Sunday Finds + Thoughts on banks and consumer health

Podcasts on Dollar Tree and short selling this week...

Welcome to Chit Chat Money’s Sunday Finds + One Thought From Last Week newsletter. In this newsletter you will find a topic I wanted to write about from last week, links to shows we’ve recently released, and links to some interesting articles, podcasts, and tweets. Check out the archive here.

Chit Chat Money Podcasts From Last Week

Chit Chat Money is presented by:

Potentially you! Reach out to our email chitchatmoneypodcast@gmail.com if you are interested in doing a sponsorship on our podcast network. Check out our media kit for more information.

Some thoughts on banks and consumer health

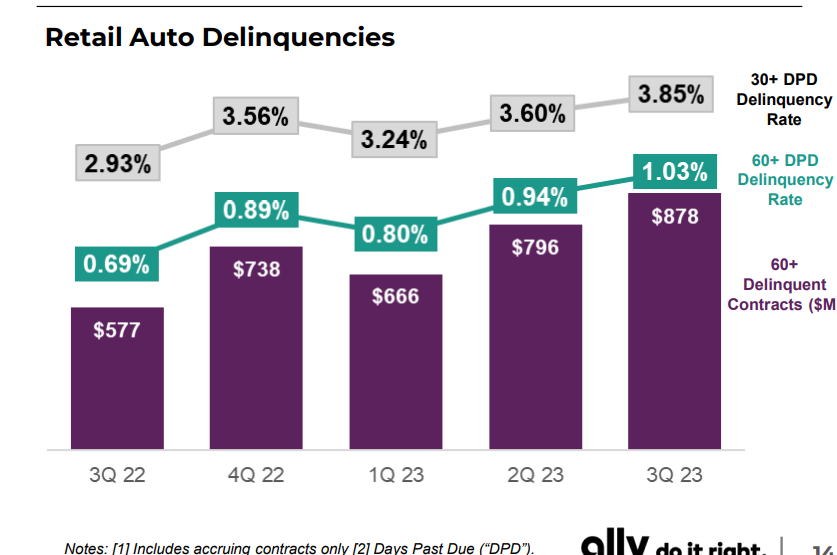

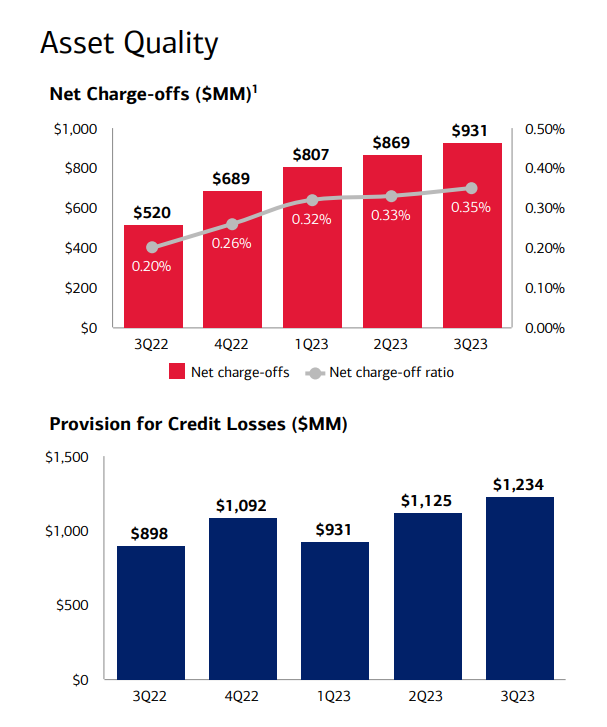

A lot of banks and lenders have reported third-quarter earnings. These reports are my favorite insights into the state of the consumer. If people (or businesses) are not paying back loans, they are probably feeling more pressure on their personal balance sheets. Simple.

Here are some charts from various lenders that readers may find interesting.

Ally Financial:

Discover Financial:

American Express:

Bank of America:

I could add more. It looks like loan charge-offs are increasing, which some people seem to be extrapolating forever (shocking). Oh my god! Amex’s net write-off rate has doubled in the past year! The health of the consumer is in shambles.

That seems disingenuous to me. Comparing 2021 and 2022 is going to make most lenders look terrible, as the government essentially decided nobody was defaulting during the pandemic. The famous savings rate chart exemplifies this.

It seems better to compare loss rates to pre-pandemic levels. Check the American Express chart above, write-offs are still significantly below 2019 levels. And it’s not like 2019 was a recessionary period.

Even better would be to look at past recessions. In Q4 of 2009, Discover’s net charge-off rate was 8.43% and its 30-day delinquency rate was 5.31%. If that happens next year, you will be seeing clickbait headlines pop up all over the place, no doubt. But guess what? In 2009 Discover generated just under $1.3 billion in net earnings. It has generated positive net income every year since 2007.

So all in all, it looks like the consumer is fine. Could a recession/depression easily hit next year? Yes. But if you look at the valuations of some of these lenders, I think the market is already pricing in a major downcycle.

For someone looking to partner with durable franchises and never sell, I think there are some fantastic opportunities in consumer finance right now. I like Ally, Amex, Nelnet, and Discover. Of course, position size accordingly and do your own research.

See you next week,

Brett

***Our fund, Arch Capital, may own securities discussed in this newsletter. Check our holdings page and read our full disclosure to learn more.***

***Want our FREE weekly wrap-up delivered to your inbox each week? Subscribe here***

3 Intriguing Reads

Interest Rates, Some Books - The Brooklyn Investor

This is not to pick on this kid, good for him to start investing early. But my kid also sent me a list of stocks that he bought recently, and I was baffled. I asked him to explain to me these businesses, but he wasn’t really able to. I think he was also investing in themes.

So I told him, don’t invest in themes. The only thing you should invest in are good businesses. On-theme businesses can often be horrible investments. Look at the wasteland in biotech, green energy and many other areas where ideas may have been exciting but business models horrible.

The Rise and Fall of the Telecom Bubble - Fabricated Knowledge

One of the big reasons for so much fraud in the telecom industry is that the entire industry at the time had pushed itself to the limits. Between mis-expensing capital expenditures, vendor financing, and buying and selling revenue between competitors, the entire telecom industry had engaged in aggressive tactics to show better numbers. And if you didn’t participate, you were left behind. The incestuous ties created many opportunities to double-count revenue while undercounting expenses.

Caroline Ellison Was Supposed to Shock the SBF Trial - The Ringer

The courtroom buzzed as Ellison detailed a round-the-world whirlwind of money and power, saying or reading aloud the phrases “Saudi prince” (referring to Mohammed bin Salman, whom she said Bankman-Fried tried to sell desperate equity to), “bribe to Chinese government officials” (a sum that she pegged at more than $100 million, delivered in hopes of getting back $1 billion of overseas assets that had been frozen, and that she marked on a spreadsheet as “the thing”), “Thai prostitutes” (a resource that she said Bankman-Fried tried deploying—unsuccessfully—for the same unfreeze-the-money objective), and “Michael Lewis is going to be in the Bahamas” (to report on the book that would become the Going Infinite).

I could not agree more with your take on the health of the consumer. As long as the jobs market is strong, consumer spending and sentiment will stay strong. The consumer will always find something to worry about and whine about...that shows up in surveys but does not impact their spending habits.

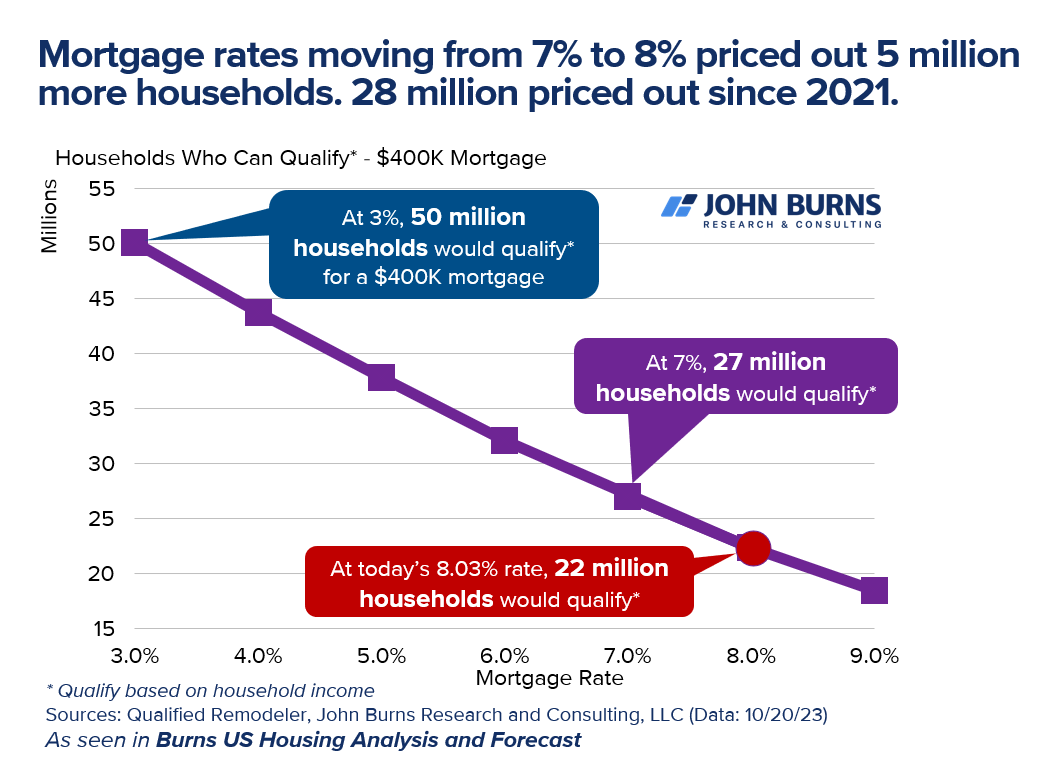

I love the Burns US housing chart...every insightful!