YouTube

Spotify

Apple Podcasts

Chit Chat stocks is presented by:

Public.com just launched options trading, and they’re doing something no other brokerage has done before: sharing 50% of their options revenue directly with you.

That means instead of paying to place options trades, you get something back on every single trade.

-Earn $0.18 rebate per contract traded

-No commission fees

-No per-contract fees

Options are not suitable for all investors and carry significant risk. Option investors can rapidly lose the value of their investment in a short period of time and incur permanent loss by expiration date. Certain complex options strategies carry additional risk. There are additional costs associated with option strategies that call for multiple purchases and sales of options, such as spreads, straddles, among others, as compared with a single option trade.

Prior to buying or selling an option, investors must read and understand the “Characteristics and Risks of Standardized Options”, also known as the options disclosure document (ODD) which can be found at: www.theocc.com/company-information/documents-and-archives/options-disclosure-document

Supporting documentation for any claims will be furnished upon request.

If you are enrolled in our Options Order Flow Rebate Program, The exact rebate will depend on the specifics of each transaction and will be previewed for you prior to submitting each trade. This rebate will be deducted from your cost to place the trade and will be reflected on your trade confirmation. Order flow rebates are not available for non-options transactions. To learn more, see our Fee Schedule, Order Flow Rebate FAQ, and Order Flow Rebate Program Terms & Conditions.

Options can be risky and are not suitable for all investors. See the Characteristics and Risks of Standardized Options to learn more.

All investing involves the risk of loss, including loss of principal. Brokerage services for US-listed, registered securities, options and bonds in a self-directed account are offered by Open to the Public Investing, Inc., member FINRA & SIPC. See public.com/#disclosures-main for more information.

Note: Written by Ryan Henderson, edited by Brett Schafer

What is Wise? What are its business Lines?

“We are on a mission to build money without borders”

Basically, Wise is a platform (app and website) that gives users a multi-currency account where they can hold, receive, send, or spend money.

And they offer 4 products:

Transfers: This is what they’re most known for. They allow individuals and businesses to easily transfer money to people in different countries and they charge a small up-front fee for each transfer. And the fee they charge depends on the corridor (country-to-country transfer).

Personal: They have 7.5 million active individual customers, and on average those customers transfer about $1.3k every month. In total, Wise processes $28 billion per quarter from their individual customers.

Business: On the business side, Wise has 395k business customers. While that’s significantly smaller than their personal customer count, business customers send much more money through the platform. On average, business customers send about $9k every month.

Wise Card: Wise also offers customers a Wise Debit card which is powered by Visa or Mastercard. The reason this is valuable is some credit cards have complications when spending abroad. So with the Wise card, you can select the currency you want to pay in and you don’t need to pay any extra fees to move money out of the account. Wise does take a small transaction fee when you convert to a different currency. I estimate that the Wise Card accounts for ~20% of Wise’s overall revenue.

High-yield cash account: The last product worth mentioning is just a high-yield account. If you’re holding cash on Wise, you can opt-in to earn interest. Last quarter, the total customer balance held on Wise was just under $17 billion. And that’s up from ~$5 billion 3 years ago. Wise earns extra interest on this as well. For reference, last quarter, Wise earned $132 million in interest income, which was 27% of its overall revenue.

Wise Platform: This is a small piece of the pie and it gets included under other revenue, but it’s their enterprise business. I’m not sure how the pricing works on deals like this but banks, brokers, and other enterprises can plug into Wise’s payments network (I’ll talk about what that is in a second) and enable their customers to cheaply transfer money abroad.

So to sum things up: Wise helps people transfer money, and because they are typically the lowest cost provider, it has been sticky and caught on with lots of customers. Wise is also layering on additional features to help keep the customer funds on its platform.

History: How did they get started? How are they able to offer cross-border transfers for less?

To understand whether or not Wise actually has a competitive advantage that can last, we need to understand what’s really going on under the hood. And the best way that I’ve found to do that is often to look at the company’s origins.

Wise was started in 2011 by Taavet Hinrikus and Kristo Kaarman, and it was kind of born out of a frustration they had. They were both from Estonia but working in London, and Kristo was being paid in pounds. However, he had a mortgage back in Estonia that he had to pay, so he was having to transfer money into euros in order to pay it off. Initially, he was going about this the traditional way by going through the banking system, and as you can probably guess, he was losing money to fees in the process.

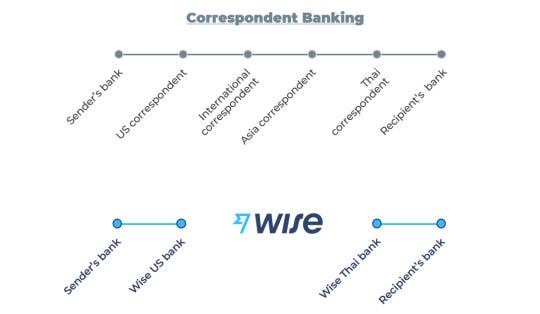

Here’s why that process is expensive:

“Regular banks usually process international payments with the SWIFT network – a messaging system that’s been in operation for around 50 years. It’s established and reliable – but it’s not often fast or cheap. That’s because SWIFT transfers can involve one or more intermediary or correspondent banks moving your money along until it reaches the destination account. This takes time to arrange – and the banks involved can also charge a fee, pushing up costs.”

So Kristo came up with a way to circumvent the transfer process. Remember Kristo and Taavet both had bank accounts in each country. So instead of transferring the money from London bank account to Estonian bank account, Taavet would take the Euros he was receiving and put money into Kristo’s Estonian account. And in exchange Kristo would replace the amount in Taavet’s UK account with the appropriate amount of pounds. So the money was never actually crossing borders.

Today, the business is pretty much the same just at a much larger scale. Here’s what it says on their company page: “When you make a Wise payment you fund it by sending money to the Wise local bank account in Australia (whatever country you’re sending from). Wise then passes on the equivalent amount to the recipient from their account in the destination country.”

And that’s a direct connection. There are certain countries where they still have to go through partner banks and it’s more expensive. In general, this system of local accounts has become their own infrastructure.

To give a little context on how much cheaper Wise is, the global average cost of sending remittances was 6.09% in Q122, according to the World Bank’s Remittance Prices Worldwide report from June 2022. Wise, on the other hand, averages a 0.65% take rate.

Give some numbers on their growth:

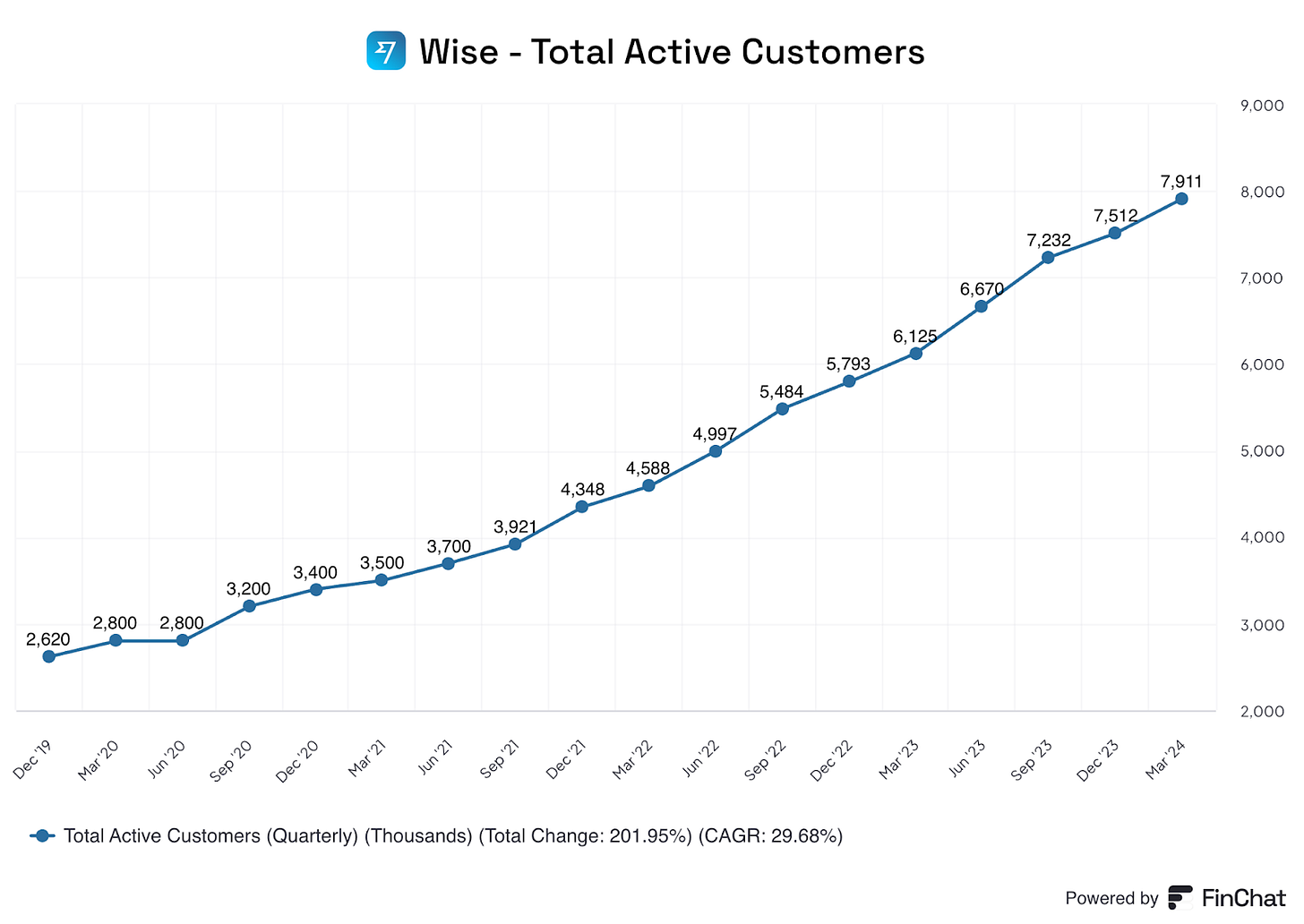

It seems like Wise has been growing rapidly pretty much ever since 2011, but we don’t really have data that goes that far back. The earliest I’ve found is Q1 2019. At that time, Wise had 1.4 million total active customers. Last quarter, they had 7.9 million.

And it seems that their network effect is beginning to take hold. In the last 2 and a half years, Wise has added more customers than it did in the 11 years prior (4 million). For reference, PayPal has lost 2 million active accounts over the last 2 years. So Wise is rapidly stealing share here.

In general, the remittance market is huge. It’s estimated to be about $25 trillion globally. ~50% of that comes from enterprise customers, and the remainder comes from SMBs and individuals, which is what Wise is really going after.

What has enabled them to grow so quickly?

First and foremost, being the low-cost provider helps. It’s great for word-of-mouth marketing. I really like situations where your customers become your best salesmen and that seems to be happening for Wise.

Not to mention, this is a classic network effect. If I’m a business — which we are — and I want to pay to market the podcast somewhere (which we do), I would much rather pay you through Wise than PayPal or any other service. So it helps grow accounts. This is evident in the lack of marketing spend as a % of revenue.

On the actual revenue side, I think Wise has built 2 products that are actually helpful in the card and the high-yield account. These really help people keep their money on the platform, which means Wise can earn more interest income. As of their latest report, 48% of personal customers and 60% of business customers use more than one product.

That’s why total revenue has grown by 51% annually since 2019, while total volume has grown by 38%.

What are their costs? How profitable are they? How profitable could they be?

Wise has ~76% gross margins, which is quite high for a fintech. The bulk of that cost of sales is just bank and partner fees where they don’t have direct connections. As interest income has grown, the gross margins have increased since there’s virtually no cost to investing in treasuries.

So the bulk of Wise’s costs come from investments in their workforce and other operating expense lines. Of the ~$900 million in gross profit that Wise generates, they spend just under $600 million on operating expenses.

The majority of their operating expenses are administrative (bulking up their product development, customer service, and marketing teams). Keep in mind, they include marketing personnel as administrative expenses, not marketing. But in terms of actual marketing expenses, in the last full-year, they spent just $47 million. Which is really quite low for a business doing north of $1 billion in revenue.

And I tend to like the way they think about investing in their workforce. Here’s a quote from last year’s shareholder letter:

“Gross profit provides us with the capacity to cover our operating expenses, invest in building a better experience for our customers and of course provide a healthy and growing stream of profits to our shareholders. Through reinvestment, we deepen our competitive advantage with infrastructure and products that continually improve, attracting more and more customers which leads to more gross profit to reinvest, and so the cycle continues.”

Management + Proxy:

They only report the compensation for 2 of their directors, the CEO Kristo Kaarman and their CFO Matthew Briars.

As you can imagine, they follow some similar strategies to that of American companies. They pay them a base salary, an annual bonus, and Long-term incentive awards. Their LTI awards are based on 2 factors: 1) Total shareholder return relative to the FTSE 250 and 2) Volume growth. I honestly don’t think that’s too bad.

An interesting sentence from the Proxy:

“Executive Directors are required to build and maintain a 300% base salary minimum shareholding whilst in employment and for 2 years post-employment”

Wise has a dual-class share structure where Class B shares are worth 9 votes and Class A are worth 1. In total, the company has ~1.4B total shares outstanding (72% are class A, 28% are class B). Kristo Kaarman owns 26% of all the shares but has 48% voting power. So he really runs this company.

In general, I actually thought this was a pretty good proxy. However, there have been some departures at the company which leave me a little confused.

So for starters, Kristo Kaarman had some tax troubles in 2022 with the UK and had to pay a big fine. It sounds like he basically just didn’t have his affairs in order and had to pay a huge fine. But then last year he took a couple quarter leave of absence that I believe was paternity leave, not 100% sure. He’s back now, but it was just a weird period.

Now Matthew Briars, who is the CFO, left the company this year. At first, I was a little worried by this, but it turns out he was hit by a bus and now he’s basically retiring to focus on his health. I guess I’d like to see a couple quarters of the new CFO because this guy did a good job.

Valuation:

Using the share count from FinChat, Wise has a current market cap of $10.25 billion. They have $1.1 billion in cash and equivalents on the balance sheet, and $130 million of deferred tax assets, so ~$1.2B in cash. They have $358 million in short-term debt which is through a revolving credit facility. So tldr, market cap $10.25B minus ~$900M in net cash, current enterprise value of $9.35B.

Now they don’t report their income numbers until mid June so it’s actually a bit hard to value. We have the revenue figures, but we don’t know what their margins were, so there’s going to be some guesswork involved here. In the first half of the year, Wise generated 35% free cash flow margins. Now in their little Q4 business update, they said that gross margins in the 2nd half were higher than the first half. I think that some of that will have trickled through, so I’m going to assume they generated around 36% free cash flow margins. That would imply $346 million in free cash flow in the 2nd half and $652 million in free cash flow for the full year (they did $961M in revenue in H2).

All that’s to say, they have an EV/FCF of ~14x. That’s wayyy lower than I was expecting, and frankly, I think that a lot of people are probably valuing this wrong because it takes so long for the aggregators to update the numbers.

As for modeling this out, I think it’s reasonable that Wise could grow volumes by 10%+ for quite a while and revenue will likely grow even quicker thanks to the additional ways that they can earn from customers now. If we assume 15% revenue growth for 5 years and steady free cash flow margins, you’ll get $1.3B a year in free cash flow.

For a company with a $9.4B EV, that’s cheap any way you slice it.

What are the risks?

Their medium-term (have no idea what that means) Adj. EBITDA margin guidance was 20%. They’re earning well above that. I worry that there might be some risk they spend money they don’t really need to. That’s not really the end of the world depending on how they spend it. But once you start growing your teams just because you feel like you have the capacity to, it becomes a negative self-reinforcing cycle. You hire more people to manage all the people you already hired and before you know it, it becomes harder and harder to claw back.

Are you buying shares today?

Yes. This report finally put me over the edge.

They have so many things going for them. Their network is a real advantage that should continue to drive growth in accounts. The more functionality they provide customers, the more likely they are to keep money in their wise accounts. And that means more revenue for Wise.

And it’s really not that costly of a business to grow. I could see this being a much larger business in the future.

Really enjoyed the writeup! One concern I have with Wise is how interest rates could impact the business. In H1 2024, interest income accounted for 58% of revenue growth (rest of business growing at 25% so still quite good) and also led to most of the margin expansion.

Have you made any adjustments in how you value interest income vs transaction based revenue?

I do think the long-term story is great and interest rates don't materially change that BUT could be a reason why this trades 14x free cash versus a higher multiple.

One of the greatest companies I have come across this year. The counterpositioning reminds me of Tesla...the industry watches the company grow und wakes up way too late. And even if they do wake up (like HSBC this year), they are competing with a company that passes through their scale economies consistently. Achieving this growth with 4% marketing spend just shows the product-market fit.

On the interest part of the current income - I mean either I model the DCF with a high discount rate and high interest revenue or with low discount rate and low interest revenue. Both scenarios suggest the stock is undervalued (even if growth slows down significantly).