The Next Carvana? A Potential Cardlytics Stock Inflection With IndraStocks

Risk, reward, and investing when everyone else has thrown in the towel

YouTube

Spotify

Apple Podcasts

This week, we brought on IndraStocks (Twitter) to discuss Cardlytics:

The stock has a lot of the factors a contrarian investor might like.

It is in a 95% drawdown, meaning most of the prior shareholders are going to hate it and have a bias against the name.

It has a weird revenue recognition (talked at length in the show) that can mislead investors who don’t look deep enough at the fundamentals.

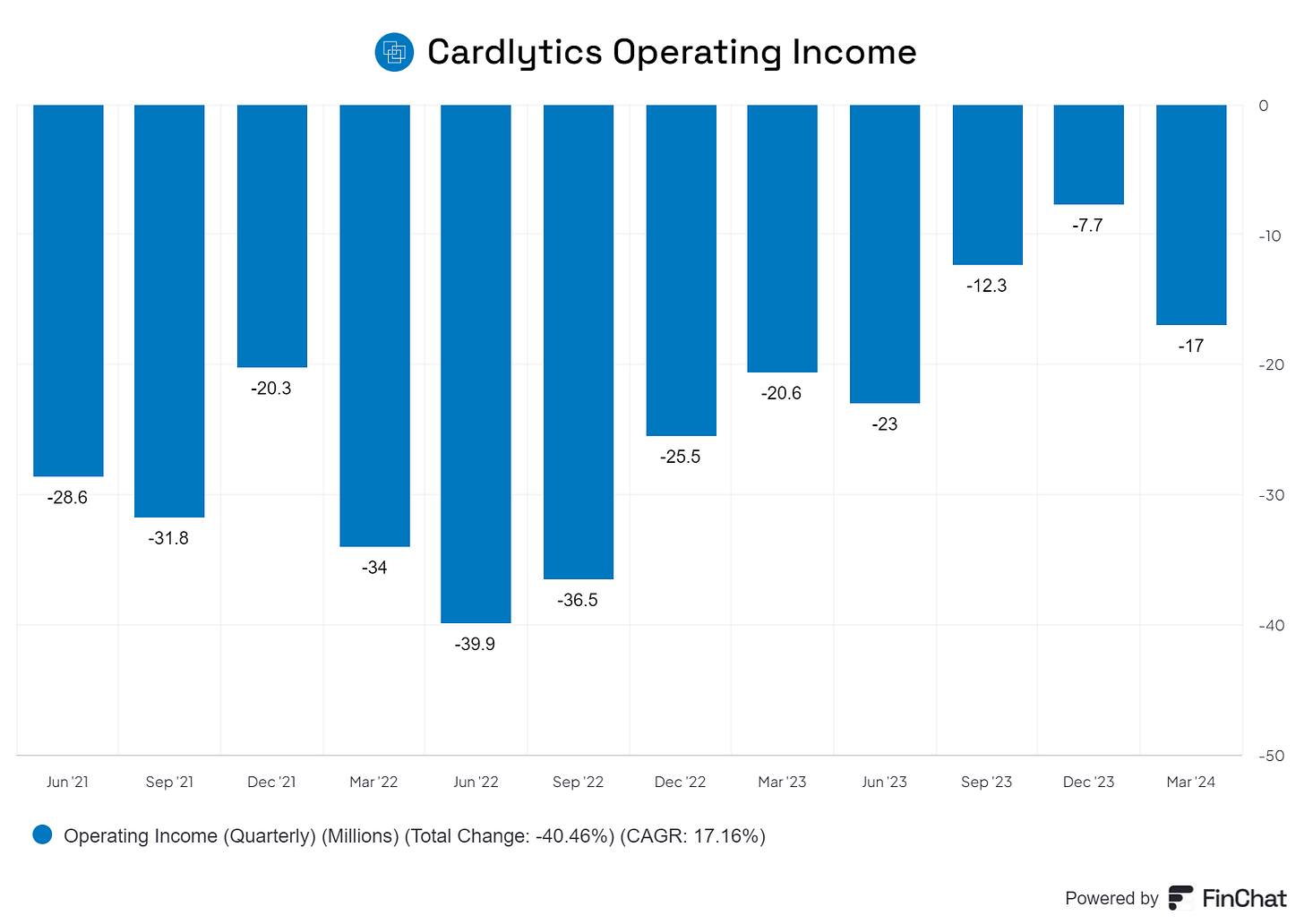

It is not profitable but making progress toward break-even soon.

Management is new.

There are new business developments that can potentially help profits/sales inflect higher (American Express, Bridge).

The stock trades at an EV/GP of 4.

Check. Check. Check.

Now, I don’t know if I like management, or whether Cardlytics is about to flip to profitability. I have not done enough research on them to have a strong opinion.

But this is a setup that can lead to fat outcomes over a 2 - 3 year period. Most people hate this stock. If you can get conviction on the few things that need to happen for Cardlytics to start generating a profit, this looks like a great risk/reward at current prices.

Which is why I think you should listen to this week’s interview.

Chit Chat stocks is presented by:

Public.com just launched options trading, and they’re doing something no other brokerage has done before: sharing 50% of their options revenue directly with you.

That means instead of paying to place options trades, you get something back on every single trade.

-Earn $0.18 rebate per contract traded

-No commission fees

-No per-contract fees

Options are not suitable for all investors and carry significant risk. Option investors can rapidly lose the value of their investment in a short period of time and incur permanent loss by expiration date. Certain complex options strategies carry additional risk. There are additional costs associated with option strategies that call for multiple purchases and sales of options, such as spreads, straddles, among others, as compared with a single option trade.

Prior to buying or selling an option, investors must read and understand the “Characteristics and Risks of Standardized Options”, also known as the options disclosure document (ODD) which can be found at: www.theocc.com/company-information/documents-and-archives/options-disclosure-document

Supporting documentation for any claims will be furnished upon request.

If you are enrolled in our Options Order Flow Rebate Program, The exact rebate will depend on the specifics of each transaction and will be previewed for you prior to submitting each trade. This rebate will be deducted from your cost to place the trade and will be reflected on your trade confirmation. Order flow rebates are not available for non-options transactions. To learn more, see our Fee Schedule, Order Flow Rebate FAQ, and Order Flow Rebate Program Terms & Conditions.

Options can be risky and are not suitable for all investors. See the Characteristics and Risks of Standardized Options to learn more.

All investing involves the risk of loss, including loss of principal. Brokerage services for US-listed, registered securities, options and bonds in a self-directed account are offered by Open to the Public Investing, Inc., member FINRA & SIPC. See public.com/#disclosures-main for more information.

I see AI taking this companies edge away. Soon banks etc., can do their own management of offers from their own data.