Welcome to Chit Chat Money’s Sunday Finds + 3 Thoughts From Last Week. In this newsletter you will find three topics I thought about last week, links to shows we’ve recently released, and links to some interesting articles, podcasts, and tweets. Check out the archive here.

Chit Chat Money Podcasts From Last Week

Chit Chat Money is presented by:

Potentially you! Reach out to our email chitchatmoneypodcast@gmail.com if you are interested in sponsoring the newsletter, podcast, or both.

1. Thinking through Ally Financial

Writing about stocks you own clears up your thinking. Whenever we are researching a company for the podcast I tend to write an article for the Motley Fool to see what pops out. If I can’t put out my analysis in a concise 800-word article in plain language (which the Fool requires) then maybe I don’t actually understand a company.

For our fund’s first-half update (website here) we plan on explaining why we bought Ally Financial earlier this year. It is the only proper new position in the portfolio that we’ve taken in the last six months.

The easiest place to begin is that the stock is cheap. If it earns anywhere around the net income it has earned for the last five years (lowest TTM numbers of around $800 million) it is trading at a P/E below 10 and can pay a ~5% dividend yield and consistently reduce shares outstanding through buybacks.

But why is it cheap? There’s an easy answer there: Ally shares got caught up (wrongfully) in the regional banking mess this spring. We believe investors are tossing out a wonderful banking franchise that has minimal exposure to hard-hit sectors like real estate and is already pricing in a 15% drop in used car prices (which will affect its realized losses on loans). Even if used car prices fall even further in the interim and squeeze Ally’s net interest margin, the company is still poised to grow deposits over the long term and should retain a ~4% net interest margin once the car market recovers.

The executive culture is ideal — at least for a bank. Ally has meticulously grown its customers for 56 straight quarters, and with only 2.8 million depositors and a clear competitive advantage as a neobank with no physical branches (allowing it to be profitable even by paying higher interest rates on deposits), it should only continue to grow customers. They have also stuck with their bread-and-butter in car loans while only slowly moving into new lending products. This sort of restraint and disciplined growth is a big highlight when looking at a bank’s management team.

It always comes down to our three criteria for evaluating an investment:

Do we trust management?

Are earnings predictable and growing? (i.e. does it have a moat?)

Is the stock cheap enough to meet our return hurdle rate?

This is our north star in evaluating any investment and something I come back to again and again.

Disclosure: these are not our full thoughts on Ally. Look for a more comprehensive report coming out soon (will make sure to link to it in this newsletter).

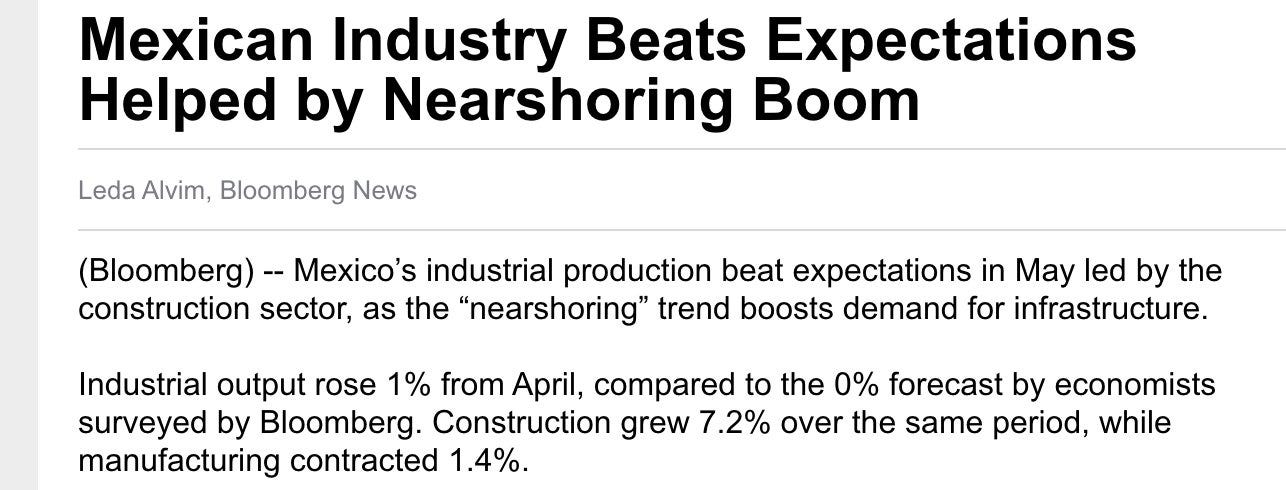

2. The Mexican decade is off to a hot start

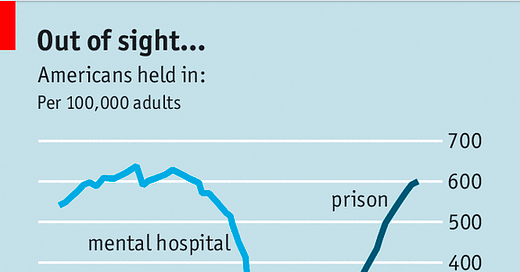

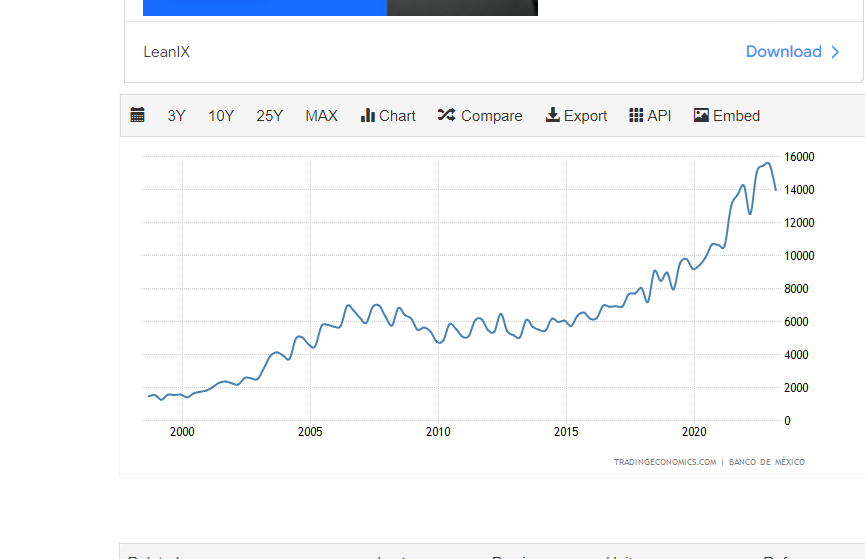

Mexico’s productive capacity continues to rise. Construction growing 7.2% year-over-year is a great sign that the “reshoring” theme actually has some bite to it. Remittances from the United States to Mexico continue to boom and the Peso is absolutely exploding in value vs. the U.S. dollar:

The country is also in a demographic sweet spot with a ton of people aged 15 - 35 that will be hitting their prime spending/earning years shortly:

I am cautious investing in Mexican companies given I live in the United States. But the setup here looks phenomenal and it is the international market I am going to spend the most time learning about.

Listen to Ian Bezek discuss the Mexican Airports on our podcast for more information on the country:

3. Microsoft making Google “dance”

See if you can spot when Microsoft made Google “dance” with all its AI investments.

Is it clear now that — unless Microsoft/OpenAI can come up with a different innovative way to convince people to leave Google — the tens of billions in investment towards stealing market share from Google Search will be a waste? I am leaning toward answering yes, but maybe we need to wait a few more quarters to make sure.

The Google moat — as people have discussed ad nauseam — is not because the search product is better than Microsoft’s (although it is). It is because they have billions of people using so many services that the switching costs are so high it would just be annoying to switch to other platforms. And it is almost always given away for free.

I mean…

See you next week,

Brett

***Our fund, Arch Capital, may own securities discussed in this newsletter. Check our holdings page and read our full disclosure to learn more.***

***Want our FREE weekly wrap-up delivered to your inbox each week? Subscribe here***

3 Intriguing Reads

The Art of (Not) Selling - Akre Capital Management

Taking a step back, our investment philosophy involves concentrating our capital in a small number of what we believe to be growing and competitively advantaged businesses. These kinds of businesses are rare and are only periodically available for purchase at attractive valuations. With that in mind, we do our best to hold on for the long term, so that our capital may compound as the businesses grow.

From Hustle to Scale - MicroCapClub

I love the story of Sam Walton and Wal-Mart. In 1962, at the age of 44, Sam Walton started with 1 store. In just 30 years, Wal-Mart became the #1 retailer in the United States. At the time of his death in 1992, there were 1,735 Wal-Marts, 380,000 employees and annual sales approaching $50 billion. The fact this was all accomplished in the second half of Sam Walton’s life is staggering. This wasn’t a present-day tech company that could scale effortlessly. Walton had huge tangible and logistical challenges. He was CEO up until 1988, and Chairman until his death. He was in charge. Only an exceptional leader can successfully lead a company from hustle to scale.

Quality at 10x P/E! - The Brooklyn Investor

OK, so you guys can laugh at me. Having said what I said in the other post (you would have to sacrifice a lot to find a 10x P/E stock in a 20 P/E world), here are some really good companies for 10x P/E. I didn’t write the last post to set this one up or anything like that. As you guys know, I have followed these companies for years and have a high level of comfort, familiarity with them. Of all the industries I talk about, I am probably most comfortable with financials, since that’s where I come from.

1 Good Podcast

Smart, Insightful, and Funny Tweets:

(link)

(link)

(link)

(link)