Welcome to Chit Chat Money’s Sunday Finds + 3 Thoughts From Last Week. In this newsletter you will find three topics I thought about last week, links to shows we’ve recently released, and links to some interesting articles, podcasts, and tweets. Check out the archive here.

Chit Chat Money Podcasts From Last Week

Chit Chat Money is presented by:

Potentially you! Reach out to our email chitchatmoneypodcast@gmail.com if you are interested in doing a sponsorship on our podcast network. Check out our media kit for more information.

1. Airbnb isn’t your housing scapegoat

(side note: lol)

New York City has started enforcing its ban on unregistered short-term rentals (i.e. Airbnb). The reasoning makes sense to me. You don’t want people signing up for a rental lease and then immediately renting out that place on Airbnb. Maybe you could argue this should be up to the landlord, but either way, I don’t think it is the end of the world that cities only want people to rent out things they own.

Some of the rules under this new law seem strange, but that’s not what I want to discuss. What intrigues me are all the takes saying this is a sign that the Airbnb bust is imminent, the company is going down the drain, and that Airbnb is a key reason apartment rents are so high in New York.

The facts don’t support any of this. Airbnb has approximately 40k listings in NYC compared to an estimated 2.1 million apartment rentals. So, if every Airbnb was taken off the market and available for rent, supply would increase from 2.1 million to 2.14 million. And there’s no way every Airbnb is getting taken off the market. There would be an uproar from both travelers and hosts.

From Airbnb’s perspective, 40k units are even less meaningful. The platform passed 7 million listings this summer.

But what about the Airbnb bust? There is a theory out there that a lot of Airbnb hosts over-levered and bought up too many short-term rentals during the pandemic. Now, with demand falling in pandemic boomtowns, they are primed to go bankrupt.

This could easily be true. But how would it affect Airbnb? They do not care if a few thousand individuals and SMBs on the platform go bankrupt, because they own none of the supply. In fact, Airbnb is (probably not purposefully) inflicting even more pain on these over-levered hosts by making it a priority to increase the supply on the platform. This could reduce daily rates but would likely bring on more customers.

Even if the Airbnb bust materializes, it might actually help the platform by restricting supply. A reduction in supply and steadily increasing demand would mean growing daily rates for travelers to stay at Airbnbs, which translates to an increase in revenue. Either way, Airbnb wins.

Airbnb has a beautiful and competitively advantaged business model. If you want our full thoughts on the business, check out our recent podcast on the stock:

2. Instacart debuting below $10 billion

According to the Journal, Instacart is pitching its IPO at a valuation a touch below $10 billion:

Instacart is targeting a valuation of roughly $8.6 billion to $9.3 billion in its imminent IPO, a fraction of what the grocery-delivery company was previously worth, in the latest sign of diminished investor enthusiasm for private growth companies.

In 2021 it received a funding round at a valuation of $39 billion. Another reminder of how insane the COVID bubble was.

Regardless, Instacart has an interesting business that is still growing and is profitable. Revenue was $2.55 billion in 2022, up 73% from 2020. That has continued in 2023, with $1.48 billion through the first half of this year, up 31% year-over-year.

Profits have finally shown up, with $269 million in operating earnings (18% operating margin) through the first half of this year.

Things look solid for Instacart today. However, I do have a concern with where they are getting these profits: advertising. Instacart’s advertising revenue grew from $67 million in 2019 to $740 million in 2022.

Why does this scare me? Because it shows that Instacart has achieved profitability not through scale but through squeezing its merchant suppliers. This could open itself up to competitors like Uber and DoorDash to take share here. Both businesses have succeeded in grocery in recent years.

I also think there is some uncertainty about how big the grocery delivery space will be. Regardless, this is an interesting business and I am glad we will now get quarterly updates to track its progress (or lack thereof).

3. Roundtripping the dotcom bubble

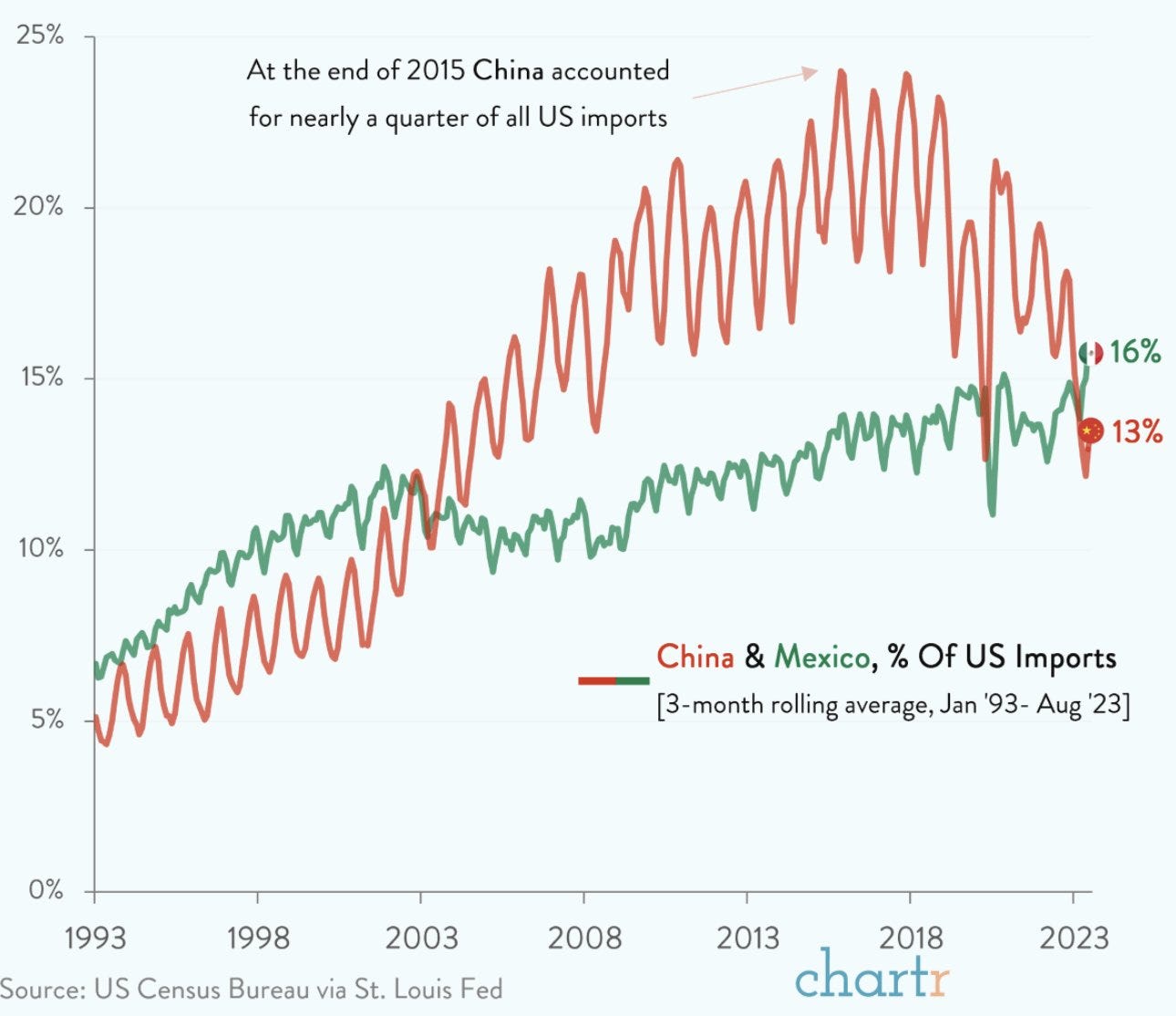

Interesting chart shared by Tobias Carlisle:

What this chart is generally saying is that Nasdaq stocks (i.e the Mega 7 + others) have recently crushed small-cap stocks (the Russell 2000).

Odds are that small-caps will outperform the Nasdaq over the next decade. If forced to make a bet I would take the Russell 2000 over the Nasdaq.

However, there are a few things that make me believe the reversal won’t be nearly as bad as in 2000:

The Nasdaq companies are generally higher quality compared to 2000 and are not as egregiously valued (excluding Nvida and Tesla) as the top stocks in 2000.

High interest rates should present a growing headwind to Russell 2000 earnings in the next few years as companies have to refinance their debt. I think the market is forward-looking here.

Of course, this is not a prognostication. The reversal could easily be worse than in 2000.

For our portfolio, I am generally not concerned about Nasdaq 100 stocks underperforming over the next five years. We own Alphabet and Amazon but bought shares at significantly lower prices within the last year and a half. If they underperform for a few years it isn’t a huge deal. We also would have to pay taxes if we sold.

Looks like the next few years could be great for small-cap investors. But that doesn’t mean it is time to put 100% of your portfolio within this factor just because you saw a scary chart.

See you next week,

Brett

***Our fund, Arch Capital, may own securities discussed in this newsletter. Check our holdings page and read our full disclosure to learn more.***

***Want our FREE weekly wrap-up delivered to your inbox each week? Subscribe here***

3 Intriguing Reads

The Invention - Lewis Enterprises

There is an inclination among financial writers to center the narrative arc of mortgage securitization around the Great Financial Crisis. The speculative fervor and subsequent fallout make for a compelling denouement, but the story of credit in the housing market straddles a longer history. Since the expansion of consumer mortgage financing in the 1970s, residential housing’s importance to not only the financial system but also to the US’s economic health has grown considerably. It has changed the nature of home ownership and the social makeup of our communities. We have evolved Thomas Jefferson’s vision of yeoman farmers in ways unimaginable to the Founders or even to early 20th-century Americans. In the process, the relatively straightforward process of financing a home has become central to the plumbing of the global financial system.

When Facebook Tried to Kill Tinder - The New Internet

While the world eagerly anticipates Mark Zuckerberg and Elon Musk's Coliseum fight, the true battle has already been fought between Threads and X.

Take a stroll down memory lane with me.

That’s What I Call Ponzinomics - Intelligencer

Bankman-Fried was dressed slovenly as usual, in gray shorts and a gray FTX T-shirt. Lewis looked like a prep-school headmaster, wearing a blue blazer with peak lapels and a white button-down with blue accents, his floppy hair parted perfectly to the side. The way he was talking about Bankman-Fried, he sounded as if he were presenting a prize to his star pupil. “You’re breaking land-speed records,” Lewis said. “And I don’t think people are really noticing what’s happened, just how dramatic the revolution has become.”

1 Good Podcast

Smart, Funny, and Insightful Tweets:

(link)

(link)

(link)

(link)

(link)

(link)

(link)