Sunday Finds + 3 Thoughts From Last Week

Pods on PayPal and the music industry!

Welcome to Chit Chat Money’s Sunday Finds + 3 Thoughts From Last Week. In this newsletter you will find three topics I thought about last week, links to shows we’ve recently released, and links to some interesting articles, podcasts, and tweets. Check out the archive here.

Chit Chat Money Podcasts From Last Week

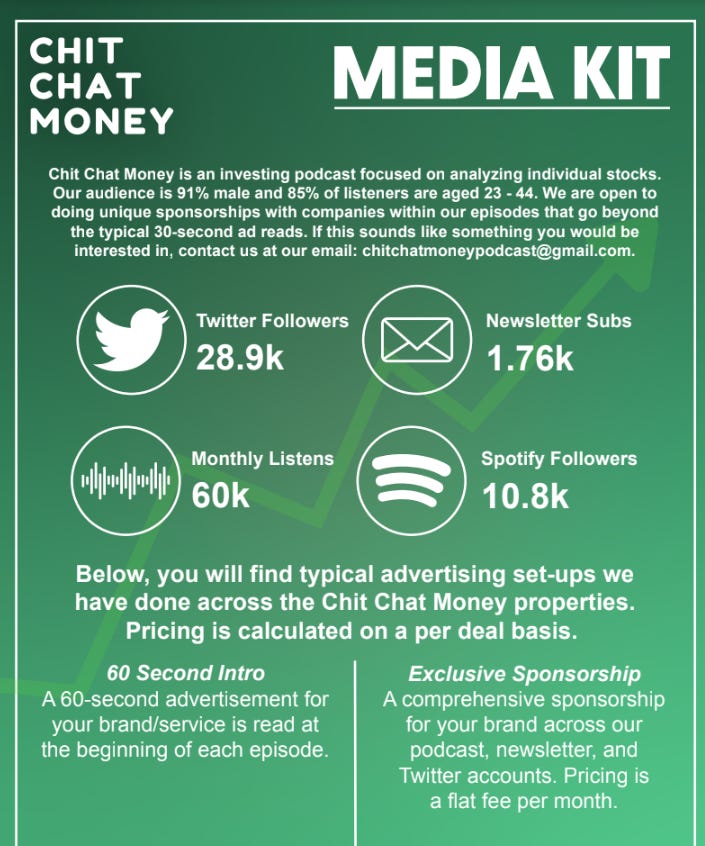

Chit Chat Money is presented by:

Potentially you! Reach out to our email chitchatmoneypodcast@gmail.com if you are interested in sponsoring the newsletter, podcast, or both.

1. So I guess we all need to have a take on the Apple ski goggles…

I’m guessing 99% of you saw that Apple announced its first mixed-reality headset. But for the 1% of you: Apple announced a mixed reality headset! It is called the Vision Pro and will cost $3,500. The Verge has more details if you are interested in learning about the technical specs.

The device looks to be extremely advanced technologically. Some of the tools scare me, like the fact they can predict what you are going to “click” on with your eyes and the fact they can analyze your mood. I don’t know if I want a piece of technology that invasive

Here’s what competitor Mark Zuckerberg had to say about the device:

More importantly, our vision for the metaverse and presence is fundamentally social. It’s about people interacting in new ways and feeling closer in new ways. Our device is also about being active and doing things. By contrast, every demo that they showed was a person sitting on a couch by themself. I mean, that could be the vision of the future of computing, but like, it’s not the one that I want. There’s a real philosophical difference in terms of how we’re approaching this. And seeing what they put out there and how they’re going to compete just made me even more excited and in a lot of ways optimistic that what we’re doing matters and is going to succeed. But it’s going to be a fun journey.

Look, I admire that Zuck wants to build a spatial computing world where people are happy and social. But that’s not what sells computing devices.

Apple does a few things extremely well:

Makes computing hardware that people think is fashionable (consistently reinforced by marketing)

Drives the perception their hardware is the most advanced in the world (sometimes the case, almost always believed)

Connects these hardware devices together with an ecosystem of software tools, increasing switching costs

Meta doesn’t seem to be good at any of these things with these AR/VR devices. I could be totally wrong, but it seems like Apple is going to wipe the floor with Meta in this new era of computing, especially when comparing where the gross profit dollars flow.

The next question is: will mixed reality devices ever go mainstream?

2. A U.S. manufacturing boom?

These charts shocked me:

Looks to me like the government subsidies are working. We are now seeing a boom in manufacturing spending in the United States, centered on computer chip and electric vehicle production. Hopefully, this trend continues for at least the next three to five years.

The reshoring narrative actually has some bite, something I wasn’t sure was going to occur. The biggest beneficiary could be Mexico. Cheap earnings multiples, a growth tailwind, and a close association with the United States (meaning less of a chance the country could pull a “Venezuela,” the biggest fear of investors in emerging markets)? Mexico could quite possibly be the best hunting ground for investors right now.

One nagging thought I have, though: Isn’t this going to be inflationary?

3. Rotating and rebalancing positions vs. letting your winners run

The market’s earnings multiple — as you might expect — has crept up again:

25x earnings is not cheap in my book, unless you are comfortable with below 5% annualized returns (which you can get in a one-year treasury right now!) or expect strong future earnings growth.

This multiple expansion has been driven entirely by five stocks: Apple, Microsoft, Amazon, Alphabet, and Nvidia. Really, you can group Tesla and Meta Platforms here as the “Big 7” technology companies driving the market higher.

Historically, when you see a narrow set of companies driving returns, forward returns for the market as a whole but especially the companies driving the returns look bleak. I think that could be the case today with the Big 7 stocks that people feel like they “need” to own right now.

We own some big tech stocks (holdings page linked below) and have been debating how to manage these positions.

On the one hand, historical precedent seems to suggest forward returns for these stocks will be bad.

On the other hand, selling will trigger a taxable event and we still believe forward returns will be solid for the ones we own. However, the risk/reward skew is much worse than at the start of 2023.

My philosophy on selling has morphed and I bet will continue to morph. But generally, I/we like to do two things:

Trim a position back down to a portfolio weighting if shares rip higher within a short time span. For us, that is selling a position back down to a 6% weighting.

Only sell an entire positon if the valuation gets absolutely absurd. For us, that would be something like Alphabet at 35x - 40x forward earnings.

A lot of investors moan about their mistakes from selling a quality growth stock too early. I think this means we all should be lenient with our holdings even if they look overvalued. However, I don’t think this means you should artificially restrict yourself by saying “I will never sell X position.”

See you next week,

Brett

***Our fund, Arch Capital, may own securities discussed in this newsletter. Check our holdings page and read our full disclosure to learn more.***

***Want our FREE weekly wrap-up delivered to your inbox each week? Subscribe here***

3 Good Reads

Writing For the Long Run - Invariant

Obsessing over a larger audience risks steering yourself away from your own interests. It’s easy to begin to cater to what you think others want, making it harder to remain skeptical, objective, and critical. Plus, ask any writer, and they’ll tell you about when they laboriously wrote something they were certain would be a home run with an audience, only to see it flop. Counterintuitively, widely acclaimed works often fill authors with doubt all the way until they publish. Too personal? Too obscure? Too weird? Those are just assumptions, and you never know how a piece will resonate and who with. So don’t guess other people’s curiosities. Chase your own. If you authentically pursue your curiosity and write about what you’re passionate about, it will be unmistakable. Instead of burning out, you will be energized, and when people who share that passion come across your work, they will eagerly join along in the journey. Your audience is out there.

ROIC and the Investment Process - Michael Mauboussin

This report extends our analysis of the ROICs for public companies in the U.S. and updates the data to cover the years 1990 to 2022. We start by providing the latest ROIC figures, then examine the link between changes in ROICs and total shareholder returns (TSRs), and finish by reviewing elements of competitive strategy as well as persistence of ROIC by sector.

How the Stock Ticker MMTLP Became an Anti-Wall Street Rallying Cry - The Wall Street Journal

Unlike typical stocks, Next Bridge shares wouldn’t be eligible for electronic transfer at the clearinghouse that settles U.S. stock trades. The restriction was an unusual, deliberate move by Meta Materials that would effectively make the new shares untradeable. Insiders such as former Torchlight CEO Brda cheered the maneuver as a way to punish short sellers.

Anticipation of a squeeze mounted. Next Bridge said in a Nov. 9 registration statement that the price of MMTLP “may rise significantly” due to short sellers buying shares to exit their trades. Echoing that claim were investors with online followings, such as Bird Lady Rollerpigeons, a Texas woman who posts YouTube videos about MMTLP while dressed in a bird costume.

1 Good Podcast

Smart, Insightful, and Funny Tweets:

(link)

(link)

(link)

(link)

(link)

(link)

(link)

(link)

Hit the nail on all three thoughts for the week!

Cheers