Welcome to Chit Chat Money’s Sunday Finds + 3 Thoughts From Last Week. In this newsletter you will find three topics I thought about last week, links to shows we’ve recently released, and links to some interesting articles, podcasts, and tweets. Check out the archive here.

Chit Chat Money Podcasts From Last Week

Chit Chat Money is presented by:

Potentially you! Reach out to our email chitchatmoneypodcast@gmail.com if you are interested in doing a sponsorship on our podcast network. Check out our media kit for more information.

1. Growth of nicotine pouches continues

If you have followed the podcast for a while now, you have likely heard us discuss what attracts us to the nicotine pouch market. We like it over vaping or cannabis given the discrete nature of the product, its extremely low (known) health impacts, and the way it can expand the oral nicotine market by getting rid of the “gross” factor of traditional chewing tobacco (i.e. women now use it).

I would describe myself as a “conflicted” shareholder in Phillip Morris International after they acquired leading nicotine pouch player Swedish Match for a slight premium. We made some money from this deal but were frustrated at the potential of cutting a long-term compounder off at the knees.

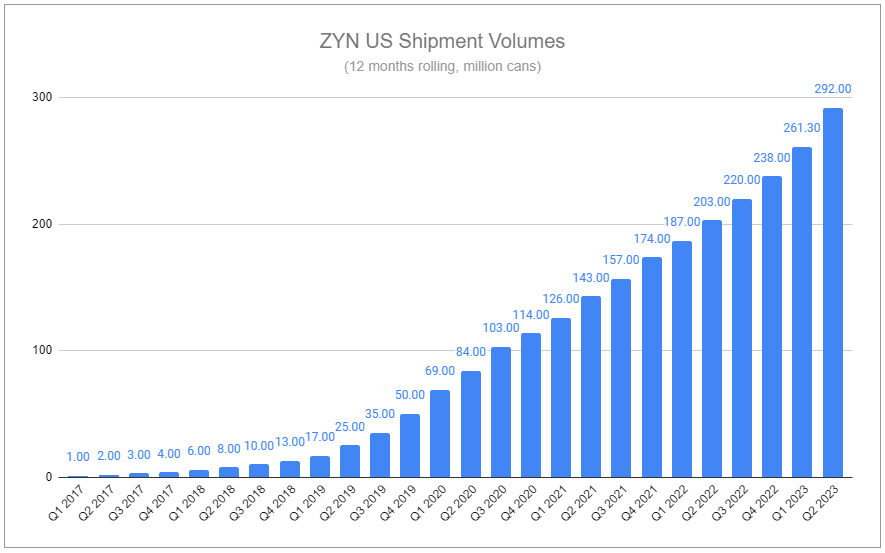

This fear is now proving true. I think Swedish Match shares would be significantly higher than its buyout price right now because, man, are nicotine pouch volumes at the Zyn brand exploding. From Devin LaSarre’s Invariant newsletter (highly recommend subbing):

Zyn Q2 U.S. shipment volumes are now at an astounding 90 million, up from just 11 million in Q2 2019. The product has hit an inflection point and shows no signs of stopping. An international roll-out is planned for the next five years or so.

What a great business. A modern Marlboro if I ever saw one. Too bad it is only a small part of the Phillip Morris International behemoth.

Side note: check out this post on Buffett’s investment in RJR Reynolds:

2. Spotify raising prices + long-term implications

According to the Journal, Spotify is planning to raise its monthly subscription fee in the United States from $10 to $11:

Under the planned change, expected to be announced next week, the cost of Spotify’s ad-free premium plan is likely to increase to $10.99 a month in the U.S. from $9.99, people familiar with the matter said. Other price increases are likely to roll out in dozens of markets globally in the coming months.

Apparently, a $1 increase in the United States would add $1 billion in annual revenue to Spotify. Over the last 12 months, the company has done $12.6 billion in revenue, to give some context.

As long as all the cartel members (YouTube, Amazon, Apple, etc.) play ball, it seems like music streaming platforms will be able to consistently raise subscription prices in perpetuity. This probably means $1 increases every two to three years.

While this price increase cadence would have Spotify barely keeping up with inflation since its launch over a decade ago, the company continues to increase the value it provides customers. For example, the new AI DJ it launched is getting rave reviews and is apparently growing as quickly as Discover Weekly.

It’s simple, but increasing the value you provide to customers increases your ability to raise prices without losing those customers. Spotify seems to have this in spades at the moment and is finally starting to use it.

3. NYC rents keep rising

This is a pretty good indicator of what younger people in a society value:

It now costs around $4k per month to live in the Big Apple, likely in an apartment layout that would go for under $1k in the rest of the country.

There were a lot of calls two years ago saying NYC was going to die. At the time, those claims didn't feel crazy, but in hindsight they clearly were. Another example showing how hard it is to make predictions on societal changes (it is usually better to bet things will just remain the same).

I’m not a fan of the NYC lifestyle (no judgment on people who are), but if you spend any time interacting with younger finance/investment professionals, you knew betting against NYC was probably a bad move. Young people in the United States value being around other young attractive people and feeling prestigious, among other things that NYC offers better than other cities in the country. That will likely never change.

See you next week,

Brett

***Our fund, Arch Capital, may own securities discussed in this newsletter. Check our holdings page and read our full disclosure to learn more.***

***Want our FREE weekly wrap-up delivered to your inbox each week? Subscribe here***

3 Intriguing Reads

Preliminary Thoughts on American Tower - Stock Thoughts

Over the course of the past week or so I have started digging into AMT for the first time. It’s one of those ones that you admire from afar for a while thinking it seems simple enough and then when you dig in the lift is heavier than expected. Never having looked at a REIT doesn’t help. I’ve probably still got a couple of days of more work to do on it but wanted to get some preliminary thoughts down on paper and hopefully find some people to talk to about it. Please feel free to DM me on Twitter - handle is stockthoughts81 or email me at stockthoughts81 at gmail dot com. Let’s get into it.

How to Blow Up a Timeline - Eugene Wei

I’ve written before in Status as a Service or The Network’s the Thing about how Twitter hit upon some narrow product-market fit despite itself. It has never seemed to understand why it worked for some people or what it wanted to be, and how those two were related, if at all. But in a twist of fate that is often more of a factor in finding product-market fit than most like to admit, Twitter's indecisiveness protected it from itself. Social alchemy at some scale can be a mysterious thing. When you’re uncertain which knot is securing your body to the face of a mountain, it’s best not to start undoing any of them willy-nilly. Especially if, as I think was the case for Twitter, the knots were tied by someone else (in this case, the users of Twitter themselves).

From Hustle to Scale - Ian Cassel

If you can find this setup it increases the chances of success from 20% to 70%. It’s like getting dealt an Ace / King or Ace / Queen in poker. You can still lose but the odds move heavily in your favor. To find great companies early, you need to find great leaders early. Winning isn’t invisible.

1 Good Podcast

Smart, Insightful, and Funny Tweets:

(link)

(link)

(link)

(link)