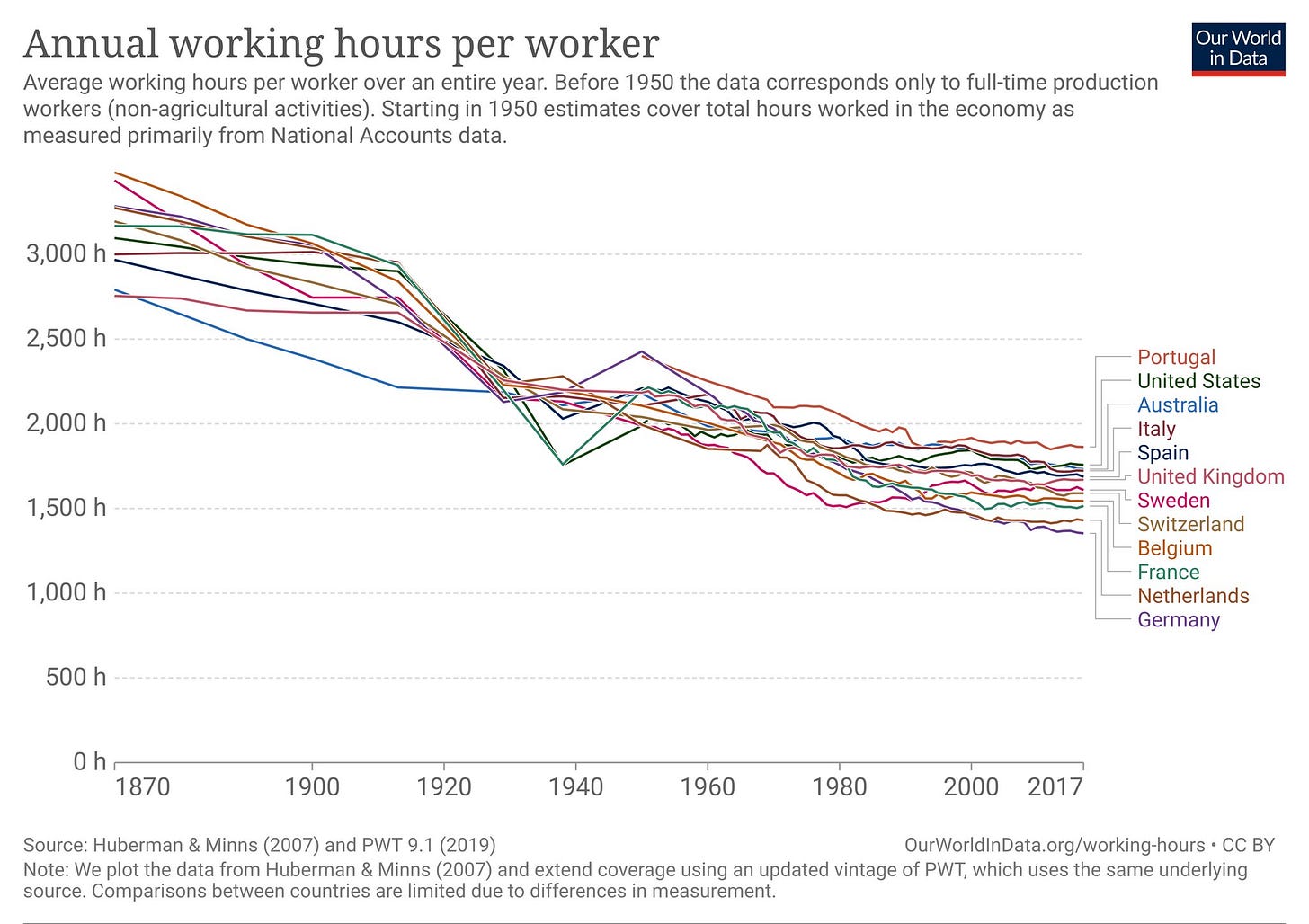

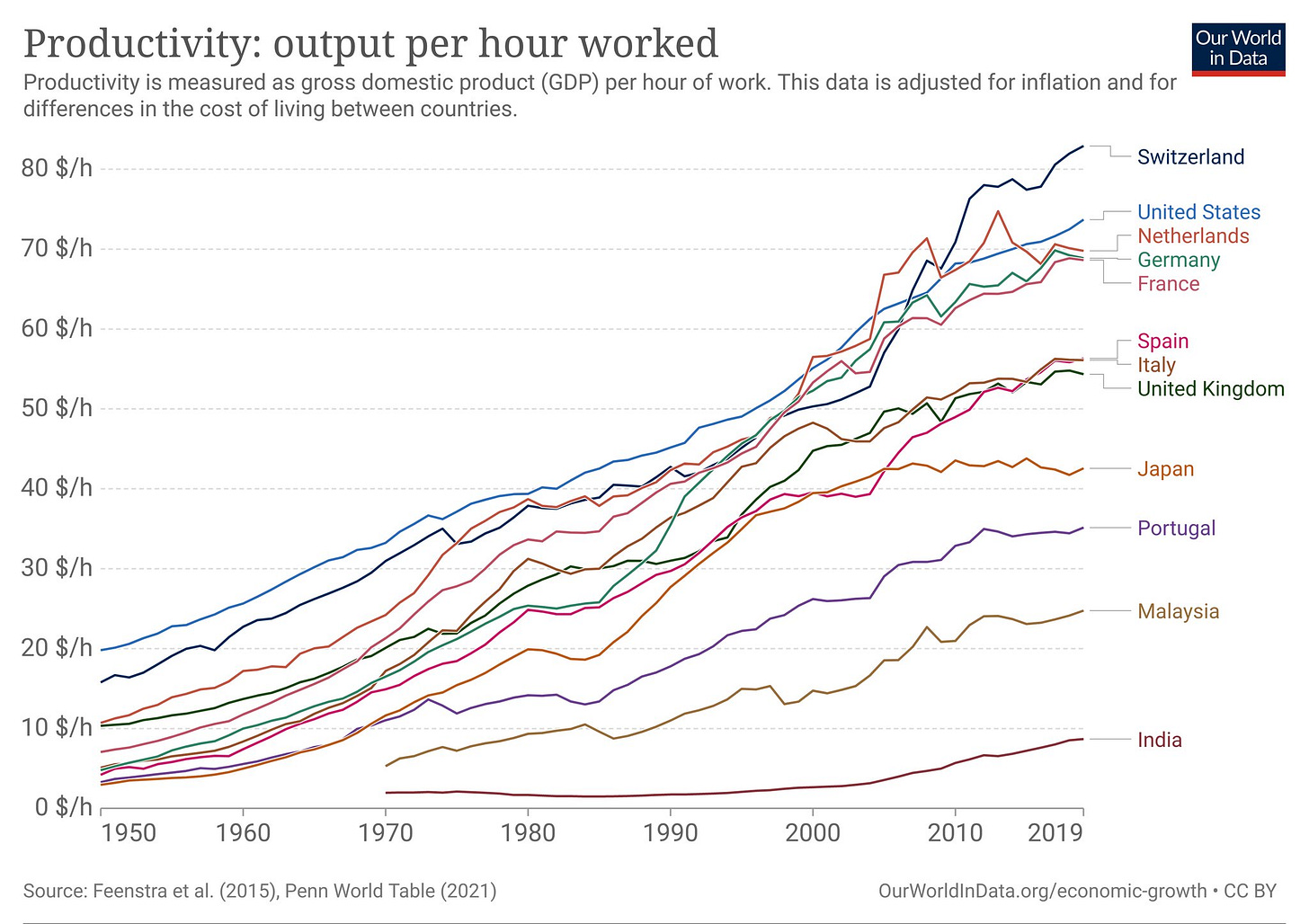

2. Long-term perspective on work and productivity gains

A lot of people — especially those who feel we are in a workaholic culture — may be shocked to see these charts:

(link to the full tweet where I found these in the tweets section)

To sum up the charts, since 1870:

We are on average working much fewer hours per year

Our productivity has consistently grown

GDP per capita has generally moved higher over time (of course, there are some major inequality problems we can hopefully solve)

If you’re wondering, yes, it is all inflation-adjusted. And remember, throughout all of these periods, there were people constantly talking about how the world was going to end. It can pay (from attention seeking) to be pessimistic in the short run. But over the long run, the optimists usually win.

And I feel like we could be on the cusp of these productivity gains accelerating if the robotics/AI revolution is finally here (I have my doubts, but a lot of people much smarter are very optimistic about both those sectors). And don’t forget the burgeoning genetics/biotech revolution. There is a ton of stuff to be excited about that could help humanity over the next few decades. Great stuff.

What sectors benefit from this trend? Well, really anything that people can spend time on besides working. Three that come to mind that should see continued tailwinds in consumer demand are fitness, travel, and video games. As we all (on average) work less and less while producing more for the world, we will have more free time to pursue hobbies and leisure activities.

Also, as a final note, I don’t know how you look at this and say capitalism is evil (or whatever the anti-capitalist people say all the time). Obviously, it isn’t perfect, but it has worked pretty darn well in some things, work productivity being one of them.

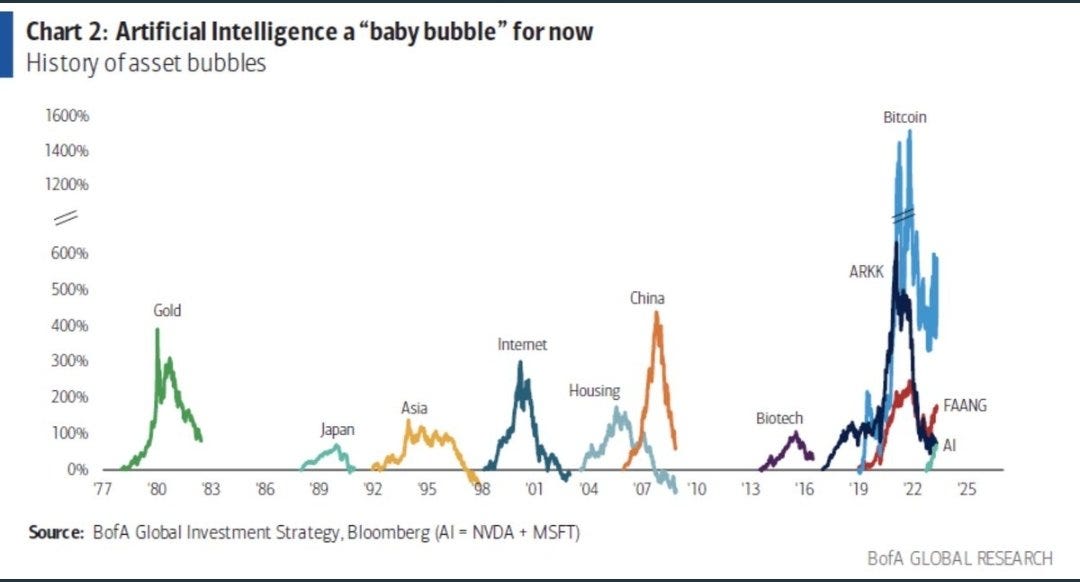

3. How early are we in the AI bubble?

Damn, things move quickly in modern markets. It has been less than half a year and we are now in the midst of a full-blown AI bubble.

First, let’s update this chart and get FAANG and ARKK out of there. FAANG was never a bubble and ARRK should not count as an asset bubble. Either way, this is a fun chart.

If we are going to look at the average returns for historical asset bubbles, it looks like we are still in the early innings and heading to the halfway point of the AI bubble (if we are in one, of course).

It looks like most bubbles last 1 - 3 years and go up around 250% - 500%. The AI bubble seems to be well on its way to hitting these returns but still has some room to run if it is going to hit the historical average. Of course, this is in no way scientific and there is no guarantee that the AI bubble will follow the same path as historical bubbles. We could have easily hit the peak last week for all I know.

I shutter to think what this could mean for Nvidia or Microsoft’s share prices over the next year if we are under halfway through this AI stock market boom.

I think I came up with a fun way to frame it by asking this question during this week’s Power Hour (link above):

If forced to take a side, do you think it is more likely that Nvidia has a larger market cap than Apple a year from now — or — is down 90% a year from now?

This is a very uncomfortable question to answer. I think I would choose the “larger than Apple” answer.

See you next week,

Brett

***Our fund, Arch Capital, may own securities discussed in this newsletter. Check our holdings page and read our full disclosure to learn more.***

***Want our FREE weekly wrap-up delivered to your inbox each week? Subscribe here***

3 Good Reads

How Acquisitions Add Value — Or Don’t - Focused Compounding

The problem with many mergers (including the above) is that the price paid by the acquiring company is often so high that the benefits of the synergies are really being paid to the selling shareholders from the acquired company rather than being captured by the acquirer. For example, I’ve seen cases where a company pays about 12x EBITDA for a business and probably gets the business at about 5x EBITDA after synergies. The selling shareholders are getting 12x EBITDA. The buyers are – if all goes well – getting something purchased at 5x EBITDA which can work if the company uses debt, cash, or overvalued shares to fund the acquisition. If they use undervalued stock, it doesn’t work well.

How American Icon Henry Ford Fostered Anti-Semitism - History.com

Indeed, as a vocal antisemite, he used his status as one of America's most well-known and trusted business leaders to systematically spread conspiracy theories about Jews. His screeds against Jewish people became so well-known at home and abroad that he is the only American whom Adolf Hitler compliments by name in Mein Kampf.

Q1 2023 Hyperscaler Earnings Review - Software Stack Investing

I tried to visualize these various effects in the diagram below. While there are a lot of moving parts and certainly unknowns, I think we can make some assumptions that explain the surge in hyperscaler revenue growth during the Covid period (2020-2021) and then the marked deceleration in growth rates we have been witnessing over the last couple of quarters. If we assume this has been driven by a cycle of over-provisioning and optimization, the trends in hyperscaler growth rates make sense. Further, if optimization will taper off and AI workloads ramp up, then we can extrapolate the likely curve of revenue growth over the next 1-2 years.

1 Good Podcast

Smart, Insightful, and Funny Tweets:

(link)

(link)

(link)

(link)

(link)