Reminder: these are show notes that should be read in conjunction with the podcast. Do not expect these notes to be a polished research report.

YouTube

Spotify

Charts

Chit Chat Money is presented by:

Potentially you! Reach out to our email chitchatmoneypodcast@gmail.com if you are interested in sponsoring our newsletter, podcast, or both.

Show Notes

(Brett) Many listeners won’t be aware of what Coupang is. Can you explain its origins and how the business works?

Coupang was founded in 2010 by Bom Kim. Originally – given its name – the company was trying to create a Groupon-like business but for the South Korean market. However, a few years after its founding it transitioned to an e-commerce marketplace model, which it is still running today.

Kim has taken this model and run with it aggressively. The company took advantage of the venture capital boom of the late 2010s and raised a ton of capital to push for growth and market share gains in the South Korean e-commerce industry. It even got a $3 billion investment from the Softbank Vision Fund (Softbank has sold most of its stake already) which gave it a ton of breathing room coming into the COVID-19 pandemic and in 2020. Then, the company went public in early 2021 and raised $4.6 billion. For anyone worried, the stock does trade on the U.S. exchanges.

Coupang is perhaps the e-commerce business most similar to how Amazon is run in the United States. In fact, I might make the argument that Coupang has borrowed (stole? Doesn’t matter) a lot of Amazon’s best ideas but has actually improved on them.

Here are a few of the company’s services:

First and third-party e-commerce marketplace. This is a classic “everything store” for South Korea where customers can shop an endless supply of merchandise.

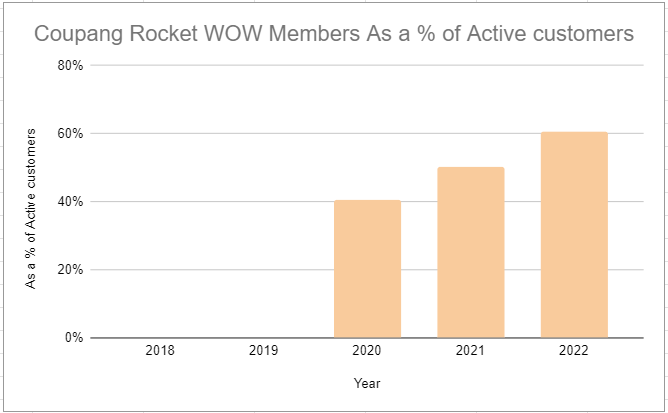

Rocket WOW membership. This is similar to Amazon Prime and offers free shipping for only $4 a month (current price in Korean Won). Members get things like same-day and dawn delivery (7am delivery if ordered by midnight the day prior), free returns, and discounts on items. There are currently around 11 million Rocket WOW subscribers vs. a South Korean population of 52 million.

Coupang Play. A video streaming service similar to Prime Video, which gets bundled into the Rocket WOW membership.

Coupang Eats. This is a food delivery service where you can order stuff from restaurants directly from an app.

Rocket Fresh. Grocery delivery (same-day delivery is free if you have Rocket WOW), which is much more popular in South Korea compared to other markets.

Coupang Pay. A payments application that lets users easily pay for things on Coupang. It is unclear exactly what the long-term ambitions are for Coupang Pay, whether it be to become a virtual wallet or just a way to reduce friction shopping on Coupang. They are a bit opaque about the long-term plan here.

myStore. This is a Shopify-like e-commerce website creator that lets merchants start selling things online while also connecting to the Coupang ecosystem.

Coupang Logistics. ***the most important part of the business***. Similar to Amazon, Coupang has built a vertically integrated delivery network, meaning they do all the storage, transportation, and drop-off for Coupang merchants. With no UPS/FedEx ecosystem in South Korea, Coupang was forced to build out its own delivery network if it wanted fast delivery on items, which has played to its advantage even though it was expensive to build out. In 2022, the company spent $825 million on capital expenditures, for reference. Almost all of its businesses (excluding digital stuff like Play/Pay) are run through the Coupang logistics network. The company is starting to open up the network to other merchants (similar to Fulfillment by Amazon), which should give it even more room to reinvest. However, it is still very early days for this, with Fullfilmment by Coupang only at 4% of units sold last quarter.

Some reasons why Coupang is a better value than Amazon:

Faster shipping times (same-day and dawn delivery for the majority of purchases)

Free grocery delivery with reusable bag system included in Rocket WOW

Frictionless returns: tapping button on the app and leaving items outside your door for pick-up

Discounts on Coupang Eats for Rocket WOW members

All for a cheaper price (again, around $4 a month in USD)

(Ryan) What are the unit economics of the e-commerce business? How have they changed in the last few years? What is the market size in South Korea? (COVID bullwhip)

Let’s start with the market size. As Brett mentioned, there are roughly 52 million people in South Korea (98% of them use smartphones) and they help to make up the 4th largest economy in Asia and the 12th largest economy globally. Total retail, grocery, and consumer food service spending were estimated to be about $500 billion last year in South Korea, while total net revenue for Coupang was ~$21 billion. So they have about 4.2% market share within their category and that’s continued to rise.

As for Coupang’s financial profile, 95% of the revenue is driven by product commerce, so the sale of 1P and 3P items, rocket fresh, and advertising on the e-commerce platform. On that revenue, they spend about 75% of each dollar on the cost of sales. This includes paying for the products from suppliers, inbound shipping and handling costs, and outbound shipping & delivery. This leaves about 25% gross margins, or $5 billion based on current sales levels, for Coupang to staff those fulfillment centers, pay for customer service expenses, pay for general corporate costs, and any other SG&A expenses.

After paying its operating costs, Coupang is left with about 5% of its revenue or $1 billion in operating cash flow. They spend about $700-$800 million of that on purchases of property and equipment to further build out their fulfillment network. In total, between 2019 and 2022, Coupang spent more than $2.2 billion on purchases of PP&E. These investments have helped Coupang, reduce their time to delivery and improve their gross margins from 16% in 2019 to 24.5% in the most recent quarter.

That gross margin expansion has helped Coupang go from -$530 million in FCF in 2019 to a positive $441 million in TTM FCF.

(Brett) Growth of “new” initiatives. What do we think of the potential for these adjacent segments outside of the core e-commerce marketplace?

As a caveat, I would say the largest opportunity for Coupang is clearly the e-commerce marketplace and that is the main reason we are interested in the stock today.

But there are still some interesting growth opportunities in the adjacent services. The two most promising to me are Rocket Fresh (grocery delivery) and the fulfillment services.

Rocket Fresh was on a $3 billion revenue run-rate in Q2 of 2022, making it a sizable portion of the business. I’m not sure how strong the margins are here but there is clearly a large market opportunity and it looks like Coupang has the best value proposition in the country for grocery delivery.

Fulfillment by Coupang is also extremely interesting as there seems to be a ton of whitespace in South Korea to be the backbone of all e-commerce and delivery operations in the country. With all this infrastructure already built out, Coupang is now opening up its operations to other merchants, giving them a huge runway for reinvestment over the next five years. Since South Korea is a small country geographically with a much denser population than the United States, this will also be less expensive to build than Amazon’s network and likely with better margins. Plus, with limited geographic space in cities like South Korea, it will be very hard for a company to physically imitate (the cost of replication is also a huge and growing hurdle). E-commerce logistics is likely a business Coupang can reinvest into continuously with high ROICs.

The other stuff either has tough unit economics (Coupang Eats) or is more of an add-on service that won’t drive revenue growth on its own (Coupang Pay, Coupang Play, etc.). Coupang is well on its way to doing over $20 billion in annual revenue, so any new product needs to get fairly large before getting accretive to this business.

I wouldn’t say the sole purpose of these services is to drive revenue growth (some will) but to reduce friction, increase customer value, and increase customer lock-in to the Rocket WOW ecosystem. This includes merchants (fulfillment and myStore) and customers (Pay, Play, Eats discounts, frictionless delivery, and returns). We’ll hit on this again during the competitive advantage section, but everything seems to be built to drive customers back to the Coupang “everything store” and increase spending per active customer.

(Ryan) International expansion. What are Coupang’s plans to expand outside of South Korea?

Coupang has slowly tested a number of international markets, and they try to be pretty methodical and cost-conscious when they do. Right now, in addition to South Korea, they are operating in Taiwan. I believe they launched in Taiwan around 2 years ago and they’ve been slowly adding new products and features to the Taiwanese market.

“Regarding Taiwan, as I mentioned, we're encouraged by the response we're getting… the same transformative potential that we saw in our early days in Korea, we're starting to see some signs of that. We'll, of course, test and learn at this stage.”

In 2022, they introduced Rocket Fresh to Taiwan and a couple of months ago, they rolled out a new product called Coupang Global Marketplace which allows Taiwanese SMEs to sell “Made In Taiwan” products in South Korea. So this will certainly expand the pool of customers for merchants there.

Something I like about Coupang’s international efforts is that they seem really keen on not being wasteful. They aren’t afraid to cut spending if they see something isn’t working. For example, in March of this year, after 2 years of testing in residential areas, Coupang decided to withdraw its operations from Japan. I believe they’ve also done something similar with Singapore. I haven’t seen any commentary around that market since they entered in 2021.

https://asia.nikkei.com/Business/Companies/South-Korean-e-commerce-Coupang-pulls-out-of-Japan

(Brett) What gives Coupang a competitive advantage? What gives us confidence that this competitive advantage will be durable over the ensuing years?

For anyone that has studied Amazon, Coupang’s competitive advantage is easy to grasp since they copied a lot of the American company’s strategy.

From my seat, Coupang has two strong competitive advantages: economies of scale and network effects.

Coupang has economies of scale with its vertically integrated fulfillment network. This allows it to offer a much better customer experience than competitors with ultrafast shipping times, frictionless returns, etc. It also layers on the subscription business in Rocket WOW which allows it to offer much better discounts on other services (i.e. 5% discount on Coupang Eats) than any other competitor. The food delivery competitors don’t have a steadily growing subscription bundle that they can use to drive positive ROIs at lower prices.

Coupang’s network effect comes from the growth of its two-sided marketplace. The more merchants that sell through Coupang 1P, 3P, and FLC the better the value proposition there is to customers. The more customers – especially Rocket WOW members – spend money on the Coupang marketplace the more value there is for merchants to sign-up and invest in their storefronts. This is a classic network effect, and while not as strong as a social network or payments network, it is still damn strong and should insulate Coupang from upstarts.

It is easy to see why this advantage can be durable as long as Coupang doesn’t perform some form of self-sabotage. The industry Coupang operates in (all of retail) will be relevant as long as we are in our current macroeconomic system. As long as it keeps investing in infrastructure and gets more and more customers/merchants on the platform, the deeper these moats will be. The proof is in the results, as Coupang has gained market share in South Korea consistently. Growing share in a growing market is a recipe for durable double-digit revenue growth.

There also should be a note that Coupang operates in South Korea, which is a small and mountainous country with limited physical space for urban infrastructure. This will make it harder for another fulfillment/logistics competitor to step in and offer a similar value proposition as Coupang. This is a high hurdle as Coupang has some of the most advanced packaging facilities in the world. If you are skeptical, watch the Bloomberg video linked in our sources.

(Ryan) Run through the numbers. What can Coupang earn in a few years and can you compare it to its market cap of $31 billion today?

Coupang’s management team has stated that they think the company can get to 10% Adj. EBITDA margins in the long run. Over the last 3 years, they’ve gone from -4% to 1.9% to 3.4%, and in the most recent quarter, Adj. EBITDA margins came in at 4.2%. So there’s clearly been margin improvement.

When it comes to cash flow, Adj. EBITDA margins have historically been a couple percentage points higher than Adj. EBITDA margins due to the significant spending on CapEx. However, as CapEx has come down as a percentage of revenue, FCF margins have ballooned to well above Adj. EBITDA margins (thanks to the working capital advantage with suppliers). 7.8% FCF margins vs. 4.2% Adj. EBITDA margins in the most recent quarter.

So let’s run some numbers. If we assume that over the next 4 years: Revenue grows by 10% annually, Adj. EBITDA margins reach 7%, and FCF margins reach 9%. Coupang would generate $30 billion in revenue with roughly $3 billion in FCF. If share count increases by 2% a year, and the company is valued at 20x FCF, that would leave a $60 billion market cap or a $30 stock price. Today’s stock price is ~$17. So ~70% upside over the next 4 years. This would be a market beater.

(Brett) Thoughts on management, and specifically the founder of Coupang, Bom Kim?

I think Coupang has a great corporate structure. We are typically skeptical of dual-class share structures that give a founder/executive a dictatorship over the business, except when there is a strong operator at the helm. A prime example of this is Mark Zuckerberg. This does give a company key man risk but can greatly reduce bureaucracy and create a competitive advantage in itself.

Bom Kim feels to us like one of these top-notch operators. A lot of this is based on qualitative feelings (I would recommend listening to conference calls to get a good sense of this), but there are some quantitative measures to back it up.

For one, Coupang’s philosophy around creating shareholder value is in the 1%. They consistently talk about increasing per-share cash flow. I think that is fantastic and a breath of fresh air.

But they also walk the walk, especially compared to a lot of their newer technology company competitors. Dilution has been minimal even though the company has invested a lot in new and sometimes speculative ventures. But the key difference between some of the free willing unprofitable tech stocks in the United States is they have been doing so with discipline. The company is growing quickly, minimizing dilution, and investing in “Other Bets” while also generating a profit. That to me shows that Bom Kim and the Coupang team actually want to (and are) creating value for shareholders.

Kim also has some qualities I think are optimal if you wanted to build a cyborg of the perfect corporate executive:

Not too young, but not too old (in his 40’s)

Good pedigree but not bogged down in the mimetic American corporate culture

Home market experience

Passionate about building the business

Skin in the game, voting control along with a rational mindset for creating per share value

(Both) What is holding us back from investing in Coupang today? What are we looking for to buy shares?

(Brett) The key thing keeping me away is valuation. I trust management and I believe the company has a growing competitive advantage in a growing market. But given that this company operates in a foreign country where we can’t get “boots on the ground” and are always reading reports instead of actually experiencing what it is like to use Coupang, I want to get a bigger price discount than normal (i.e. have higher expected returns to compensate for this international risk). What do you think the price target should be to add Coupang to the portfolio?

(Ryan) I guess nothing. I’m impressed by the business after taking another look and if we’re right in our assumptions, this would surpass our hurdle rate. The only thing for me is I don’t love investments that are dependent on margin expansion and this certainly is. Additionally, it feels like this was a great quarter operationally with very light CapEx, so what’s it take to get margins up even more from here? If you extrapolate out this quarter’s FCF margin over a full year’s sales, you’d have ~$1.7 billion in FCF. So I’d say if we can pay 15x that’d be ideal, which is around a $15 stock price.

Sources and Further Reading

Coupang deep dive: https://djyresearch.com/2022/02/17/coupang-part-1/

Video from inside Coupang center: