Welcome to Chit Chat Money’s Sunday Finds + 3 Thoughts From Last Week. In this newsletter you will find three topics I thought about last week, links to shows we’ve recently released, and links to some interesting articles, podcasts, and tweets. Check out the archive here.

Chit Chat Money Podcasts From Last Week

Chit Chat Money is presented by:

Potentially you! Reach out to our email chitchatmoneypodcast@gmail.com if you are interested in sponsoring the newsletter, podcast, or both.

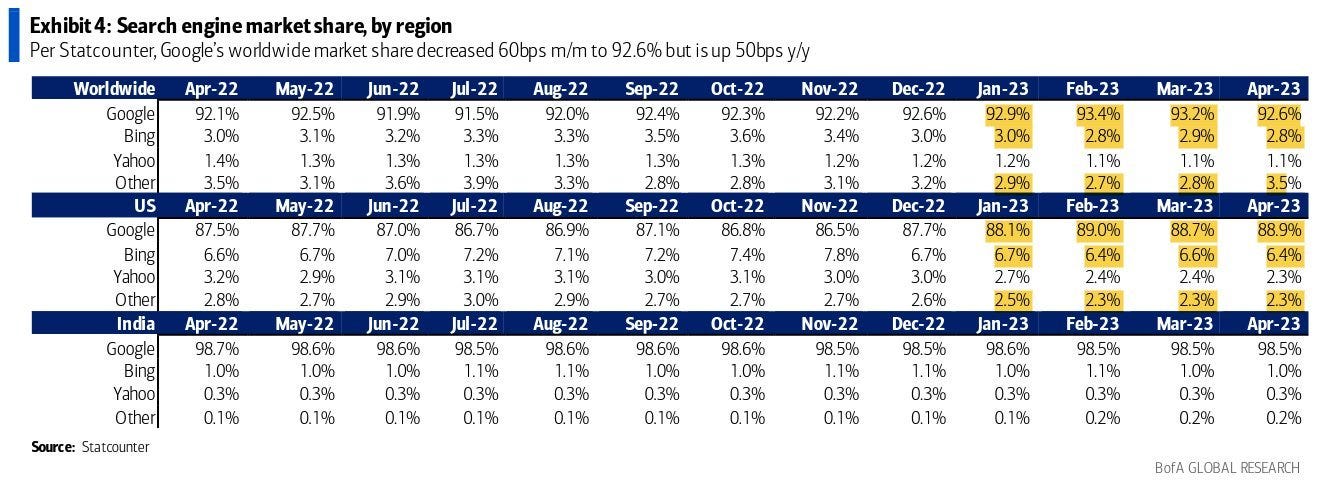

1. Microsoft hasn’t gained market share (yet)

Just some short writing this week since I’m going to be traveling this weekend (not to Omaha though). Hopefully, they can inspire some new thinking on your end.

Are we sure Microsoft isn’t just lighting money on fire with these new AI and search investments?

2. I don't understand the Shopify multiple

I guess I never have.

This week, Shopify admitted they cannot win in logistics and are going to stick to software/payments/merchant services.

The company is growing gross profit by only 12% year-over-year.

It still apparently can’t generate a profit.

There are shrinking avenues for growth.

And yet, the stock soared on these earnings with weak growth all because they decided to exit logistics. Currently, shares trade at a 25x gross profit multiple. From my seat, investors who own the stock today are basically saying a tripling or quadrupling of the gross profit (and a healthy conversion to earnings) is guaranteed. I just don’t see it.

Clearly, this is a good business. But how big can it get? Why does this have a market cap well north of $100 billion in five years?

3. Speaking of Omaha…

It has been shared many times in the online financial world, but I would recommend checking out the Berkshire Hathaway annual meeting podcast. It has archived the audio from all the meetings going back to 1994.

I would recommend the ones in the 1990s and around the tech bubble/burst and the Great Financial Crisis. The recent ones are a giant snooze though.

See you next week,

Brett

***Our fund, Arch Capital, may own securities discussed in this newsletter. Check our holdings page and read our full disclosure to learn more.***

***Want our FREE weekly wrap-up delivered to your inbox each week? Subscribe here***

3 Good Reads

Icahn Enterprises Short Report - Hindenburg Research

Our research has found that IEP units are inflated by 75%+ due to 3 key reasons: (1) IEP trades at a 218% premium to its last reported net asset value (NAV), vastly higher than all comparables (2) we’ve uncovered clear evidence of inflated valuation marks for IEP’s less liquid and private assets (3) the company has suffered additional performance losses year to date following its last disclosure.

Jeffrey Epstein Documents: Part 2 - The Wall Street Journal

Lawrence Summers wanted $1 million to fund an online poetry project his wife was developing. The former Treasury secretary and onetime Harvard University president turned to Jeffrey Epstein.

“I need small scale philanthropy advice. My life will be better if i raise $1m for Lisa,” Mr. Summers said in an email to Epstein in April 2014, referring to his wife, Elisa New, a Harvard professor. “Mostly it will go to make it a pbs series and for teacher training. Ideas?”

Technically, the bet wasn’t precisely based on US hyperinflation. Rather, Srinivasan bet that bitcoin—which he views as a hedge against inflation—would be worth $1 million at the end of 90 days, its value rising as inflation spiraled upwards. Srinivasan did not seem to consider the possibility that bitcoin’s value might also be wiped out in a hyperinflationary environment, the economics writer Noah Smith wrote on his blog.

1 Good Podcast

Open For Business (and Raiding Foreign Businesses) - Sharp China

On today’s show Andrew and Bill begin with news of more raids on Western corporate intelligence firms, investors losing access to Wind Information Co., a reported uptick in foreigners facing exit bans, and the continuing conflict between business-friendly rhetoric and what Xi's security services are doing on the ground. Then: Capital flight to Singapore, various theories to explain the timing of Xi's call to Volodymyr Zelenskyy, and head-scratching jargon from the Chinese readout. At the end: The dynamics between India, Pakistan and China, the US strategy with India, and a question about decoupling yields discussion of Apple, Tesla and the burgeoning EV industry in China.