Why We Own Match Group (Ticker: MTCH)

A podcast episode covering the upside potential and key risks for this leading dating application company

Reminder: these are show notes that should be read in conjunction with the podcast. Do not expect these notes to be a polished research report.

Upcoming schedule: CPG Companies (April), Defense/Aerospace (May), Payments (June)

As always, listen to the episode on Spotify, YouTube, or wherever you are subscribed to the show.

Charts

Data powered by Stratosphere.io

Chit Chat Money is presented by:

Stratosphere.io, a powerful web-based research terminal for fundamental research. With fundamental charting tools and data aggregation, Stratosphere saves us hours of time each month researching stocks.

Upgrade to one of Stratosphere’s paid plans and get 35+ years of historical financials, advanced KPI tables, and SEC filing aggregation.

Ditch the clunky and advertising-riddled websites like Yahoo Finance and upgrade your investing research using Stratosphere.io.

Get started researching for FREE on the Stratosphere.io platform today, or use code “CCM” for 15% off any paid plan.

Show Notes

(Ryan) What is the relevant history of Match Group? Context for shareholders today:

Match Group’s roots date back to 1995 when a Stanford Business School student named Gary Kremen started the website Match.com. However, after disputes with his investors, he ended up leaving the business in 1996 and receiving only $50,000. In the following years, Match.com found remarkable demand due in large part to the sheer growth of the internet. This eventually led to Ticketmaster, which was owned by IAC (or USA Networks as it was called at the time) acquiring Match.com in 1999 for $50 million.

Once it was under IAC’s umbrella, it appears user adoption really started to take off. By 2003, Match.com reportedly had ~$185 million in revenue, and by 2006 that had risen to $311 million. There were apparently some periods of stalled growth, but bringing in Jim Safka as CEO helped solve that. So by 2007, it was really still just Match.com. But in 2008, Barry Diller decided to break up IAC into 5 separate companies, with the remaining IAC being one of them. That IAC owned Match.com and Ask.com. A year later, IAC established the Match Group company and began expanding with an $80 million acquisition of People Media, which owned 27 different dating sites (BlackPeopleMeet.com, LDSPlanet.com, SingleParentMeet.com, etc.).

Continuing on their acquisition spree, Match Group bought OkCupid for $50 million in 2011. And by that point, they had already become the largest online dating business in the world. Although 2012 marked probably the largest turning point in the business’s history. That year IAC had funded essentially this “mobile app incubator” called Hatch Labs. Within Hatch Labs, developers created what would eventually become Tinder. As adoption grew across college campuses, IAC eventually decided to up its stake and purchase another big chunk of the business.

Despite the growth of Tinder, that incubator ultimately ended up being quite messy and leading to a number of lawsuits and high-profile departures. The most notable, aside from Whitney Wolfe-Herd’s, was that in 2019 the Tinder founders sued the company. The lawsuit alleged that IAC undervalued the founders’ stock options in the company. For context, by 2015, when Match Group went public, Tinder still wasn’t officially a part of it yet. It wasn’t until 2017 that the two merged and in that process the Tinder employee options were converted to Match Group options which reportedly undervalued the company. This litigation was settled this fiscal year and MTCH had $441 million worth of expenses related to it. That same year as the lawsuit (2019), IAC finally closed its position in Match Group and let the company operate independently. Suffice it to say, it’s had a messy history but it seems that’s now behind them.

Other important moments were in 2017 when Match Group began investing in Hinge, eventually buying the business for an undisclosed sum. And, in 2021, when Match Group acquired Hyperconnect for just over $1.7 billion.

(Brett) What are the important parts of this business?

In its current form, management divides the Match Group business into five parts:

Tinder

Hinge

Asia

Emerging and Legacy Brands

Indirect Revenue

Indirect revenue is mainly from advertising and is irrelevant today, so we won’t focus on it in this episode. We also won’t focus on Asia as we have no insights into what Hyperconnect or Pairs (the leading dating app in Japan) will look like over the next three years. Although we will discuss the long-term potential of Tinder in its non-core markets outside of North America, South America, and Europe.

Tinder was 56% of Match Group’s revenue in 2022, making it the most important asset for the company today. This is also considering major foreign exchange headwinds and product development woes (we will specifically hit on this in a future section). According to management, Tinder’s division has a 50% adjusted operating margin. That would equate to $900 million in profits just from this app in 2022, or 80% of Match Group’s consolidated adjusted operating income. Yes, we would still have to back out corporate overhead expenses, but I think this highlights how important Tinder is to Match Group’s profitability at the moment. We will hit how Tinder works in the next section as that ties into what went “wrong” with the asset over the last year or so.

Hinge is Match Group’s fastest-growing property and made up 9% of overall sales in 2022, up from virtually zero when the company acquired the app in 2018.

Emerging & Legacy brands are 23% of revenue and include older services like Match.com, OkCupid, etc. along with new niche offerings Match Group has been incubating like BLK, Chispa, Upward, Stir, and the League. These services are not very profitable compared to Tinder or Hinge and therefore are less important to the overall financial picture. However, the new management team did indicate they were going to run the legacy brands more for cash (code speak for not propping them up with tons of marketing spend). The new niche offerings are growing sales and can probably balance out the declines at these older properties. It will be interesting to track how this segment develops over the next few years.

(Ryan) Why are we so bullish on Hinge?

Let's start with what Hinge actually is. Hinge is a mobile dating app that generally targets real relationships (though it can pretty much be used however users want). By default, this typically means that it captures the post-college dater demographics. This isn’t just by happenstance either, Hinge very much targeted this from the beginning, which is why their tagline is “designed to be deleted”. The app pops up prospective matches in a single file line similar to Tinder, but instead of swiping you have to interact with a part of the user’s profile. This typically leads to more seamless conversation. The last thing I’ll say about the app itself, and this maybe isn’t that helpful to potential investors, but Hinge has the best user interface in mobile dating by a mile.

As for the business of Hinge, there’s a lot to like. For starters, it provides a very differentiated user experience from what people get with Bumble and Tinder. This has really resonated in the US where they’ve quickly become the 3rd highest-grossing app in the lifestyle category, but it’s also seeing strong demand abroad. In the markets where it has launched in Europe, it’s already the #2 or #3 most downloaded app, but it’s also one of the top 3 apps in European markets where it hasn’t even officially launched. Keep in mind, the early days of a dating app launch aren’t focused on monetization, so there may be a bit of discounting going on here which could impact RPP in the short term.

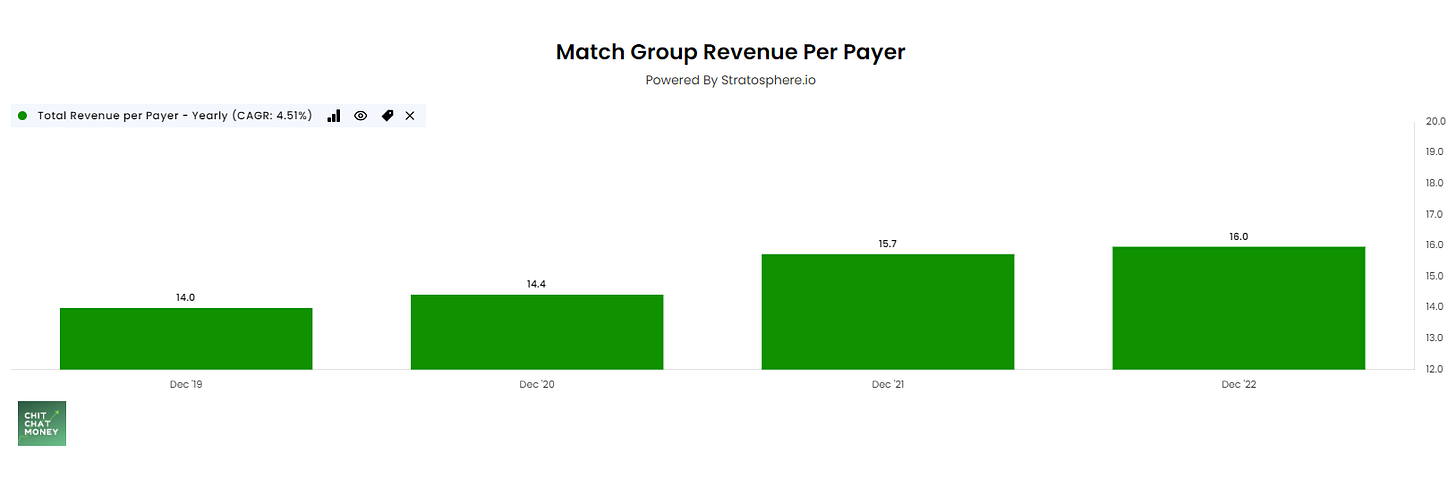

As I mentioned before, Hinge also caters to older ages which means their users have a higher propensity to spend. Not just because they make more money but frankly because there’s a level of existentialism once you graduate college. This has resulted in a strong revenue per payer relative to Tinder at ~$25 (which hasn’t been updated in a while). However, they are just now beginning to roll out HingeX and Hinge+. HingeX will be a higher priced ($60/month) subscription that gives daters preferential treatment across the board. Hinge+ will seem like a leg down in pricing (I believe it’ll be $25/month), but it gives users a number of premium perks including the ability to filter their searches. Both of these should be accretive to RPP.

For some perspective on the numbers, Hinge generated $31 million in revenue in 2019 versus $284 million in revenue over the last 12 months. Management expects that number to increase to $400 million by the end of this year, which would be a 12x increase over 4 years. And this would be largely pre-monetization in Europe, so I think it’s fair to assume they could be doing more than $500 million within two years.

(Brett) What went off track at Tinder? Is it fixable? What are we looking at to analyze this asset over the next few years?

Looking at the financials (16% revenue growth FX-neutral in 2022 and ~20%+ revenue growth in the years prior) you would think things are going just fine at Tinder. But listen to management commentary and you’d think the app was headed into free fall.

A little context on what happened in 2022. Match Group hired a new CEO from Zynga named Bernard Kim in late Spring. After meeting with all the management teams, he decided to fire the existing leaders at Tinder, install himself as interim CEO, and brought in four or five other leaders to the division.

On the 2nd quarter conference call, Kim addressed these changes and basically said the app was deteriorating in quality due to mismanagement and bad product rollouts. Investors (including us) got caught a little off guard by these announcements because of the historical revenue growth over at Tinder. It also didn’t help that the rising value of the U.S. dollar was crushing revenue growth in some markets.

So what went wrong? It is hard to tell precisely the issues, but I think we can generally say the division rested on its laurels for the past three years and didn’t come up with any strong new engagement and/or monetization tactics. While not rocket science, the four main ways Tinder makes money (Tinder Plus, Tinder Gold, Tinder Platinum, and Boost) were executed very seamlessly within the app and led to consistent revenue growth as the app proliferated around the globe.

In recent years, the company has still grown revenue through these core subscription and a la carte tools (and will in the future) but struggled to come up with new ways to engage its users and get people to use the app to seriously look for romantic encounters, which leads to a percentage paying for products.

The prior leadership team was focused on metaverse stuff, an Explore feature that garnered little engagement, and other things that were not resonating with users. The UI/UX on the application also has not improved for years, leading to a worse layout (my personal opinion) than Bumble or Hinge.

Kim and the new leadership team decided to “rip the bandaid off” and scrap Tinder’s existing product roadmap for 2022. This led to deteriorating monetization throughout 2022 until they got a new plan in place (coding products doesn’t happen in a day). This is why the division’s revenue growth decelerated last year.

Now, as of the Q4 letter to investors, Tinder has a new roadmap in place which includes a better marketing campaign, improving engagement tactics on the application, and new monetization techniques like shorter-term subscriptions, more expensive packages, and advertising.

Since the app has already solved the hardest part of being a dating app (getting users of all types onto the platform and swiping), I think the company will not struggle in getting Tinder back to its long-term growth trajectory. If you fix the UI/UX issues, get some smarter monetization strategies in place, and better engagement products that don’t just rest on the “swipe right or left” innovation from a decade ago and this thing will start humming again.

My analogy for this is the local bar in your town that is popular with young singles. It is very difficult to become that bar, but much easier to keep your position. However, if over multiple years you make decisions that anger customers (bad DJs, bad drinks, expensive cover charges, no security) you can open up your position to a new entrant. Tinder has opened itself up a bit but this is not unfixable.

And there is still a huge opportunity to grow this business globally:

Engagement (generally) follows monetization within the dating app sphere. If 75% of Europe/LatAm/North American singles try a dating app within the next five years and the rest of the world continues to catch up, I see no reason why Tinder cannot double its revenue over that time frame.

Investors should remember that dating apps like Tinder own no physical infrastructure (they use AWS) and have extremely high incremental margins. As the company grows in lower-income countries it may lead to lower ARPU numbers, but they will still be margin accretive due to the ability to build once and deploy these products around the globe.

Were we a bit blinded as shareholders to a stagnating Tinder application that we could have identified as users?

Thoughts on the trajectory of the non-flagship (Tinder/Hinge) brands over the next three years:

(Ryan) Legacy (Match, Meetic, OkCupid, etc.)

For context, Evergreen and Emerging are now being managed together with the goal of having the legacy players help the smaller, growing apps. But with regards to the legacy portfolio, Bernard Kim was clear about how he wanted to manage the apps: “The first strategy is to maximize cash flow and be disciplined with costs, especially marketing spend. This is the case at several of our Established Brands such as Match and Match Affinity™, Meetic, OkCupid®, and Plenty of Fish®.”

The most recent disclosure we’ve seen on revenue for these businesses was in Q2 of 2021 when Match Group reported $192 million in quarterly revenue across the established brands. However, revenue is typically elevated in the summer months and it has been declining since that point.

For 2022, both established and emerging generated $730 million in combined revenue. Based on the growth rates of each since the numbers were last reported, my rough estimate would be that there’s about a 75/25 split in revenue between established and emerging, meaning establish generates ~$550 million in revenue per year.

Honestly, I think all these brands are pretty much in runoff mode. OkCupid is still a decent size (7th top-grossing app in the lifestyle category), but it seems unlikely that the established brands in aggregate will grow.

(Brett) Niche/cultural/demographic (Upward, Stir, Chispa, BLK, The League)

I think the cultural or demographic apps have promise but will likely still fail to achieve a large enough scale over the next few years to make meaningful profit contributions for Match Group. However, over the long term, I think they can be beneficial as long as they share overhead/development costs (I’ve tested Chispa/BLK and they are the exact same app except for a few UI choices) and start monetizing effectively. Even if they run at break-even for the next few years, they can still help Match Group suck all the oxygen out of the room from failed subscale players (listen to our episode on Spark Networks). If they use paid marketing to eliminate these players/bankrupt them, it leaves a lot of greenspaces to dominate a certain niche.

For example, use the common sense test. Do I think a dominant dating app for black people in the United States can be profitable? Of course. The same applies to Hispanic Americans (Chispa), Christian Americans (Upward), etc.

(Ryan) APAC (Pairs, Azar, Hakuna Live)

Just to describe what each one is: Pairs is the most popular dating app in Japan and it sounds similar to Hinge in terms of functionality. Azar and Hakuna Live were both acquired in the Hyperconnect acquisition and are both centered around Live Video. Azar is one-to-one live chats with real-time language translations whereas Hakuna Live is more of group video and audio broadcasting (seems less dating focused).

In total, Pairs, Azar, and Hakuna Live generated $322 million in revenue this year. I don’t know the precise split, but at the time of the acquisition, Hyperconnect’s estimated annual revenue was around $200 million.

The acquisition added $1.7 billion in goodwill to the balance sheet, and so far they’ve written down $366 million or ~21% of it.

Hard to get a sense of their Asian business honestly. They’ve clearly struggled there, but some of that seems to be an overall slower rebound from covid as well as FX headwinds. They’ve now got a leader in place there in Malgosia Green (former PoF CEO) and they still see a big opportunity. Here’s what Gary Swidler said at a recent conference: “We really acquired 2 apps, Azar, which is the one-to-one chat app. And that app is actually performing reasonably well. It’s back to some reasonable growth levels. We’re also improving the profitability of Hyperconnect. I think 10% kind of margins this year are achievable.”

(Brett) How important are the relationships with the mobile app stores? What is our scenario planning for potential outcomes here?

Match Group has a shaky relationship with the two dominant distribution platforms for its services, the Apple App Store and the Google Play Store. It is currently in a lawsuit with Google Play over its new payment requirements and is working with other major mobile applications to get government legislators to bring down the Apple App Store tax.

While the lawsuits and lobbying are expensive, this is by far Match Group’s largest expense (unless you include all employee expenses into one category). Match Group’s cost of revenue was 30% in 2022, and let’s say 25% of that over the long term gets attributed to app store take rates. Running some simple arithmetic, if app store fees get legislated down to 15% that could lead Match Group’s adjusted margins to climb from the low 30s to the low 40s as a % of revenue.

It is unclear how likely a reduction in app store fees is. But we feel comfort in knowing they won’t climb materially higher, meaning the relationship with the distribution duopoly is not a key risk to owning shares today. The duopoly does not have the political wiggle room to raise fees across the app stores. It is a “tails I don’t lose, heads I win” situation for the company.

Is it possible app store fees could come down to the 15% - 20% range for Match Group? There is definitely a scenario where this happens across the globe over the next few years. Do we think it is necessary to achieve adequate returns by owning shares? Absolutely not.

(Ryan) What do we think the financials could look like three years from now?

As a reminder, just under half of Match Group’s revenue comes from outside the US (Europe and APAC), so the strength of the dollar over the last year led to a significant headwind. The US Dollar has since weakened versus many other currencies, most notably the euro, so that should serve as a little bit of a tailwind to the guidance that management provided in its Q4 letter.

Before I get into my assumptions, let me first lay out some stats:

Since 2018, Match Group’s revenue has compounded at 16.5% (If it weren’t for last year’s currency headwinds, it’d be 18.4%)

From 2018 to 2022, Match Group averaged an Adj. Operating Income margin of 37.25%.

From that Adj. OI, Match Group converted ~82% into free cash flow (excludes 2022, due to litigation settlement).

Over the last 3 years, shares outstanding have grown by 1.91%.

If you exclude the litigation settlement from this year, these numbers have led to 15% annual free cash flow per share growth.

Now when it comes to financial outlook, I’ve tried to put together some reasonable assumptions. This might be tricky to follow but bear with me.

Management guided for 5%-10% revenue growth for 2023. FX headwinds have subsided a bit so I went with 7% growth this year and 10% growth the 2 following years. By 2025, they’d be doing $4.1 billion in annual revenue.

Management also stated that they expect to generate higher Adj. OI margins this year than last year and low 70% FCF conversion due to higher tax rates. I’ve assumed 36% Adj. OM’s (they did 35.4% last year) and 72% FCF conversion. In 2024 and 2025, I expect both of those numbers to expand gradually as Hinge matures.

I’ve also assumed that the share count grows at the same rate as it has historically (~2% a year). Hopefully, they’re buying back instead and this isn’t the case, but management seems reluctant to do that so I thought it’d be safe to bake it in.

If I’m right, or the results are better than I expect, Match Group will at least be generating ~$4/share in FCF by 2025. If the market values those at 15x, that would give Match a $60 stock price or 60% higher than today’s price.

(Brett) Thoughts on the new management team? postmortem on our inability to properly analyze the old management team

With less than a year in charge, I think we still need to be open to a lot of possibilities with the new management team. It has clearly brought in some uncertainty with the business, which is a key reason why shares are down so much in the last two years.

Generally, I think an executive who has had success running a mobile games business (Zynga) has the experience to win in dating applications. They are generally the same products. You need to attract users to download the applications, engage them with gamified activities, and monetize through upsells and subscriptions. He knows the formula and I think will get a nice bump from the “one-foot hurdle” optimizations they will implement in the next few quarters.

The key error we had when owning Match Group stock historically (aside from valuation) was thinking the old management team was sound. We don’t need to go into specific people we now know were bad managers, but it is pretty clear in hindsight that they were not strong leaders. We can look at the commentary on riding the “metaverse” hype, virtual coins, and product stagnation at Tinder as clear examples.

I think the lesson we can learn here is to simultaneously ignore management (look at the actual products and how we feel about them in the marketplace + financial performance) in some aspects but also try to be very critical/have a high bar for them in other areas (acquisitions, capital returns, riding hype cycles, etc.) to see whether they are truly focused on creating value for shareholders.

For Match Group, through this lens, there were definitely things we could have identified as red/yellow flags to give us caution in paying up for this business. These include our experience using the Tinder application, the Hyperconnect deal, metaverse stuff, and conference call commentary in late 2021 and early 2022. Should we beat ourselves up too much? I don’t think so. The prior management team wasn’t terrible, and the company got hit with foreign exchange headwinds in 2022 that were somewhat unpredictable. Our main error here was valuation, but we should have still had some caution with the old management team.

(Both) What do we think of the long-term competitive advantages of scaled dating applications?

(Brett) I am going to include an excerpt from our write-up on Match Group from early 2022 for this section, as I still think it applies today. But don’t take it for certainty because we also said the stock was a great buy at over $100 a share in that research note.

Match Group has three competitive advantages that we’ve identified. Two (network effect and “Relationship George”) are powerful, while one (brand) is helpful but not crucial.

“Dating apps have some of the strongest network effects in the world. Each incremental user makes it more valuable for existing users on the app, as it helps increase the chances of finding a potential mate. This is why apps can gain rapid momentum in cities once they hit a certain adoption level among their target demographics. Tinder did this five years ago and it is happening to Hinge today. Network effects, especially when powered by the internet, create winner-take-most scenarios where the established players (in this case Tinder, Bumble, and increasingly Hinge) have an easy time fending off potential competition. Why would anyone switch to a competing application if it has 5% of the user base as Tinder? It is not likely.

The least important but still relevant competitive advantage for Match Group is the brand value of its services. Creating an online dating profile takes a big leap of faith, and comes with some risks of fraud and/or someone misleading you. Most people will not head down to the 40th ranked dating application on the app store unless it caters to something specific to them. Tinder and other established brands have an advantage being the top of mind among consumers and by likely having someone they know using the service before.

Lastly, and most important, is what we are calling the “Relationship George” effect with online dating (if you don’t know the reference, watch this video):

You almost assuredly haven’t heard of this competitive advantage before, since we made it up just for this write-up. But we think it is the key to why Tinder, Hinge, and other top dating apps will have staying power for many years. Dating is personal and operates in a separate realm than friends/family unless the relationship gets serious. Things are no different online. People want to keep “relationship George” (their online dating profiles) completely separate from “independent George” (their online social profiles/personas). If you are a company that caters to “independent George,” like Facebook, good luck convincing “relationship George” to join the party. Any consumer company that does anything that isn’t a dating app already will find it almost impossible to succeed with an online dating product (Instagram and Snapchat work as pseudo dating apps, but could never succeed pushing an independent dating product). This conflict creates a huge moat for Match Group to fend off competitors. Remember Facebook Dating?”

(Ryan) I think the dominant dating apps today will maintain their lead as long as mobile remains the dominant mode of computing. At this point, the most significant competitive advantage I see is the network effect. It’s really simple: As a dater, you want to be where you can find the highest number of suitable dates. And in the US, Canada, and most of Europe, there are about 3 places where you can do that. Tinder, Bumble, and Hinge.

If you’re questioning the power of this network effect. Ask someone you know who is single what dating apps they’re on and ask how they found those dating apps. I’m willing to bet they didn’t pick it because they saw some ad. They probably knew before even looking at which app they were going to go to. Now think about that from the business perspective. Those users are extremely low cost.

(Both) Pre-mortem: At $40 a share, how do you think we lose money owning Match Group over the next three years?

(Brett) I think at these prices, our two concerns are continued deterioration at Tinder (is it deteriorating? Or just stagnating? It still grew revenue by 10% last year) along with poor capital allocation. Management has shown some struggles with buybacks (inconsistent) and made some bad acquisitions that could burn a few years of cash flow. The real concern for me right now is Tinder. If the network effect unravels in some key markets obviously this stock will perform terribly. However, at this stock price, I don’t think you need herculean growth assumptions to achieve a 15% CAGR over the next five years.

(Ryan) I agree with Brett. The biggest risk is that Tinder has hit saturation and we maybe see users gradually trickle away toward other apps. I don’t think that’s likely though unless Tinder shoots itself in the foot with excessive scam accounts or a worse user experience than they already have.

The second largest risk is irrational decisions from management. The unwillingness to buy back stock at current levels is gravely concerning. Either, management is incompetent, or worse, they’re very competent and they see something we don’t. In other words, they think the business is going to struggle.

Sources and Further Reading

Arch Capital 2022 Write-up on Match Group: https://www.archcapitalfund.com/_files/ugd/d7eae5_c768709d17b6480ebe3c3b0b222340c2.pdf

Great work guys. My biggest question, which you hit on here, relates to management - there's been a revolving door in the C-suite for years, and some scuttlebutt (expert interviews and the like) points to a similar conclusion. Can they fix it and / or the assets in a strong enough position to withstand it? I leans towards yes, but not overly confident on that conclusion. Still a name I'm watching closely!

Thanks guys! Great insights and definitely saved me sometime on the company background research I was doing.

Quick question here... What are you thoughts about the declining amount of users (not payers) for Tinder, which was around 20% last year? They are telling a nice story that the decrease in payers was due to the increase in price, but that doesn't explain the active user decrease. It might be compromising the the main moat, network effect.

P.S. from what I found online it seems that this is across the board issue for the whole dating app market.