Why We Like Adyen Stock (But Aren't Buying Shares Today)

The payments giant that decided to "start again"

Reminder: these are show notes that should be read in conjunction with the podcast. Do not expect these notes to be a polished research report. Enjoy the episode!

YouTube

Spotify

Charts and Graphics

*Thank you to Giblet Stocks for sharing some of these graphics

Chit Chat Money is presented by:

Potentially you! Reach out to our email chitchatmoneypodcast@gmail.com if you are interested in sponsoring our newsletter, podcast, or both.

Show Notes

(Brett) Adyen is discussed a lot by investors, but can be confusing to understand since it is not a consumer-facing product (for the most part). What does Adyen do? What value do they provide to merchants?

If you go to Adyen’s homepage, it says it is “engineered for ambition.” That doesn’t tell us much. But if you read below that, the company lays out in one sentence an overview of what its products do and its long-term ambitions:

“End-to-end payments, data, and financial management in a single solution”

One thing I would add that will help understand Adyen from an investment perspective is that it hopes to be a global end-to-end payments company. So global end-to-end payments with data and financial management on top of that.

But what exactly does that mean? First, let’s divvy up all the stakeholders in a cashless payment transaction. There are:

The consumer (you, paying with a credit card)

The bank that issued you the credit card (Bank of America, Chase, etc.)

The payments network (Visa, Mastercard, Discover, American Express)

The merchant (seller of goods/services)

The merchant payment processor (the terminal or online checkout solution)

The merchant’s bank (Bank of America, etc.)

Plus a few others, depending on what type of transaction it is. Online payments may seem easy when you shop for things, but there are constant moving parts in the back end that allow you to tap/swipe and instantly pay for something.

So where does Adyen come in? They are both a payment processor and the merchant’s acquiring bank, with banking licenses around the world that allow them to manage funds on behalf of its merchant customers (it received its charter in 2021 in the United States but has operated for much longer in Europe).

This may all seem confusing for a first-timer, but I like to think about it like this: Adyen is trying to provide every service for a payment transaction excluding the payment networks and customers’ bank. They want to offer their merchant customers (which is who they sell to) the ability to accept any form of payment anywhere in the world, which they are slowly building towards over time.

Adyen’s products include, but are not limited to:

Adyen Checkout: With just a few lines of code (API), you can make a checkout UI that works on any device across the world.

Accepting Online Payments: The basic front-end for B2C, subscriptions, etc. Adyen makes these payment tools for companies like Uber and Spotify to get better at onboarding users and eliminating leakage.

POS Systems + Software: They offer point-of-sale Solutions (their own systems) plus software connections to help you manage an omnichannel solution.

Enhancements: Add-ons for merchants to improve the customer journey. This includes authentication, connecting shopper profiles across channels, risk management, and revenue optimization.

Financial services: Business bank accounts, capital financing, card issuing, global real-time payouts.

Originally, Adyen’s niche was in Europe serving large enterprises with online payment processing. But since then, they have expanded to most geographies, most forms of payment acceptance, and are now inching into smaller merchants (although that is much earlier on in the journey compared to the other two expansions.

Adyen’s value is providing a modern, non “duct-taped-together” solution (Ryan will discuss the backstory in the next section) that can work seamlessly for large merchants around the world. This saves Adyen’s merchants time and headaches while also improving their own customer experiences. When accepting payments, the most important thing for a merchant is that you don’t lose the customer at checkout over frustration and/or mistakes. Adyen is best-in-class at helping merchants make sure payments work at checkout. There will always be leaks in the checkout process, but Adyen brags about being one of if not the “least leaky” boat for merchants when looking at a global basis.

Now that the company has all of these services, it has started marketing a new service that it calls “Unified Commerce.” You may hear them talk a bunch about it on conference calls. They describe this as a “connected” omnichannel solution that improves upon the siloed solutions for in-person or online transactions. I believe this can be extremely valuable for larger merchants who want one unified solution for in-person and online transactions given how complicated payments have become.

So how does Adyen make money? It is fairly simple at its core. When Merchants process a payment, they give a cut of each dollar spent to their payment partners. For example, in a payment transaction that Adyen processes the cash could get split up between them, Visa, and Bank of America. The % that Adyen keeps can vary depending on the type of transaction and the deals it makes with larger merchants, but analysts generally assume around $0.25 is kept, give or take, by the merchant acquirer such as Adyen.

Above, I have some graphics that hopefully will illustrate some of what has just been explained. Adyen looks at its income statement starting with net revenue, which is the money it keeps after paying out every other stakeholder (Visa, Bank of America, the merchant, etc.). So, its “revenue” is much lower than the actual dollar volumes it processes.

In the first half of 2023, Adyen processed 426 billion Euros through its network but only kept 739 million Euros in net revenue. This means it had a take rate of just 0.17%.

(Ryan) How was Adyen formed? What is its ethos that makes it different from other payment providers?

A little bit of history for Adyen. The company was founded in 2006 by Pieter van der Does and Arnout Schuijff. The two founded a company called Bibit in 1999 and sold it to the Royal Bank of Scotland in 2004. That acquisition along with some others would eventually become what’s now known as Worldpay. RBS required the team to stay on at the company for at least two years in order to integrate everything, but in that time, Pieter really discovered the patchwork of products and efforts going on at some of these larger payment companies. So when he was finally able to leave he decided that he wanted to start his own payments processing company and gave it the name Adyen, which in Sranan Tongo means “Start Again.” And they started with all ex-Bibit employees. And everything they built, they wanted to be from the ground up. So they could have a clear understanding within the organization of how everything was working.

I found this quote from an analyst named Michael Willar interesting, he says “Let's just take a step back and think about this for a second. Pieter helped create an incumbent processor in Worldpay and spent two years inside of it. He then created a business built to eat Worldpay's lunch. So this is unique and I think important part of Adyen's story. So Pieter is what's called a round two founder, who knows better than anyone on the planet how to attack the vulnerabilities of these incumbents.” And that’s exactly what they’ve done. I know it’s a little cliche to talk about a company’s culture because every company brags about it, but at Adyen, it really shapes the way they run the business.

Today, most people familiar with the business describe the company as a bunch of payment nerds who enjoy the complexity involved in the business. They are very protective over their culture and meticulous about how they actually grow. This is a no acquisition company and a board member interviews every single employee that gets hired. They have built everything on their own and cut out middlemen wherever possible, which enables them to ship products/updates faster.

Here’s an example of that from the blog Scuttleblurb. When talking about how Adyen differs from other PSPs he says “a merchant who wanted to accept card payments could open an account with Stripe, who would rent the Bank Identification Number (BIN)1 of acquiring banks (”rent-a-BIN”), an arrangement that gave Stripe the right to onboard merchants according to the acquiring banks’ underwriting rules…Stripe pays a fee to the acquiring bank, who still assumes risk of loss, but otherwise retains most of the merchant acquirer economics.” But in the case of Adyen, he says: “Instead of renting BINs or integrating with an aggregator, they own banking licenses outright wherever they can3 and directly integrate with local payment methods.” This not only helps Adyen be more agile but can allow them to have higher authorization rates than most.

(Ryan) Who are Adyen’s competitors? What competitors scare us? What competitors do we think Adyen can take market share from?

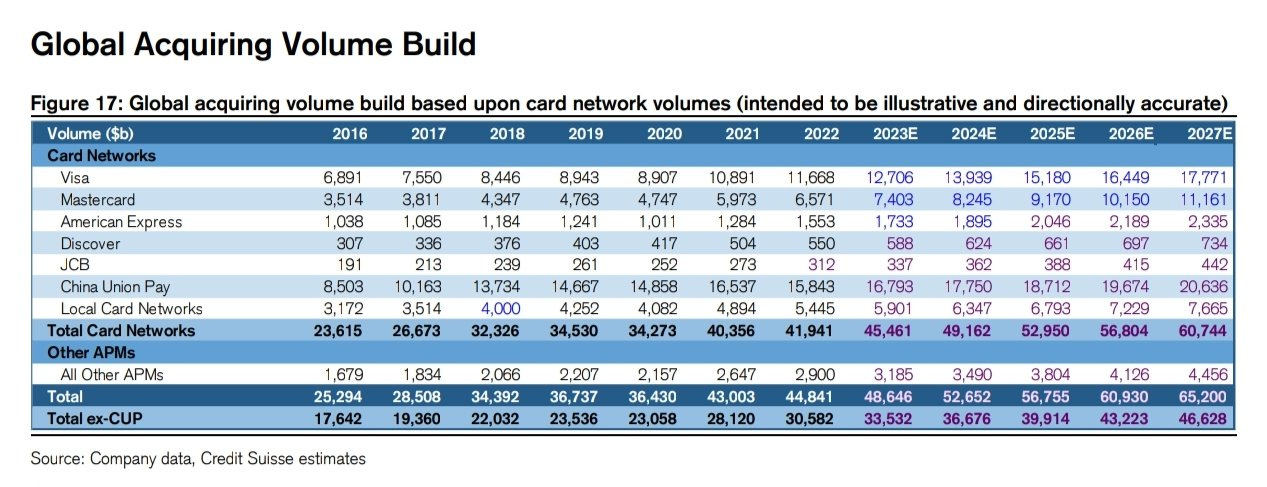

Adyen has tons of competitors. The ones that probably come to mind for most people are Stripe and Braintree, but the enterprise payment processing space is enormous. At $848 billion in processed payments over the last 12 months, that puts Adyen at about 2% of all enterprise processing and low teens of the online-only portion of that. The 3 largest in the US are JPMorgan Paymentech, FIS (owns Worldpay), and Fiserv (owns First Data). As we mentioned earlier, these are typically businesses that have been tossed around from different ownership teams and are stitched together with a bunch of different back-ends and teams that don’t communicate that well.

The company that has been causing the most trouble lately and it sounds like led to the stock decline since the last report, has been Braintree. On the conference call, Adyen’s management team talked about certain North American competitors dropping prices and attracting lots of price-conscious merchants.

In terms of the competitors that scare me most, I think Stripe is probably number one. We talked about the pay gap for talent with MBI last year, and I think it is a bit of a risk for Adyen. Maybe that’s why we’ve seen the company really bulk up its employee base over the last two years. But MBI made an important point when we asked him about the risks. He said something along the lines of with payment capabilities fairly close together, what’s going to be the differentiator if we look out 10 years? It’ll probably be the company with the best talent that can ship the best products the quickest, and if Adyen is known for paying not so well, especially relative to Stripe, that seems like a risk.

Question for you: Do you think Braintree’s share that it has taken in North America lately can last?

(Brett) Why do we believe Adyen has a competitive advantage? Why do we think this moat can widen over the next five years?

When I wrote up Adyen as a watchlist pitch internally earlier this year, I wrote this about its competitive advantages and I still believe that applies today:

Even before thinking through the qualitative reasons for Adyen’s differentiation, I believe there is something to be said just by looking at its rapid market share gains since 2015:

Total Payment Volume (TPV) in 2015: 32.2 billion Euros

TPV in 2022: 767.5 billion Euros

This was a ~57% CAGR. So why have they gained so much market share? One reason: authorization rates. Adyen’s purchase authorization rate is known to be superior to the competition. Higher authorization rates mean a better customer experience at its merchant customers and more revenue generation for its merchant customers since more payments are getting approved. It is a win for all parties and something merchant acquirers are continually trying to improve.

And why is Adyen’s authorization rate better? Because it is not a bunch of acquired solutions from different geographies being built by a legacy financial institution. It is a 21st-century software stack with zero acquisitions (management says they will essentially never acquire a company) that makes the connectivity much cleaner than any of the other solutions out there. This makes it easy for Adyen to win and retain clients even though it might face pricing competition from the likes of Braintree.

The proof is in the revenue growth from existing customers, which is where the majority of Adyen’s revenue growth comes from. A lot of large merchants will use multiple merchant acquirers where they can toggle payment volume depending on who is better. Adyen’s existing customers like Uber, Spotify, Wise, and Crocs continue to send more volume to them each and every year, on average.

I also think there is evidence that Adyen has a superior product in its “gross volume churn” number, which means the payment volume from the prior year that gets churned away to a competitor in the existing year. The number is less than 1% and shows that Adyen’s products are sticky and superior to the legacy products since virtually none of its existing customers switch their payment volumes over to other merchant acquirers.

To sum it up, I think Adyen has multiple competitive advantages:

Process and technology (management principles, positioning vs. bungled together competition)

Economies of scale (can offer a better value prop through volume discounts the bigger they get. Also, geographical advantages for payments are well known given the local eccentricities of each market)

Switching costs (even though it is not as large as some software programs, adding another merchant acquirer to your system is not something you can flick on and off like a light switch)

I think these competitive advantages will only improve over the next five years, especially in the economies of scale and switching costs as Adyen grows its ancillary products like POS, card issuing, and checkout landing pages which will tighten its relationship with large merchants. The more integrated an enterprise is with Adyen and the more services it uses, the harder it will be to leave. As well, the more services it offers in more geographies, the harder it will be for an upstart to copy its products. Why would someone like Levi Strauss leave Adyen for a competitor if that competitor doesn’t have a Unified Commerce solution? That is why I believe customers choose Adyen, stick with them, and grow with them over time.

But it is not like these merchants will leave anyway because Adyen has much cleaner software that brings them higher revenue amounts than most other alternatives in most markets.

(Ryan) Why do we like this management team? Do we trust them?

I think so. Pieter owns a lot of equity (~3% of shares outstanding) and the organization has consistently been self-funded. They could have taken way more capital if they wanted to early on but they chose to build on their own. And during the calls, you can get a good sense of the way the company looks at its investments. Especially right now, during this big hiring spree.

They are truly long-term oriented. They’re a very cost-conscious organization, they mention that they don’t pay anyone in the company more than 1 million euros. And to grow the way they have while operating so lean is a clear testament to the management team.

(Brett) I trust them because of the long-term focus, zigging while others zag, and the prior track record of profitable growth. The company grew its TPV at a 57% CAGR while profitable, which is highly impressive. Management has run a lean organization without “overhiring” for years but with the downturn in the software market, they have taken the last few quarters to accelerate hiring. It is hard to describe, but this is in my top 5 management teams for new companies along with Airbnb and Coupang.

(Brett) Valuation work: Let’s run through the numbers we came up with for Adyen

(all work in Euros)

We do not do complicated models. Generally, what we are looking for is getting confident in the competitive advantage and management and then buying at what we think is a conservative price. These projections have a 99%+ likelihood of being wrong.

In 2022, Adyen generated 1.33 billion Euros in net revenue at a 55% EBITDA margin. We are comfortable using EBITDA for earnings with Adyen given minimal capital expenditures, high net cash position, and the ability to earn interest income. Free cash flow should not be too different over the long term.

In the first half of 2023, Adyen’s EBITDA margin sunk to 47.4%. Over the long term, management believes it can hit 65% EBITDA margins after it gets through this period of intense employee onboarding.

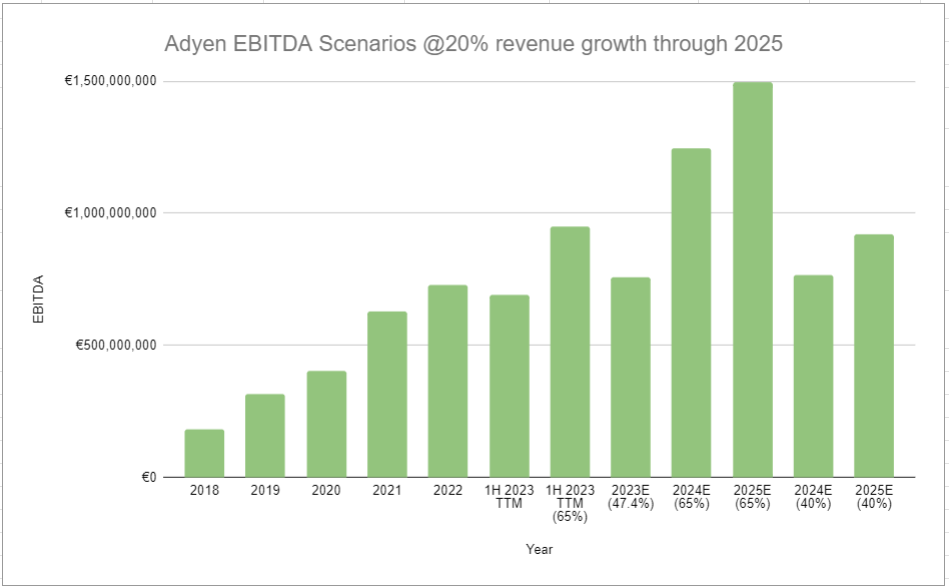

For our forward estimates, I went out to 2025. I made two assumptions: 20% average net revenue growth and a range of EBITDA margins from 40% (downside) and 65% (management target).

Here’s a chart of what these come out to:

Here are a few of the multiples the stock could be trading at depending on what scenario you use:

1H 2023 TTM EV/EBITDA of 28.8

TTM EV/EBITDA assuming 65% margin of 21

2025 EV/EBITDA at 40% margin of 19

2025 EV/EBITDA at 65% margin of 11.7

Discussion question: What is the best scenario to use here?

(both) What price (however you want to define it) would you want to buy Adyen as a standard-sized position in the portfolio?

(Ryan) I tend to like the idea of not paying more than 20x owner earnings (however you measure that) for a business because I’ve been hurt in the past by assuming too high of growth rates. If Adyen gets around there, I would consider buying.

(Brett) On the one hand, the stock looks cheap if you think they can easily get back to 65% margins. I think that they can due to the fact that – after getting to net revenue – the only costs are R&D, marketing, maintaining systems, and corporate overhead. There is a ton of operating leverage here and if they keep disciplined on hiring, they can get back to 65%. I also like their chances to grow at a double-digit rate every year this decade. However, I do want a bit of a margin of safety here if things do go wrong. I think currently we are close to where I would want to buy, but I would like it a bit lower.

(both) As we sit here during this recording, what scares you about an investment in Adyen?

(Ryan) For me, it’s hard to find any hard data about authorization rates. It feels like you’re basically taking it on their word (and their historical growth) that they’re the best ROI for most organizations. I just worry that Adyen is saying “This loss in market share in North America is just short-term and it’s unsustainable” when that might not be the case and maybe some of these other PSPs are closer in authorization rates than most people think.

(Brett) My biggest concern with the business is the competitive threat of pricing. So far, Adyen hasn’t seen too much of an effect from Braintree slashing rates, but as we can see from its EBITDA margin, there is a lot of room for pricing to come down and still make money. The fatter the margin, the wider the competitive advantage needs to be. If we’re going to buy a business such as Adyen and think it can get back to 65% EBITDA margins, we need to be confident that it has a strong competitive advantage. I think today Adyen has a strong competitive advantage, but not nearly as strong as Visa. But over the next decade if things go right I believe Adyen can have as strong of a moat as Visa does today.

Sources and Further Reading

Business Breakdowns:

Scuttleblurb:

Jerry Capital on Twitter (X): https://twitter.com/JerryCap

Mostly Borrowed Ideas interview on Chit Chat Money: