Sunday Finds + 3 Thoughts From Last Week

Podcast episodes covering Alphabet and Allison Transmission Holdings

Welcome to Chit Chat Money’s Sunday Finds + 3 Thoughts From Last Week. In this newsletter you will find three topics I thought about last week, links to shows we’ve recently released, and links to some interesting articles, podcasts, and tweets. Check out the archive here.

Chit Chat Money Podcasts From Last Week:

Arch Capital Episode: Why We Own Google/Alphabet (Ticker: GOOG)

Interview: Allison Transmission Holdings with Rod Alzmann (Ticker: ALSN)

Investing Power Hour #45: MSFT Coming For Google; Affirm Layoffs; Uber Earnings

Chit Chat Money is presented by:

Stratosphere.io, a powerful web-based research terminal for fundamental investors.

Stratosphere.io has made it easy for us to get the financial data we need with beautiful out-of-the-box graphs for researching stocks.

🎉Stratosphere.io just launched their brand new platform and you can give it a try completely for free.

It gives us the ability to:

Quickly navigate through a company’s financials on their beautiful interface

Go back up to 35 years on 40,000 stocks globally

Compare and contrast different businesses and their KPIs

Easily track insider transactions and news updates for any stock we follow

Get started researching for FREE on the Stratosphere.io platform today, or use code “CCM” for 15% off any paid plan.

1. Some questions about Microsoft and ChatGPT

It seems the whole business world wants to talk about Microsoft’s integration of ChatGPT into Bing. Investors in Google seem spooked, with shares down 8% the day after the announcement. I have a few questions about its implications:

Does having easy access to a chatbot meaningfully improve the value a person gets when interacting with a search engine?

How many people will switch over to the Microsoft Edge browser, if any, because it has ChatGPT?

If Bing steals market share due to having the chatbot, will these be profitable searches? I.e. will it steal the lucrative “car insurance provider” searches that Google prints money on?

What does this mean for Google’s monopoly in mobile search? Will Microsoft vie for the Apple license?

How much worse can Google’s competitor (called Bard) be than ChatGPT for it to stop losing market share (if that ends up happening)?

What if Google’s product is much better than ChatGPT? What if these chatbots are all commodities in a few years?

How will this impact the semiconductor market? And cloud computing? Can our current internet infrastructure support a billion users regularly querying these tools? If not, how long until it is possible?

Will we even be talking about this three years from now? Or is this just the same as Amazon Alexa in 2017?

I think I know the answer to some of these questions today, but definitely not all of them. My gut tells me one thing though: distribution and switching costs matter. Ask yourself why Microsoft Word/Excel still prints money when Google gives an equivalent product away for free.

2. One thing I don’t understand about the Fed haters

I don’t want to sound like a Fed defender here, but some of the hate they get just makes zero sense and I felt like putting pen to digital paper and explaining why.

Look, you can hate on the Federal Reserve all you want. That is your right. But all it does is change the price of money through interest rate changes and change the reserve levels at commercial banks. Both are monumentally important, but the Fed really doesn’t do much else.

Which is why it baffles me to see people again and again say something along the lines of “this is the most Fed-controlled market in history.” What? Is the Fed buying stocks for all of the hedge funds and individual investors in the world now? I guess I didn’t get the memo.

Yes, the market might trade wildly whenever the Fed does or says something, but that has nothing to do with them. Here’s a meme I think explains what I see on a regular basis:

My advice? If you have Fed brain, work to ween yourself away. Stop talking about how things are a “ZIRP phenomenon” (they aren’t) and get back to analyzing the fundamentals of individual companies.

Or don’t, and just buy some index funds and head to the beach.

3. Forward inflation readings heating up?

What’s more interesting than the Federal Reserve at the moment is inflation, because the inflation rate will directly determine how the Fed will adjust interest rate levels in the coming years.

Disappointingly, it looks like some inflationary pressures that were easing are starting to flare up again.

First, mortgage rates are climbing back to 7%:

Higher mortgage rates eventually funnel through to increased shelter costs across the board. They directly impact the affordability of a home and will indirectly make rentals more expensive.

My take? Housing prices need to fall considerably or else shelter inflation will continue to be an issue.

Second, used car prices are rising again:

It’s pretty straightforward how this impacts inflation. Higher selling prices on higher interest rates make automobiles much more expensive to purchase, increasing the costs for consumers.

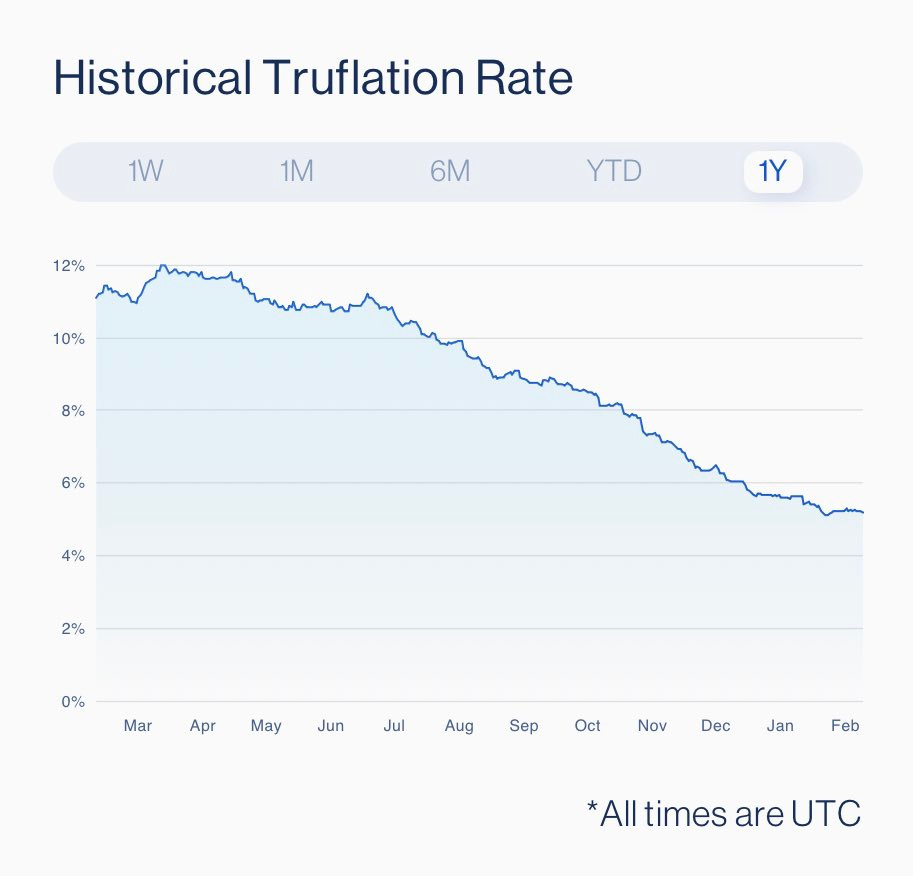

We’re also seeing stabilization from research groups that try to be more forward-looking than the government’s CPI number:

Inflation could be 2% or 8% a year from now, I really have no idea. But with shelter + automotive costs rising again, it seems like there is a good chance inflation is higher for longer. Let’s hope oil/energy doesn’t join the party…

See you next week,

Brett

***Our fund, Arch Capital, may own securities discussed in this newsletter. Check our holdings page and read our full disclosure to learn more.***

***Want our FREE weekly wrap-up delivered to your inbox each week? Subscribe here***

3 Good Reads

That said, it is apps like this (in addition to competition from Google, Microsoft, etc) that will force Apple to release their own digital assistant (or upgrade Siri) sooner than later.

It’s one thing to have a chat interface with apps, it’s quite a different thing for voice to be the medium. It’s too personal and Apple won’t like it. They won’t ban apps like Embra, but they will release their own version that will effectively result in the same thing.

The big question is how long it will take before the upgrade is technologically feasible. Response times will have to be similar to what they are today even though the algorithm in the background will be having to work through more compute.

United Guardian: Analysis, Valuation, Pricing - Invariant

United-Guardian (UG) has formed marketing and supply agreements with partners around the world, presenting unique opportunities for growth. This is further amplified by the company’s R&D efforts, which aim to not only formulate new products but identify new uses for their existing portfolio. Continued operations are extremely profitable while being very capital-light, allowing the company to generate substantial free cash flow it eagerly returns to shareholders.

The media industry is in the middle of change. There’s little doubt legacy cable TV will continue to bleed millions of subscribers each year as streaming takes over as the primary way the world watches television.

Still, the details of what’s about to happen to a transitioning industry are unclear. CNBC spoke with more than a dozen leaders who have been among the most influential decision-makers and thinkers in the TV industry over the past two decades to get a sense of what they think will happen in the next three years.

CNBC asked the same set of questions to each interviewee. The following is a sampling of their answers.

1 Good Podcast

After a decade of dominance, 2022 saw tech stocks badly underperform the rest of the market. However, so far in 2023, tech stocks and other speculations have surged again. According to Steve Eisman, what we're seeing is the natural process by which a "paradigm shift" is playing out in stocks. Eisman, a portfolio manager at Neuberger Berman, won big betting against CDOs during the Great Financial Crisis and was famously depicted in the book and movie The Big Short as one of the few investors who got it right. In this conversation, he talks about lessons learned from his career in investing, how and why big shifts happen in markets, the state of the financial system, and what sectors could win over the next decade.

Smart and Funny Tweets: