YouTube

Spotify

Apple Podcasts

When the Federal Reserve started to raise interest rates in 2022, everyone and their mother started to call for a recession:

Quarterly conference calls were filled with CEOs “batting down the hatches” and giving out excuses for poor results due to a “tough economic environment.”

The yield curve inverted in July of 2022, which is supposed to signal a recession arriving in the next 12 - 18 months. People used this as a reason to call for an upcoming recession in late 2022 or 2023.

Then, in early 2023 Silicon Valley Bank, Signature Bank, and First Republic Bank failed. Wake up doomers, time to party. People were calling for the next financial crisis and saying the banks all had liquidity issues.

There were even multiple calls that Charles Schwab — what one may call a “too big to fail” brokerage — was teetering and could face a liquidity crisis. Scary.

So, what has happened since then? Well, everything is fine.

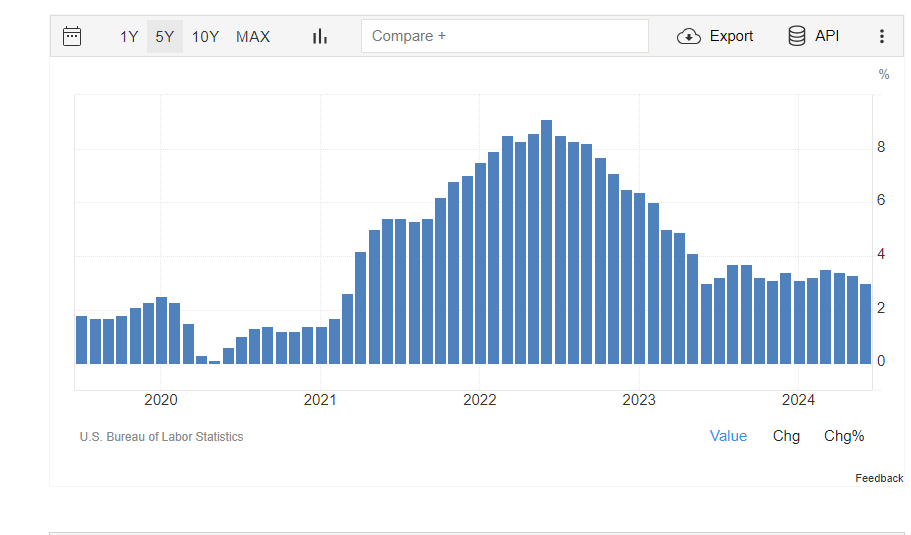

Inflation is coming down:

GDP grew at 5.8% in 2021, 1.9% in 2022, 2.5% in 2023, and by 3% in the last two quarters:

No recession. No banking crisis. The stock market is soaring. Stagflation? A little bit. But nothing like the 70’s.

Looks like everything is (still) going fine.

Funny enough, half the country seems to think we are in a recession (although you should never completely trust a survey).

The big banks reported earnings for the second quarter of 2024 this week. They seem to be saying, once again, that everything is still fine.

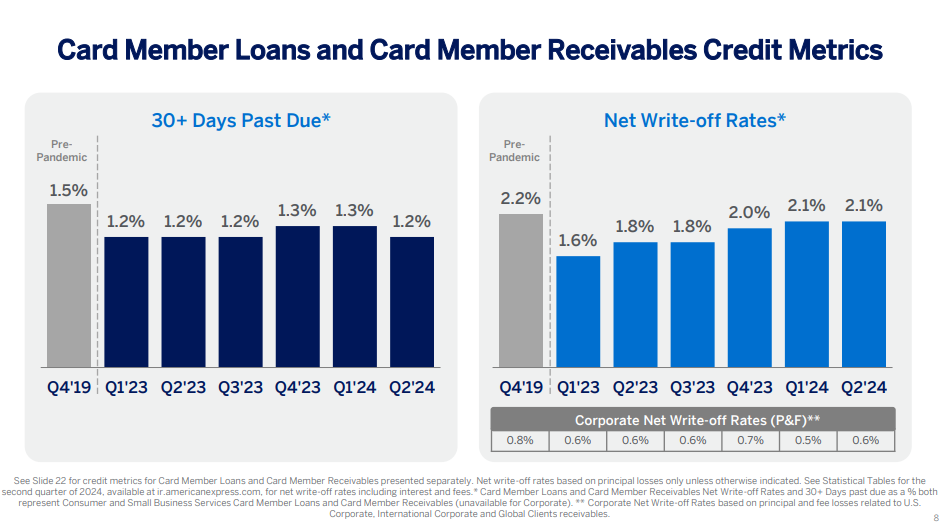

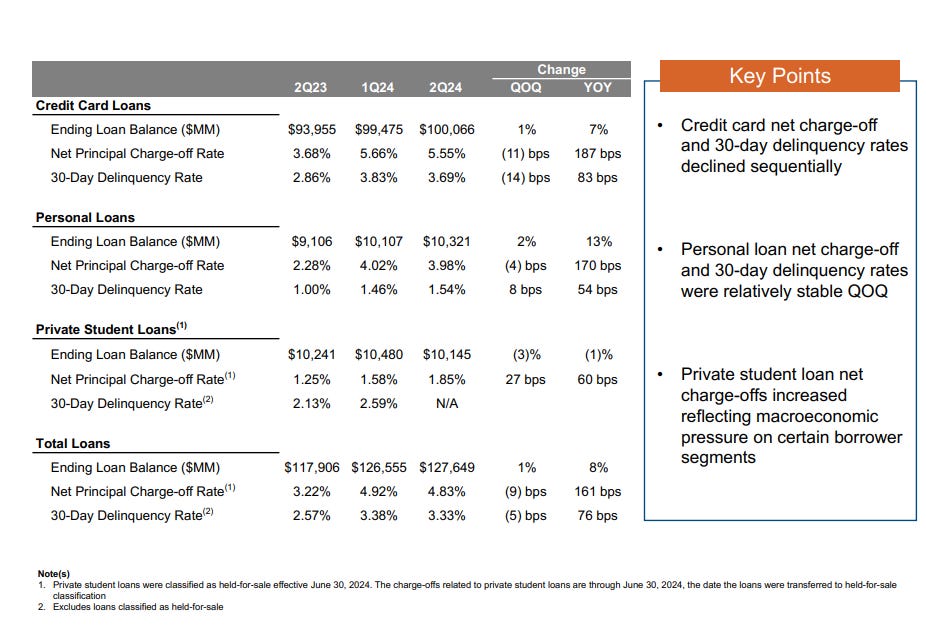

Here are some more charts:

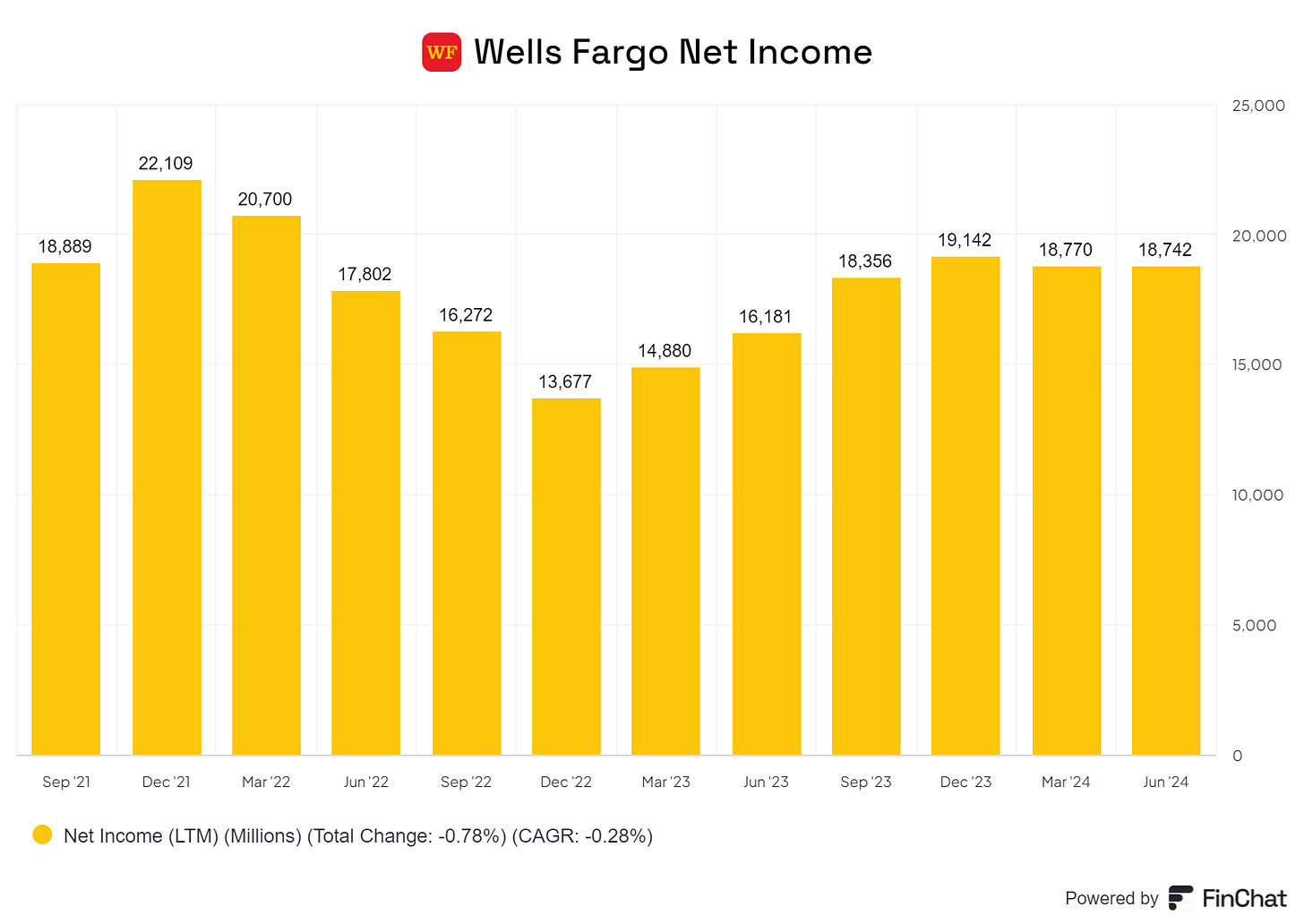

The banks are earning plenty of money. Assets (bank loans), which are the lifeblood of a credit-based economy, are growing. Even at beleaguered Wells Fargo.

Ok, well how are these assets performing?

The high-end consumer (American Express) is still fine. The low end (Discover) is weakening but the company remains profitable. I understand this is just the consumer.

Next week, Visa will give us the best update on how much consumer spending is growing (or not) in the United States.

Does that mean a recession won’t happen in the next twelve months? No. It is possible one might occur. I would never take a hard stance that a recession will not occur within any 2 - 3 year period. There are just too many variables at play.

But don’t let anyone who was banging the drum for a recession back in 2022 tell you they “called it” if one occurs in late 2024 or 2025.

“Oh yeah, you can’t raise interest rates like this with inflation soaring and an inverted yield curve, the recession was inevitable. Anyone could see it”

Uh-huh.

A broken clock is right twice a day, and the doomers who always call for calamity sound right about once a decade (even though they were wrong in 2022).

So, why do I write all this? Because it is a clear example of how dumb macroeconomic analysis is. All these economists, all these “strategists” with so much IQ power, and they were mostly wrong.

Don’t focus on the macro. Don’t let the macro doomers scare you. Stop caring about unpredictable things. Just invest in a group of reasonable companies (or index funds, or a 60/40 portfolio) and stay the course over the long term. Then go enjoy your life.

The recession forecasters may look smart on occasion. But you will make more money than most of them.

What matters more to you?

Brett

Chit Chat stocks is presented by:

Public.com just launched options trading, and they’re doing something no other brokerage has done before: sharing 50% of their options revenue directly with you.

That means instead of paying to place options trades, you get something back on every single trade.

-Earn $0.18 rebate per contract traded

-No commission fees

-No per-contract fees

Options are not suitable for all investors and carry significant risk. Option investors can rapidly lose the value of their investment in a short period of time and incur permanent loss by expiration date. Certain complex options strategies carry additional risk. There are additional costs associated with option strategies that call for multiple purchases and sales of options, such as spreads, straddles, among others, as compared with a single option trade.

Prior to buying or selling an option, investors must read and understand the “Characteristics and Risks of Standardized Options”, also known as the options disclosure document (ODD) which can be found at: www.theocc.com/company-information/documents-and-archives/options-disclosure-document

Supporting documentation for any claims will be furnished upon request.

If you are enrolled in our Options Order Flow Rebate Program, The exact rebate will depend on the specifics of each transaction and will be previewed for you prior to submitting each trade. This rebate will be deducted from your cost to place the trade and will be reflected on your trade confirmation. Order flow rebates are not available for non-options transactions. To learn more, see our Fee Schedule, Order Flow Rebate FAQ, and Order Flow Rebate Program Terms & Conditions.

Options can be risky and are not suitable for all investors. See the Characteristics and Risks of Standardized Options to learn more.

All investing involves the risk of loss, including loss of principal. Brokerage services for US-listed, registered securities, options and bonds in a self-directed account are offered by Open to the Public Investing, Inc., member FINRA & SIPC. See public.com/#disclosures-main for more information.