Welcome to Chit Chat Money’s Sunday Finds + 3 Thoughts From Last Week. In this newsletter you will find three topics I thought about last week, links to shows we’ve recently released, and links to some interesting articles, podcasts, and tweets. Check out the archive here.

Chit Chat Money Podcasts From Last Week:

Chit Chat Money is presented by:

Stratosphere.io, a powerful web-based research terminal for fundamental research. With fundamental charting tools and data aggregation, Stratosphere saves us hours of time each month researching stocks.

Upgrade to one of Stratosphere’s paid plans and get 35+ years of historical financials, advanced KPI tables, and SEC filing aggregation.

Ditch the clunky and advertising-riddled websites like Yahoo Finance and upgrade your investing research using Stratosphere.io.

Get started researching for FREE on the Stratosphere.io platform today, or use code “CCM” for 15% off any paid plan.

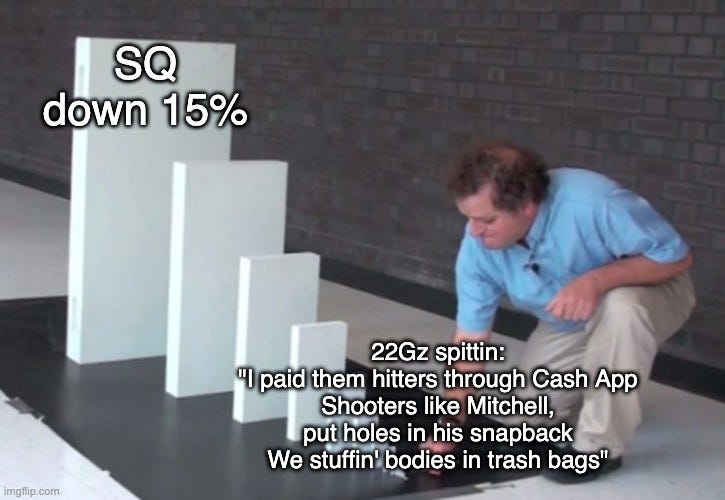

1. Is Block facilitating crime?

Of course they are. But that’s not the question investors care about.

(context for those that didn’t see the short report published this week)

Any large payment platform is going to be used for unethical purposes. Plenty of crime gets done through big banks, Visa/Mastercard, and American Express. You don’t ban the sale of hammers because someone used one for murder.

However, here’s what I think regulators (both general and financial ones) will care about with Block:

Are they knowingly letting criminals thrive on the Cash App? Are they using standard industry techniques to minimize the number of bad actors? If not, the company could be in for some huge fines and/or restrictions on the platform.

Have they knowingly inflated MAU numbers to investors? Hindenburg alleges this could be as much as 75%. If they are, regulators will not be happy.

How much is crypto involved? Is this the fuel for criminal activity?

There is a ton of smoke around the prevalence of criminal activity on the Cash App. We’ll see how much actual fire there ends up being.

Block seems confident Hindenburg is way off on their research, stating in a press release they intend to “explore legal action” against the short sellers (they provide no evidence, however). Giddy up.

2. A disruptive period in the automotive market

We are possibly in the most chaotic period for automotive companies since the mass production of cars 100 years ago:

Screenshot:

The post can generally be summed up as:

Shortages caused weird supply/demand imablances across the automotive market

These shortages are still being felt across autobody shops and new cars, driving the price of used cars through the roof

Rapidly rising interest rates are making cars increasingly unaffordable

The transition to electric vehicles is expensive (see Ford operating losses) but must be done by automotive manufacturers in order to maintain relevalance by the end of this decade

It is hard to argue with all these points. Unlike maybe 30 years ago when the automotive market seemed relatively stable, right now there is a giant amount of uncertainty within the industry.

What does that mean for investors? I don’t know much about the car market, but I know increasing uncertainty generally means you should want a bigger discount — all else equal — when buying a stock. The risk/reward equation doesn’t add up when you can buy something like Alphabet or Microsoft at a similar forward earnings multiple to some of these carmakers.

No doubt there will be some big winners that emerge seven years from now in the automotive industry. But will a basket of the entire automotive sector put up solid stock returns this decade? I doubt it.

3. The psychology of risk management

Fascinating share from Modest Proposal this week:

This makes perfect sense. When you outsource a function like risk management, the people who perform the action (traders, bankers, analysts, etc) feel the need to be less careful. Ask yourself why trash piles up at concerts and sporting events but not backyard barbeques. The same principle applies.

There is comfort in knowing you have someone who is supposedly watching your back and making sure everything is on the up and up. But it can actually lead to much worse outcomes when you aren’t taking personal accountability.

Strangely, this reminds me of a fundamental flaw rookie investors make (I certainly made it a few times). Novices will look at historical numbers that are baked in concrete and tie themselves to them because it feels safe. Stop if you’ve heard this one before:

[X stock] is trading at a P/E of 12 and has grown its revenue by 30% annually for the past three years. Generational buying opportunity here.

In reality, you need to get out of your comfort zone and ask what the future holds. Generally, I find that makes me a lot less confident in my stock picks.

See you next week,

Brett

***Our fund, Arch Capital, may own securities discussed in this newsletter. Check our holdings page and read our full disclosure to learn more.***

***Want our FREE weekly wrap-up delivered to your inbox each week? Subscribe here***

3 Good Reads

Why Coinbase Will Lose Its Battle With the SEC - John Reed Stark

Rather than respond to the Wells Notice privately, as most companies would do, Coinbase, as per usual, instead immediately went into full offensive mode and laid out their defenses on Twitter and elsewhere in an attempt to rally the mob, and publicly shame the SEC into backing off. For whatever reason, Coinbase believes a Twitter rant against the SEC (who will never respond, unless it is with a lawsuit) is the best way to do battle against a Wells Notice.

Not only are Coinbase's arguments weak, misguided and more akin to public relations than legal positions, but Coinbase's arguments are also proven failures of crypto-mumbo-jumbo and ludicrous jaundiced rhetoric.

Assessing Altria And Tobacco Fundamental Five Years After the Peak - Fortune Financial

With that being said, some might argue with me about why the stock has performed so poorly the last several years. Perhaps it is related to a deterioration in business fundamentals? If that is the case, you certainly cannot find evidence of it in company results; since 2009, the first full year in which Altria was fully separate from Philip Morris International (PM) and thus a pure play on U.S. tobacco, the shares have outperformed the S&P 500 by a healthy margin, a result almost entirely driven by earnings and dividend growth. By comparison, since the end of 2017, the entirety of the underperformance was driven by multiple compression, as earnings growth and dividend growth were little deviated from the longer-term trend, and in fact surpassed the index’s fundamental results

Capital Markets and the Commercialization of Applied Science - Sophie’s Substack

In terms of aligning incentives, I'm not an expert, but there does seem to be a need for greater collaboration between "the Bell Labs triangle," that is, the interplay between academia, the government & industry. And from the investment side, being able to put capital behind companies that are seeking to develop ideas that have the potential for step function progress should be adequately rewarded (not just thinking of potential returns from early or growth stage but also the idea that investors could be more confident in earning reasonable returns in capital intensive/highly regulated industries).

1 Good Podcast

John Maxfield on Investing in Banks in a Post-SIVB World - Yet Another Value Podcast

John Maxfield, Editor of the Maxfield on Banks Newsletter on Substack, has spent nearly two decades studying America's best and worst banks, the history of banking, and interviewing bank leaders. John joins the Yet Another Value Podcast today to answer your burning questions regarding investing banks, his mindset during this "crisis" and how to think about investing in banks moving forward.

Smart, Insightful, and Funny Tweets:

Hit the nail on the head with all your 3 thoughts this week!

This was the best take-away for me...

"In reality, you need to get out of your comfort zone and ask what the future holds."