Welcome to Chit Chat Money’s Sunday Finds + 3 Thoughts From Last Week. In this newsletter you will find three topics I thought about last week, links to shows we’ve recently released, and links to some interesting articles, podcasts, and tweets. Check out the archive here.

Chit Chat Money Podcasts From Last Week

Chit Chat Money is presented by:

Potentially you! Reach out to our email chitchatmoneypodcast@gmail.com if you are interested in sponsoring the newsletter, podcast, or both.

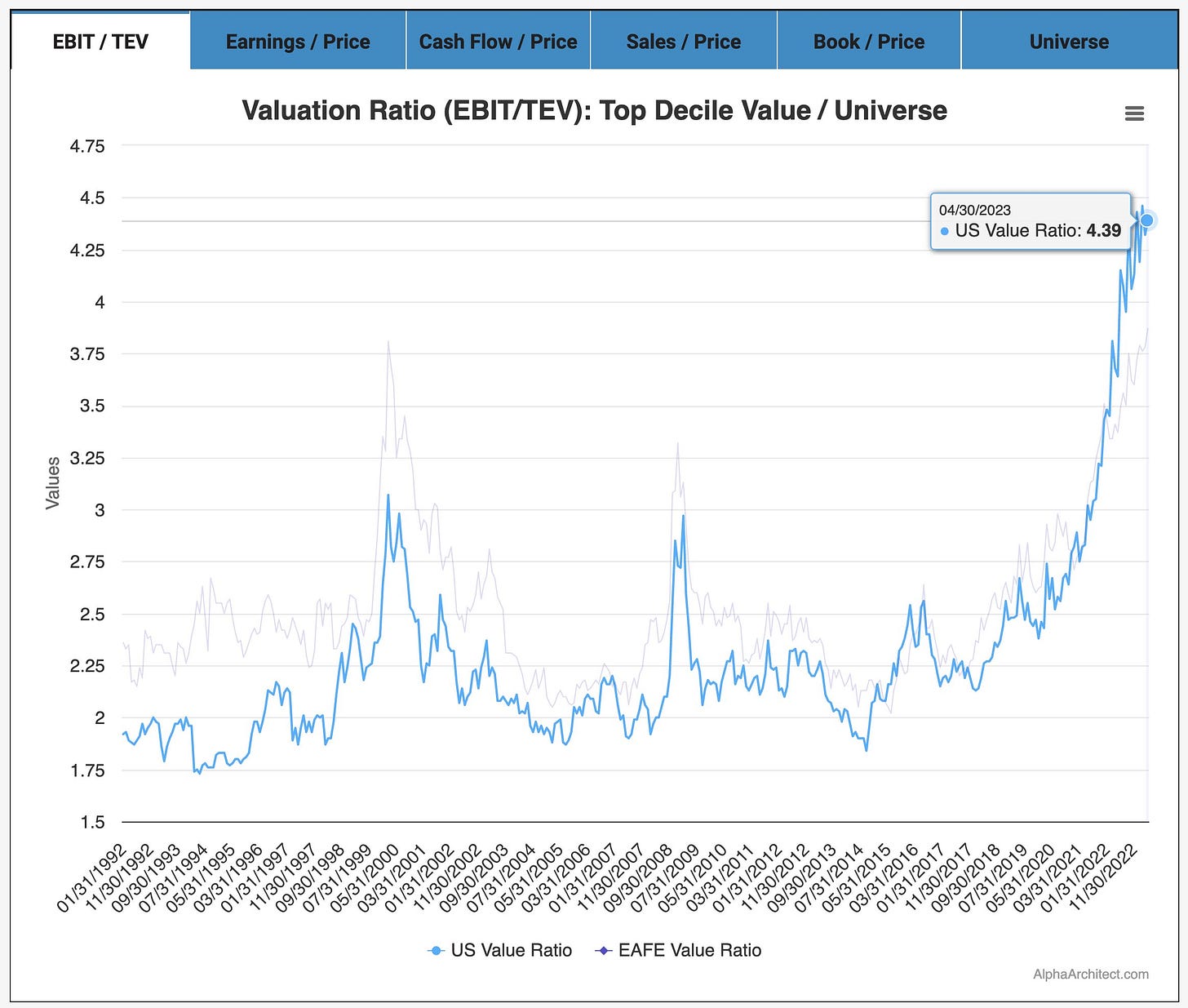

1. A record value spread

Shout out to Tobias Carlisle and Alpha Architect for sharing this research and educating investors.

Full disclaimer, I am no quant so my explanations may not be technically accurate. But my interest lies in why this blowout is occurring.

This chart takes the earnings ratio of the cheapest decile of stocks of the 1500 largest US companies and divides it by the median earnings ratio of that same group of companies. So, a larger number means value is trading at a “cheaper” multiple than the entire universe, while a smaller number means it is more expensive (on a relative basis).

As you can see from the chart above, we are at a much larger value spread than at any time in modern history, even the dot-com bubble.

Why is this occurring? I think it is a bit of a lollapalooza effect. Here are a few things I think could be driving this spread:

The recent AI bubble driving the largest US stocks (Nvidia, Microsoft, Alphabet, etc.) to outperform to start 2023. These stocks are not in the cheapest decile and therefore contribute to a widening of the spread.

Commodity/energy companies can be more skewed to the cheapest decile, especially when commodity prices soar and boost profits. A lot of these stocks may be trading at dirt-cheap trailing multiples, but investors are nervous that forward earnings may be a whole lot weaker.

Banks and financials may make up a good chunk of the cheapest decile. After the mini-banking crisis in March, investors sold out of a lot of these stocks (the regional banking ETF is down 28% year-to-date).

So what do you make of this if you are not a quant investor but own individual stocks? I’m a bit conflicted. On the one hand, if you run a concentrated fund it is probably best not to worry about factor exposure as it might just make you confused and indecisive. On the other hand, there seems to be a flashy sign in all caps saying “REBALANCE YOUR PORTFOLIO BEFORE THE VALUE SPREAD REVERTS” right now.

I/we don’t have huge exposure to big tech, so I’m not terribly concerned if a reversal of the value spread occurs (some of our stocks may benefit). But I don’t think this is a crazy time to trim/rebalance any stocks in your portfolio that have ripped in 2023 because of the AI rebubble.

2. Are we now underestimating self-driving cars?

Many of you are aware of the Gartner hype cycle:

This happened to the autonomous car market over the last 10 years. Companies like Uber and Tesla were saying “self-driving cars are just around the corner!” for what seems like every year since 2015.

Now, you rarely hear much from the general public about autonomous vehicles. We have definitely gone from inflated expectations to the trough of disillusionment.

A loose prediction I have right now: Over the next two to three years we will hit the slope of enlightenment with autonomous cars. Well, maybe not fully autonomous cars but geofenced robotaxis.

Waymo looks to be leading the way here. It has operations in three cities (San Fran, Phoenix, and Los Angeles) with its robotaxi network. It is now doing over 10k rides per week with plans to 10x (!) this number by next summer.

That would be a 36.5 million annual ride run rate by next summer. Smells like the slope of enlightenment to me.

3. Amazon wireless?

This would be something:

Amazon.com Inc. has been talking with wireless carriers about offering low-cost or possibly free nationwide mobile phone service to Prime subscribers, according to people familiar with the situation.

The company is negotiating with Verizon Communications Inc., T-Mobile US Inc. and Dish Network Corp. to get the lowest possible wholesale prices. That would let it offer Prime members wireless plans for $10 a month or possibly for free and bolster loyalty among its biggest spending customers, the people said, who requested anonymity to discuss a private matter.

Free wireless with Prime! Talk about a churn reducer…

I don’t have the data in front of me, but Amazon’s contribution profit per customer is much higher for Prime members than non-Prime members. Like a few thousand dollars a year higher.

If it costs Amazon $500 (or even more) each year to subsidize a wireless plan for customers, it can more than makeup for these losses through churn reduction and new Prime members as these customers spend more on the e-commerce network. It will also give them more pricing power over the long term. Prime costs $140 a year. Jack that up to $160 or $180 in North America and very few customers will churn.

No one comes close to competing with this. I don’t know why any of the telcos would pursue this either. It is a classic “your margin is my opportunity” idea, and not one of these companies can earn a profit from their gargantuan vertically integrated e-commerce platform to make up for these subsidies.

See you next week,

Brett

***Our fund, Arch Capital, may own securities discussed in this newsletter. Check our holdings page and read our full disclosure to learn more.***

***Want our FREE weekly wrap-up delivered to your inbox each week? Subscribe here***

3 Good Reads

Big Tech’s Biggest Bets - Matt Ball

Over its first 12 or so months, the Quest 2 outsold the Quest 1 (May 2019) by a factor of 10, or 10MM to 1M. Such a steep change is unlikely for the Quest 3, but some multiple seems well within reach. Furthermore, these sales may sustain better than the Quest 2, which saw sales slow considerably in its second and now third years in market—during which Meta’s costs surged, leading to a doubling of annual net losses. Meta is also suggesting that the device will no longer be sold quite so far below cost (Meta likely lost about $150 per Quest 2, i.e. $1.5B for every 10MM units). This will harm sales but also reduce losses. With this in mind, it’s likely that Meta’s losses peak in 2023—perhaps to the tune of $16B or $17B—and then improve every year thereafter. Still, annual net profits seem far off. And if so, then Meta’s cumulative losses might cross $80B first.

Apple Prepares For a Platform Shift - Platformer

One of the great gifts of the AI mania of the past six months is that it has shown us, clear as day, what it looks like when consumers actually get excited about something. ChatGPT is a product people bring up to me in everyday life before they even find out I’m a tech reporter; roughly seven months after launch, 12 percent of Americans have already used it for work. There’s something deeply funny about the fact that, after billions of dollars spent hyping up VR and crypto, the product that actually captivated the world’s attention again was a text box.

Sins of The Father - Yes I Give a FIG

Recognizing that the Fed’s lagging measures of inflation were leading them astray, Jerome Powell pulled up his bikini briefs (hunch, no direct knowledge) and proceeded to take the American public for another ride in pursuit of a “Volcker-esque legacy.” Somewhere along the way, in a nod to the lagged nature of OER, the Fed adopted a new, new metric — “Core Services ex-Housing”. The term “core services” was, for all intents and purposes, “new” — apparently an attempt to distract from banned “transitory”:

1 Good Podcast

Smart, Insightful, and Funny Tweets:

(link)

(link)

(link)

(link)

(link)