Welcome to Chit Chat Money’s Sunday Finds + 3 Thoughts From Last Week. In this newsletter you will find three topics I thought about last week, links to shows we’ve recently released, and links to some interesting articles, podcasts, and tweets. Check out the archive here.

1. Where will profit margins be in 2030?

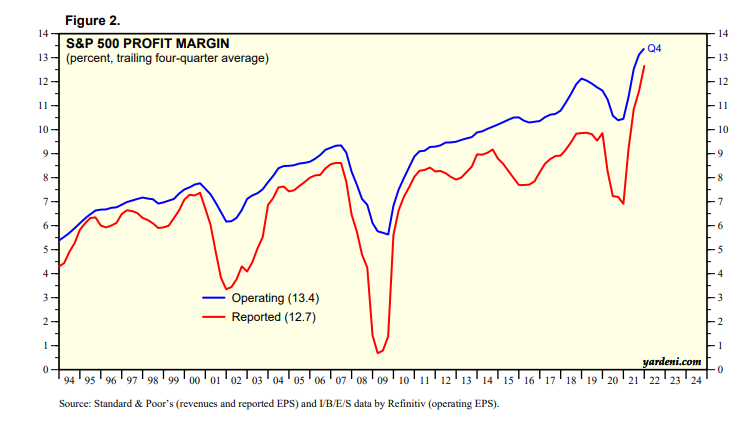

Over the last few decades the S&P 500’s profit margin has steadily risen, going from around 5.5% in 1994 to ~13% at the end of 2021. This expansion has been a huge driver of market returns in the last 30 years.

I believe the long-term average going back 100 years is around 5% - 7%. This makes the expansion over the last few decades an anomaly, or a diversion from the long-term average. A lot of smart investors argue that this margin expansion is unsustainable, and that a reversion to the mean is coming. If true, stock prices will have a long ways to fall over the next decade unless total revenue growth accelerates.

Call me a naive youngling, but I think profit margins returning to 6% are highly unlikely. In fact, I think there is a decently high probability the S&P 500’s profit margins will be higher in 2030 than they were in 2021. Why? three reasons.

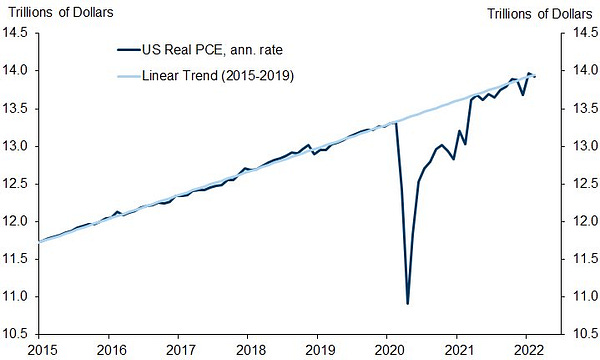

First, as you can see from the chart above, the margin expansion occurred right when the internet started gaining traction. I don’t think that correlation is a coincidence. If you think the internet will make up a larger part of our economy by 2030, this will be a tailwind to profit margins.

Second, if you just look at the underlying businesses that make up the S&P 500, the fastest growing are the ones with the highest gross margins (Big tech, semiconductor companies, video games, engineering/design software, social media, etc.). As these industries continue to mature, that should be a tailwind for overall S&P 500 margins. I mean, it is hard to see how profit margins revert when Google grows 15%+ a year with something like 50% incremental margins.

Third, we have proof that this trend is not attached to the business cycle. Just look at the chart above. We’ve gone through three downturns, and while profit margins declined slightly during each one, once the economy recovered, the long-term trend of margin expansion continued.

2. Stock research doesn’t need to be 100% efficient

One of my top reads this week (linked below) was from Rational Reflections on how some inefficiency/redundancy can be beneficial:

Retrenchment was a strategic choice for strong companies, but a matter of necessity for companies with weak cash positions in industries where revenues were about to dry up. No one wants to maintain excess liquidity during normal times, especially when interest rates are stuck at zero, but over-optimizing the balance sheet reduces flexibility when it comes to taking advantage of opportunities and reacting to a crisis.

They talked about strategic inefficiency in relation to supply chains, buybacks, companies, countries, and energy policies.

I think this also applies to researching stocks. Our instincts are to optimize our research process, build specific checklists for every company we go through, and try to limit the amount of time “wasted” (whatever that means). It seems like a lot of investors are trying to skim through as many stocks as quickly as possible. I’ve even heard multiple times from people that when a good research report comes out on a platform like Value Investors Club or published on Twitter they will stay up all night researching the stock to make sure they don’t miss the potential opportunity.

Yes, turning over a lot of rocks, as the analogy goes, is going to help increase your chances of finding a strong idea within your circle of competence. But when you lift the rock up, you have to make sure you actually get a good look at what’s under the surface.

I like to think of finding new stock ideas as a serendipitous process. During the week, I spend a lot of time researching/writing articles for the Motley Fool, researching/recording for the podcast, and perusing things to read on Twitter. I’m constantly coming across new stocks during these times. If I come across anything that feels interesting, I’ll do a quick search to its IR page and make sure its something that will potentially fall in my circle of competence. Then I write the ticker down on a sticky note on my desk. A few weeks later, if my mind is feeling sharp and I have at least an hour open, I’ll crack open the idea and read through all the basic information about the company through SEC filings, conference calls, and whatever else I can find. Sometimes, this research might not start until six months after first discovering the ticker. After this basic due diligence, 95% of companies get discarded because of either valuation concerns or discomfort around what the financials will look like 5 years from now. For those that make it through, I then do enough research (the time associated is unique to each company) where I feel I understand the business well enough to pitch it as an investment in the fund. Finally, I’ll pitch it to Ryan, and if he agrees, we either put it on the watchlist or make it a portfolio holding. A stock gets put on the watchlist if we don’t believe the risk/reward from owning the stock over the next 3 - 5 years is better than our least favorite holding at the time.

It is a process, but a very inefficeint one. It may not be very marketable to institutional allocators, but it’s what I do. And over the long-run, I think I’ll benefit from it.

3. Does the shoeshine indicator work?

Let’s finish this off with a short thought. I’ve heard a lot of people over the past few years say that the shoeshine indicator is dead.

(For those that don’t know, the shoeshine indicator came about from the roaring ‘20s when investors started getting stock pitches from their shoeshine boys)

Frankly, these investors are not exposed to the “shoeshine boys” of our day (i.e. 18 - 35 year old broke guys) like I am. And I can tell you the shoeshine indicator is alive and well. This is very unscientific, but I have two examples:

In the first meme stock craze, I had multiple people with no interest in finance call me up and talk about buying GME/AMC. This was right around the first peak in meme stocks.

At a party last Fall, I had multiple people telling me to buy “Shib” (Shiba Inu Coin) because it was going to $0.01. This was literally within days of the peak of the Shiba Inu chart.

To be clear, I don’t invest/trade because of any “shoeshine indicator” I get. It’s just fun to think about.

See you next week,

Brett

***Our fund, Arch Capital, may own securities discussed in this newsletter. Check our holdings page and read our full disclosure to learn more.***

***Want our free weekly wrap-up delivered to your inbox each week? Subscribe here***

Catch up on Our Shows From Last Week

Deep Dive: Leandro From Best Anchor Stocks Discusses Constellation Software

Investing Power Hour #1: Lessons From the Great Depression, Zillow, Robinhood 24/7 Trading (New show format!)

3 Good Reads

While there are many companies that are considered competitors to Poshmark, the reality is that Poshmark is well-positioned to gain share against them

NFTs and the Money/Status Exchange Rate - Bryne Hobart at the Diff

NFTs might fall out of fashion, be the victim of environmental regulation, get hit with even more hacks, or run into some unforeseen problem—though that last one is unlikely given that foreseeing problems for NFTs is a big growth industry. For now, though, collectors are buying them and it's worth analyzing why.

Neccessary Inefficeny - Rational Reflections

Optimization is a good thing, up to certain limits, but it can be taken too far. When the cost of redundancy is low and the cost of falling short is high, accepting some redundancy can make sense. You don’t want to find yourself in the Sierra Nevada at 12,000 feet during an August cold snap taking nighttime temperatures into the teens or twenties with only a thirty degree sleeping bag. While discomfort is the most likely end result of this example, hypothermia and death is possible in extreme scenarios.

1 Good Listen

Nvidia: The GPU Company - Acquired Podcast

He wears signature leather jackets. He can bench press more than you. He makes cars that drive themselves. He’s cheated death — both corporate and personal — too many times to count, and he runs the 8th most valuable company in the world. Nope, he’s not Elon Musk, he’s Jensen Huang — the most badass CEO in semiconductor history. Today we tell the first chapter of his and Nvidia’s incredible story. You’ll want to buckle up for this one!

Sunday Finds Is Brought to You by Knack Bags

Is your closet cluttered with bags you rarely use? Then you need a Knack Bag! Knack Bags are a hybrid laptop/travel/everyday bag that can solve all your day-to-day needs. The bags are professional, stylish, and extremely versatile. Once you buy a Knack Bag, you’ll never need another bag or backpack again.

Interested in purchasing a Knack Bag? Check out their website and explore all the different bag styles: knack-bags.pxf.io/4eMgNZ

Smart and Funny Tweets: