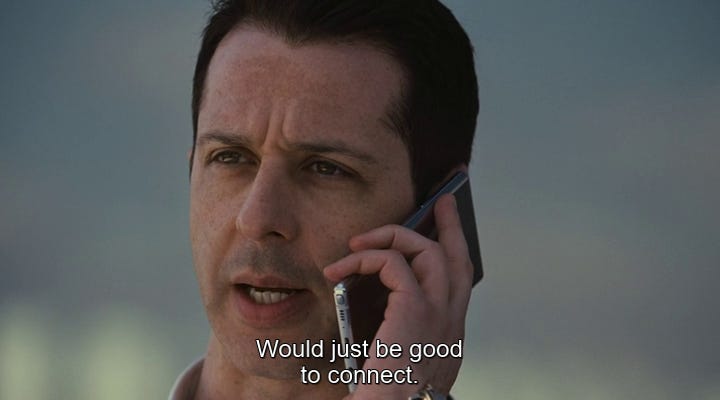

Welcome to Chit Chat Money’s Sunday Finds + 3 Thoughts From Last Week. In this newsletter you will find three topics I thought about last week, links to shows we’ve recently released, and links to some interesting articles, podcasts, and tweets. Check out the archive here.

Chit Chat Money Podcasts From Last Week

Chit Chat Money is presented by:

Potentially you! Reach out to our email chitchatmoneypodcast@gmail.com if you are interested in sponsoring the newsletter, podcast, or both.

1. Why apparel and fashion investments scare me

I had no idea this company even existed:

Exactly how the Alo Yoga matching workout set became the definitive look of our time is a business story, a marketing story, a pandemic story and a celebrity story all wrapped up in one—alongside a healthy dose of happenstance. Right time, right place, right Lycra.

Alo, which stands for “air, land, ocean,” was co-founded in 2007 by childhood best friends Marco DeGeorge and CEO Danny Harris, both 50. But it truly took off during the pandemic, when body-conscious uber-influencers including Kendall Jenner, Hailey Bieber and Bella Hadid ventured out in the brand’s simple, coordinated workout pairings.

Apparently, this brand did over $1 billion in sales in 2022. Who knew! Not me, I guess.

Defining your circle of competence is important. For me, I find clarity when looking at sectors and inverting the question: Am I incompetent here?

Apparel is one of those sectors I can confidently say I am not competent. For other investors, it may be a source of strength.

Everyone’s circle of competence is going to be different. That’s why I would never invest in Lululemon, even if it fell to something like 10x earnings and sales were growing by 10% per annum. Because there is a good chance I am the patsy at the poker table.

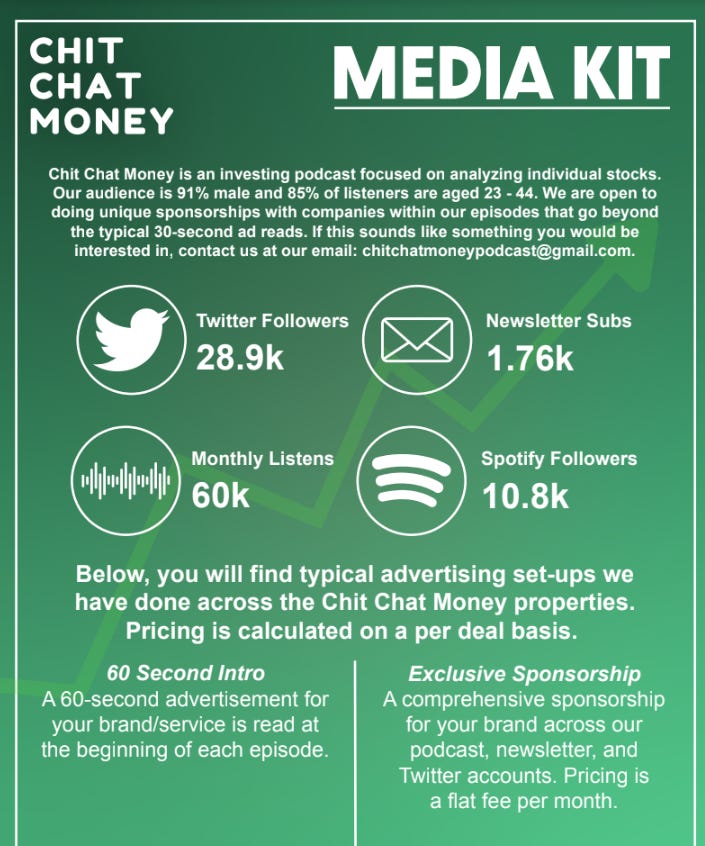

2. The Bud Light boycott breaks trend

We were asked on a recent Power Hour about the Bud Light boycott after its recent advertising campaign. I don’t know much about what happened, but my general take on boycotts is that they have a lot of bark and no bite.

So, if you like a business and the stock falls because of some “controversial” topic, it could be a good time to buy.

Boy, does that look wrong with Bud Light:

Look at that discount! We’ll see whether everyone has forgotten about this whole thing a year from now, but it looks like the Bud Light brand could be permanently impaired, which is shocking to me.

It’s good to have some rules of thumb when it comes to business. One I like is that boycotts or uproars against a company are almost always overblown.

The key word is almost, though.

3. Should you have a sell price?

Read the piece I linked from Bronte Capital this week. Trust me. The title looks very boring but you will enjoy it.

I don’t want to spoil the punchline of the blog post, but it got me thinking of sell targets and sell decisions. It is one of the most difficult things for fundamental investors to get good at, and there are a lot of conflicting opinions out there.

On the one hand, valuation clearly matters. If a low-growth business is trading at 50x normalized earnings, forward returns will almost assuredly be below 5%.

But on the other hand, there are a lot of mistakes made by selling too early.

Take two of the best investing philosophers of our time: David Gardner and Charlie Munger (don’t roll your eyes at Gardner, his returns are almost assuredly better than yours).

David Gardner at the Motley Fool (he is now retired) explicitly buys and never sells positions. This obviously hurts his returns as he won’t sell a stock after a business collapses or a fraud gets exposed, which will happen on a regular basis when buying shares of early-stage unprofitable companies like he does (or the Motley Fool has historically done).

But he’s also the only person who has never sold Netflix and now 60 bags from his cost basis after the stock pops 10% after an earnings report. And all he did was make two decisions:

Buy shares of Netflix

Never sell his stake

Munger — a 99-year-old with tons of worldly wisdom — says he still doesn’t know when to sell a position.

Maybe being good at selling stocks is impossible. Does that mean we should focus more of our attention on it, or less?

See you next week,

Brett

***Our fund, Arch Capital, may own securities discussed in this newsletter. Check our holdings page and read our full disclosure to learn more.***

***Want our FREE weekly wrap-up delivered to your inbox each week? Subscribe here***

3 Good Reads

Valuation and Investment Analysis - Bronte Capital

This is a general quality of investment analysis. Proper valuations are far more art than science. DCF valuations - especially of something growing near or above the discount rate are famously sensitive to assumptions. The right comparison is to the Hubble Telescope: move direction a fraction of a degree and you wind up in another galaxy.

Asking the Right Questions - Ian Cassel

Whether its microcaps, private equity, or venture capital, investing in small illiquid companies is an art-form because you are investing in people. You need to find out all the valuable nuggets you can which means asking the right questions. You can’t expect to become a master interviewer or master investor overnight. It takes a lot of practice. A common thread with people that ask great questions is they spend more time listening than talking. It’s hard to truly listen and let the conversation take you where you need it to go instead of always thinking about the next question and forcing it. As Chip Maloney stated in his article, it’s important to not be robotic or rude. A CEO or management team isn’t going to give you thoughtful answers if they think you’re an asshole. You need to be respectful and friendly, so you can build rapport and trust quickly. View the questions in this article as tools for your toolbox. The more you use the tools the better you’ll get at using them.

Deception, Exploited Workers, and Cash Handouts - MIT Technology Review

This may be why some of Silicon Valley’s biggest names, in addition to Altman, are pouring money into it; Andreessen Horowitz recently led a $100 million investment round that tripled the startup’s valuation, from an already heady $1 billion to $3 billion

1 Good Podcast

Smart, Insightful, and Funny Tweets:

(link)

(link)

(link)

(link)