YouTube

Spotify

Apple Podcasts

Happy Independence Day Eve to all our United States listeners!

Today, we have a great episode to celebrate the 4th of July: a research report on Molson Coors, owner of the Coors, Miller, and Blue Moon beer brands.

(Ads like this work because they make us remember how something tastes/feels as well as invoke a sense of nostalgia)

Below are my full show notes from the podcast. We used these as notes for our hour-long discussion on the Molson Coors business, history, management, and stock valuation.

Read the notes and listen to the episode to get a full overview of the business. Here, I want to summarize my thoughts on the company/stock:

Beer volumes in the United States are uncertain. There is a transition to spirits, young people are drinking less, and seltzers are still quite popular. With the stock at a 10-year low EV/EBIT of 9.5 (chart below), I think the market is pricing in continued volume declines for Molson Coors.

Coors Light has a decent brand heritage and advertising dominance. Coors has a connection to the Rocky Mountains and a plain advertising strategy that reminds me of Coca-Cola. Coca-Cola ads essentially always say “you will be happier with a coke” and Coors Light ads say “our beer is cold.” You may think this is dumb, but the ads work and that is why Coors Light has steadily gained market share over the past few decades. Does it have the same brand dominance as a luxury house? No. But it still gives the company an advantage.

Management is returning capital to equity holders. They are repurchasing stock, paying a dividend that should grow, and reducing debt. I think this all bodes well for shareholders over the next five years.

And that’s it. The company’s strategy seems reasonable and I could argue it has a competitive advantage (more details on that in the episode). The big hold-up is the industry uncertainty, which we discuss at length on the show.

(Use our link finchat.io/chitchat for 15% OFF any paid plan)

I think if they ran various versions of this ad it would get a fantastic ROAS. One of the best ads ever imo:

I think the Coors Light (and Miller Lite) brand has strong durability. Are you really going to bet this brand won’t be around in 30 years?

That’s all for this week. Now, time to enjoy a refreshing light beer that is as cold as the Rockies…

Brett

Molson Coors: What do they own? What drives sales?

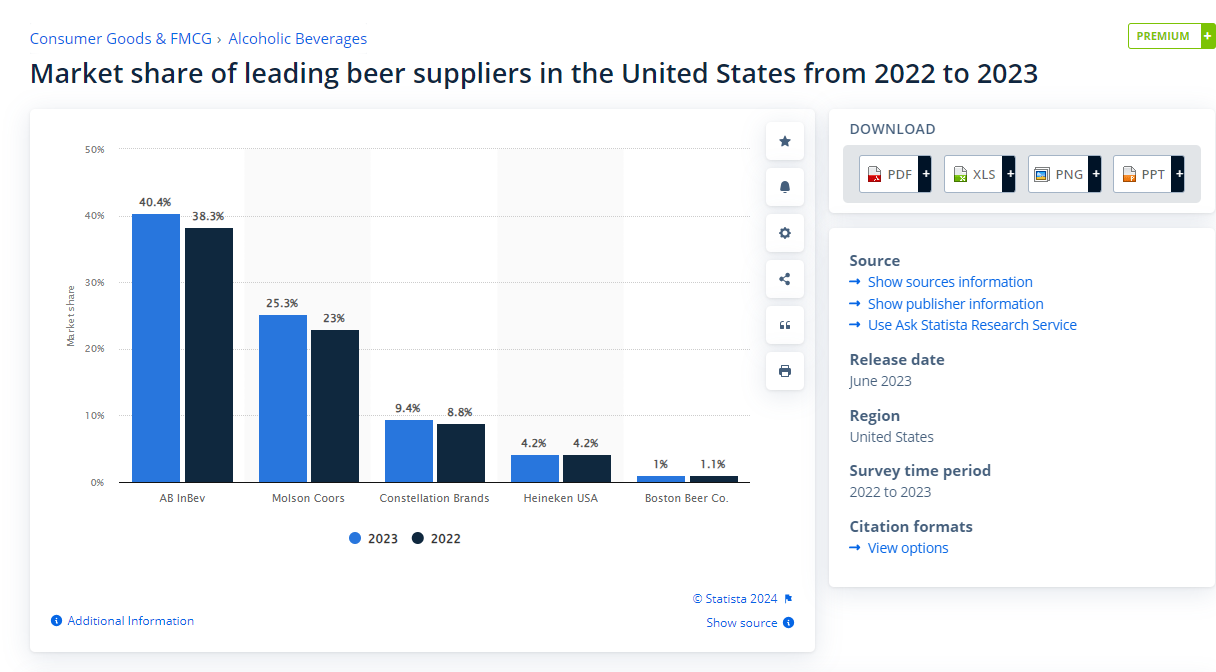

Molson Coors is a beer conglomerate. It is the second-largest brewer in the United States (75% of sales in the country come from three parent corporations), but importantly 80% of its sales come from the Americas.

Within the Americas, 84% of sales are from the United States. So, this is a U.S.-driven business.

Molson Coors has many brands it works with, but only a few that matter to drive sales. Coors Light and Miller Light drive around two-thirds of sales, with the rest coming from the “Other beer” category. The other segment includes brands like Icehouse and Hop Valley, really just a ton of niche brands.

There is also Blue Moon, which is a small part of the business but is considered one of the largest craft beer brands in the United States.

20% of sales come from Europe and Asia, mainly focused on the United Kingdom and Southeastern Europe markets. It owns brands such as Carling, which is huge in the United Kingdom.

Europe could be a small growth driver over this decade if they can keep executing in these markets, but the United States is what matters in the near term. Within the United States, Coors Light and Miller Lite are the important brands.

In 2016, Molson Coors fully acquired Miller, which cost $12 billion. It was a debt-fueled deal, and we will talk about the details of it later.

History: How did they get to where they are today?

According to the company website, this is how the Coors Brewery began:

“Adolph Coors, a penniless brewer’s apprentice, stowed away on a ship from Germany in 1868 and made his way west, coming upon the perfect water of Clear Creek in Golden, Colo., at the foot of the Rocky Mountains. He opened a brewery in 1873. A century later, in 1978, Coors Light was born. It is now one of the best-selling beers in the U.S. and enjoyed by beer drinkers in more than 25 countries worldwide.”

The original Coors (gold can with the tagline “the Banquet Beer”) was a niche brand with a focus on Cowboy culture. For example, today the brand is working with the Yellowstone TV show to help with advertising. You see ads for Coors at rodeos, for example.

Molson Coors is helping the original brand grow today, but it has always remained a subscale product. Growth for the brand took off with the introduction of Coors Light in 1978.

Coors Light can be traced back to World War II:

“Bill went back to the drawing board to create a beer – a low-ABV light lager – that would appeal to American drinkers at a time just eight years after Prohibition ended when breweries were still trying to regain their footing.”

“So Coors Light was born. Not only did it stake its claim as the lightest beer in the land, an ad from the time declared it “the greatest achievement in all brewing history.”

“But the 1941 version of Coors Light, billed as being “brewed with pure Rocky Mountain spring water,” came and went quickly, lasting just a year in the market. The war impacted the beer, which was also called Coors New Light in ads. Materials were in shorter supply and breweries were required to send 15% of their output overseas to boost the morale of troops, Harris says.”

Then, in 1978 when management was looking to expand beyond its single Coors product, it came upon this old idea and launched Coors Light. It became a hit and has grown into the third largest beer brand (behind Modelo and Bud Light I believe) in the United States today. Market share is estimated to be between 6% and 7%.

Coors Light has remained consistent with its advertising since launch, trying to tie itself to the Coors heritage:

“Beer as cold as the Rockies”

“Cold activated and cold brewed”

“Choose Chill”

Essentially, it revolves around Coors Light being cold. A simple tagline that has worked for a long time.

Question: Does this heritage and advertising connection give Coors Light a competitive advantage vs. other beer brands?

I’ll keep things shorter for Miller. Miller was another German immigrant who started a brewery in the 1800s. Miller Lite was launched in 1975 and was one of if not the first “light” beers. It has kept a similar tagline of “great taste, less filling” ever since.

Alcohol industry dynamics

I think listeners need to understand a few things about the broader alcohol market in North America.

Spirits are slowly gaining share vs. beer and have been for a few decades. From early 2023:

“New figures show that spirits surpassed beer for U.S. market-share supremacy, based on supplier revenues, a spirit industry group announced Thursday.”

“The rise to the top for spirit-makers was fueled in part by the resurgent cocktail culture — including the growing popularity of ready-to-drink concoctions — as well as strong growth in the tequila and American whiskey segments, the Distilled Spirits Council of the United States said.”

“In 2022, spirits gained market share for the 13th straight year in the fiercely competitive U.S. beverage alcohol market, as its supplier sales reached 42.1 percent, the council said.”

“After years of steady growth, it marked the first time that spirit supplier revenues have surpassed beer — but just barely, the spirit industry group said. Beer holds a 41.9 percent market share”

Hard Seltzers have gone from essentially zero to $17.5 billion in worldwide sales over the last decade. This has presented a headwind to traditional carbonated alcohol beverages such as beer. However, seltzer volumes seem to have peaked, at least for now.

In early 2023 Bud Light had an advertising “incident” that caused a good chunk of its customers to stop drinking the product. Drinkers switched to Mexican beers, Miller Lite, and Coors Light (chart below).

Younger people are drinking less than older people. According to the 2023 Investor Day, Gen Z is drinking 20% less than millennials at the same age. There are also fears that increasing weight-loss drug usage will lead to a decline in drinking. A narrative has formed that beer volumes will continue to decline in the United States, which is why the stock is down.

You can see the seltzer impact and Bud Light benefit in the Americas volume chart since 2018:

Discussion Question: Which of these trends scares you the most? Can Molson Coors benefit from any?

A note on how Alcohol/beer distribution works in the United States and how Molson Coors uses it to its advantage

Alcohol producers are required to go through independent distributors to sell to retail outlets in the United States. One might argue it drives prices higher due to more regulations and forcing another business to be involved, but the point was to make it so a brewery couldn’t go “exclusive” with a retail outlet and force people to only drink their brands.

So, Molson Coors is required to sell through to distributors. The distributors then sell to the retail outlets (grocery stores, convenience stores, bars).

If a retail outlet buys beer supply from a distributor and it does not sell, they will obviously be upset. The distributor is then upset with the beer brand. This is what happened with Bud Light last year, and it put huge stress on the distributors. Now, distributors have a more sour relationship with that brand.

Molson Coors has taken advantage of this. Over the last 12 months, the beer distributors have increased the volume coming from Coors Light and Miller Light, which I think is likely to remain indefinitely. A grocer (on average) will not get rid of a beer brand if it is selling, and the most important thing is getting it on the right shelf for the customer.

Outside of this specific situation, a large beer company such as Molson Coors is insulated somewhat from new competition as long as it can maintain a good relationship with its distributors. It is difficult for an upstart brand to get distribution quickly, which is why so many breweries remain local.

The number of craft beers has taken off over the last 15 years, but Molson Coors and the other top dogs still have the distribution advantage given the scale and switching costs.

Today, the number of new breweries is tailing off, which could be a benefit to these older brands as they try to keep and/or increase shelf space.

93% of distributors want to build momentum with Molson Coors in 2024:

Management + Strategy + Proxy

The CEO is Gavin Hattersly, who grew through the accounting/finance teams at the business and rose through multiple decades to become CEO in September 2019. This was after the merger and right before COVID threw every topsy turvy.

It is very hard to judge a management team in an industry like beer/alcohol. I mean, how much can they actually affect this business? They had no way of predicting the seltzer trend, and have had to react to it. The Bud Light controversy was a benefit, but they did not control their own destiny. They cannot halt the decline in beer usage vs. spirits.

I think the company’s strategy is sound. They just run consistent marketing that works and try to increase distribution/shelf space. In the last few years, Coors Light and Miller Light have begun to gain market share. Carling is performing well in the U.K. and Madri is as well. They are testing a bunch of different non-beer stuff and want to continue to “premiumize” its volumes.

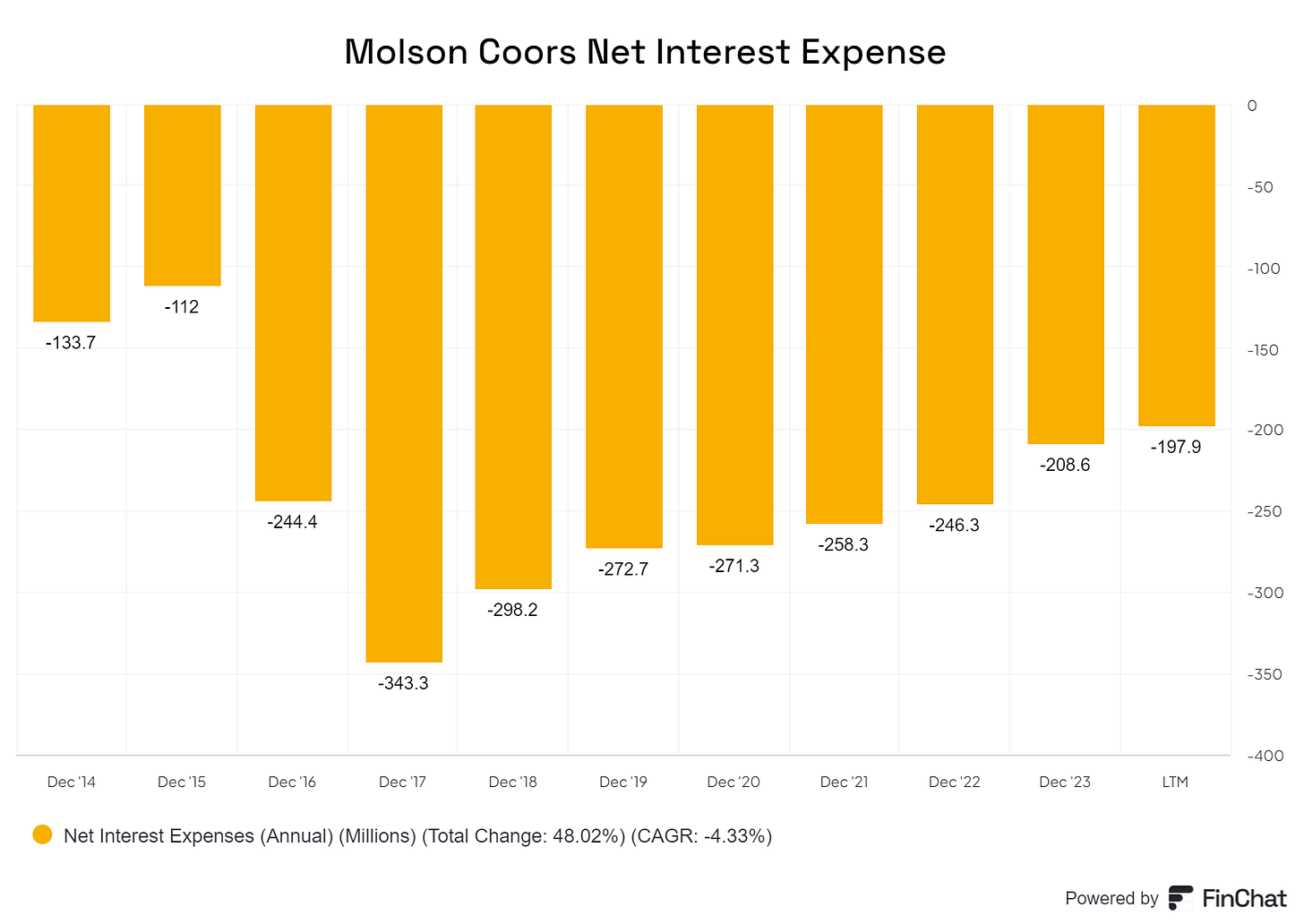

The finance team is performing well. This may be the biggest highlight from the executive suite. After taking on a huge chunk of debt from the merger in 2015/2016, long-term debt went up to $11 billion for a business that generates $1.4 billion in free cash flow. Today, that is down to $5 billion. Much more reasonable.

Debt is not all due soon and they just refinanced some Euro Bonds of 800 million Euros at a 3.8% interest rate due in 2032. God bless the European Central Bank.

They have recently launched a buyback of $2 billion that they plan to implement within the next five years. Shares outstanding have declined at a 2.5% rate since June 2023, which should begin to accelerate.

The dividend per share should start to grow again and currently yields over 3%. The buyback + dividend growth combination is a smart strategy for a (hopefully) stable business.

Executive compensation is a mess. There are over 10 different criteria for various bonuses talking about “underlying” (?) free cash flow, income before taxes, and adjusted net sales. 10% of bonuses are based on the “People and Planet Scorecard,” Good. We need beer companies focused on that.

The stock rewards are based on:

“Relative TSR over the three-year performance period was in the 90th percentile relative to the companies in the S&P 500 Consumer Staples Index at the end of the performance period, which achieved maximum level performance”

The executive compensation is definitely a downside. But, this new leadership team has definitely acted rationally for shareholders.

Overall, I like this management team, but don’t love them. They talk reasonably and act reasonably. I am not staying away from this stock simply because of the management team.

Financials, balance sheet, and what we need to make a decent return

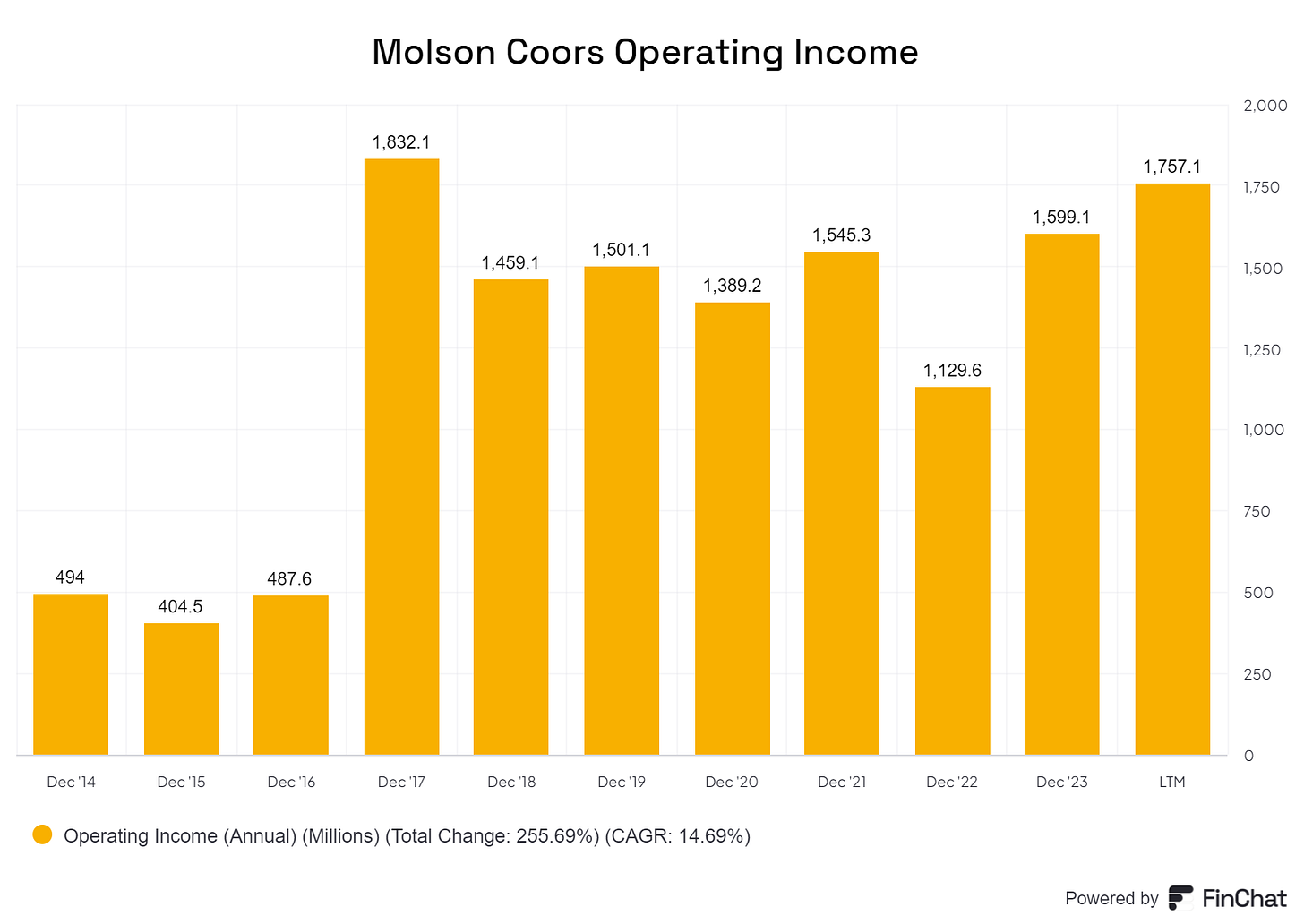

Molson Coors trades at a market cap of $10.3 billion. It has generated over $1 billion in operating earnings every year since the merger and $1.76 billion over the last twelve months.

Interest expense from debt is coming down and is only $200 million or so each year now. Definitely manageable and not a concern anymore.

Free cash flow has been over $1 billion every year since 2017 except 2022 and was $1.4 billion over the last twelve months.

It has an earnings yield well above 10% if earnings just remain stable. They can reduce shares outstanding by 5% or more each year.

If volumes remain stable, the company can grow the topline by 3% - 5% a year through price increases and mix to more premium brands. Eve

The big question is: what do volumes look like over the next decade?

What are the major risks?

I see two major risks for Molson Coors.

First, people are concerned the company is getting a one-time benefit from the Bud Light fiasco that will revert in the coming years. This is not a concern for me. As we discussed above, distributors are actually still increasing exposure to Molson Coors. This could end up helping volumes keep growing over the next year.

Second, people are worried about the broader beer/alcohol market:

Gen Z and younger people drink less

People are drinking more spirits compared to beer

Ozempic and weight-loss drugs narrative

I think this one is a real concern. I am not confident in the trajectory of beer volumes over the next decade. It could be flat in the U.S. compared to today, down 20%, up 20%, I have no clue. This presents an opportunity but also uncertainty for investors.

Discussion question: How worried are we about beer volumes for Molson Coors over the next 5 years?

(Ryan) In 5 years, do you think beer consumption will be higher or lower in the US?

Am I buying the stock today?

I think Molson Coors looks cheap. At a 10% earnings yield, investors can make a 10%+ annual return with no growth. We could see a 15% annualized return with slight sales growth + multiple expansion. I think this is a plausible scenario and expect the stock’s total return to be positive ex-inflation over the next five and ten years.

But it does not pass the hurdle of making it into my portfolio because of my concerns over beer volumes in the United States over the next five years.

For example, I own Phillip Morris International in the portfolio. It trades at a slightly higher earnings multiple than Molson Coors, yes. On the other hand, I am confident it has:

Better pricing power than beer

A better competitive moat with a historically less competitive industry

Operates in a stable industry from a volume perspective (total nicotine + international tobacco)

Has exposure to the product categories gaining market share in the industry

For me, this outweighs the positives for Molson Coors.

I like Molson Coors stock here. I think it will generate solid returns over the next five to ten years and is a good contrarian bet. It is not going to make it into the portfolio at today’s price, though.

Chit Chat stocks is presented by:

Public.com just launched options trading, and they’re doing something no other brokerage has done before: sharing 50% of their options revenue directly with you.

That means instead of paying to place options trades, you get something back on every single trade.

-Earn $0.18 rebate per contract traded

-No commission fees

-No per-contract fees

Options are not suitable for all investors and carry significant risk. Option investors can rapidly lose the value of their investment in a short period of time and incur permanent loss by expiration date. Certain complex options strategies carry additional risk. There are additional costs associated with option strategies that call for multiple purchases and sales of options, such as spreads, straddles, among others, as compared with a single option trade.

Prior to buying or selling an option, investors must read and understand the “Characteristics and Risks of Standardized Options”, also known as the options disclosure document (ODD) which can be found at: www.theocc.com/company-information/documents-and-archives/options-disclosure-document

Supporting documentation for any claims will be furnished upon request.

If you are enrolled in our Options Order Flow Rebate Program, The exact rebate will depend on the specifics of each transaction and will be previewed for you prior to submitting each trade. This rebate will be deducted from your cost to place the trade and will be reflected on your trade confirmation. Order flow rebates are not available for non-options transactions. To learn more, see our Fee Schedule, Order Flow Rebate FAQ, and Order Flow Rebate Program Terms & Conditions.

Options can be risky and are not suitable for all investors. See the Characteristics and Risks of Standardized Options to learn more.

All investing involves the risk of loss, including loss of principal. Brokerage services for US-listed, registered securities, options and bonds in a self-directed account are offered by Open to the Public Investing, Inc., member FINRA & SIPC. See public.com/#disclosures-main for more information.

I think these things move in cycles. I was listening to a recording of the 2005 Berkshire AGM in which Buffet was talking about how the beer industry was taking share from spirits. It'll likely swing back that way at some point.