Why We Own Nelnet (Ticker: NNI)

Has this student loan company turned itself into the next Berkshire Hathaway?

Reminder: these are show notes that should be read in conjunction with the podcast. Do not expect these notes to be a polished research report.

Upcoming schedule: Over the next four weeks we will be covering the four publicly traded dating companies (Bumble, Grindr, Spark Networks, and Match Group)

As always, listen to the episode on Spotify, YouTube, or wherever you are subscribed to the show.

Charts

Data powered by Stratosphere.io

Chit Chat Money is presented by:

Stratosphere.io, a powerful web-based research terminal for fundamental research. With fundamental charting tools and data aggregation, Stratosphere saves us hours of time each month researching stocks.

Upgrade to one of Stratosphere’s paid plans and get 35+ years of historical financials, advanced KPI tables, and SEC filing aggregation.

Ditch the clunky and advertising-riddled websites like Yahoo Finance and upgrade your investing research using Stratosphere.io.

Get started researching for FREE on the Stratosphere.io platform today, or use code “CCM” for 15% off any paid plan.

Show Notes

(Brett) What is Nelnet?

Nelnet is a diversified holding company that began operations over four decades ago in the student loan business. Today – and some readers/listeners might groan at this – it has turned itself into a baby Berkshire Hathaway. It even has its headquarters based in Nebraska (Lincoln, not Omaha).

Since Nelnet’s business is essentially “invest money, earn a good return on it” there is not much to cover on the “about us” page. We will be going through each relevant operating segment in detail in later sections, though.

Here are six attributes chairman Mike Dunlap says makes up the “Nelnet DNA” from his 2022 annual letter:

(Ryan) Give any history/important context for the business:

I think it’s actually worth going all the way back to 1965 before the idea of Nelnet even existed. 1965 was the year that the government rolled out the Federal Family Education Loan Program (FFELP) which stated that all new loans from banks and private lenders would be federally guaranteed. The program went through a number of revisions but it ultimately culminated in more people going to college and more institutions willing to lend money. One of those institutions ended up turning into what we now know as Nelnet.

Nelnet itself was started by Michael Dunlap and Steve Butterfield in 1996. Butterfield was 43 at the time and had spent about 15 years in investment banking and Dunlap was about 10 years younger than Butterfield (I think) and was a director at Farmers and Merchants Savings Bank in Iowa. I’m not sure how the two got acquainted, but after co-founding the business they bought out a student loan originator as well as a loan servicing company in 1998 and 2000 with the intention of vertically integrating the two functions. In 2003, they took the business public and raised $164 million in the process. At the time, Nelnet had $10.3 billion in loans on its books and that was increasing quickly every year.

However, in 2008/2009 many lenders began pulling back on their student lending as a result of the credit crisis. Instead, it was the government that stepped in and started funding those. This eventually spurred the action of the Obama administration to completely disband the FFELP altogether and take all public education college lending in-house. At the time, Nelnet had $25 billion of student loans on its balance sheet.

These loans have been slowly paid back ever since and it today sits at only $14 billion in remaining loan value. They earn interest on these loans and have interest rate swaps in place to ensure that in the event rates rise dramatically (like in 2022) they still get a certain amount of cash flow. Here’s what the remaining cash flow estimates look like.

The focus now and for the last 10 to 15 years has been on redeploying that cash flow into other ventures so that Nelnet can last beyond its loan portfolio.

*We will now be covering each segment of Nelnet’s business in detail

(Brett) Nelnet Business Services (software + payment processing for the education market):

Its largest wholly-owned business, NBS is a suite of software and payment tools for K-12 and higher education institutions, mainly in the United States. It aims to offer a holistic solution for administration departments at schools.

The most important segment within NBS is FACTS, which serves 11,000 schools in the K-12 private and faith-based markets. It offers tools for tuition management, administration workflow, enrollment, and education development.

Last year, the segment did $244 million in revenue, up from $188 million in 2021.

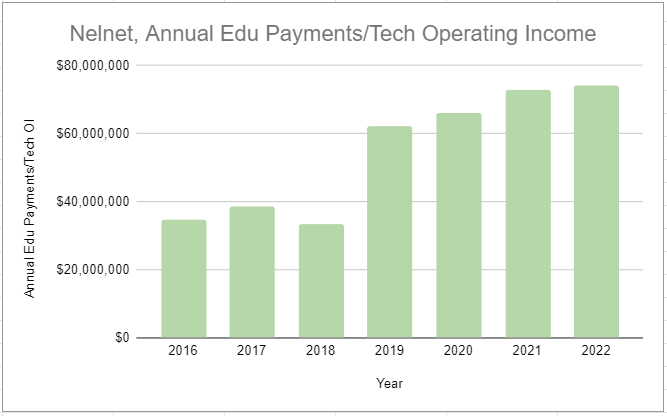

The other segments include NBS International, Campus Commerce (colleges), payment processing, and a tiny community engagement segment. Altogether, NBS generated $408 million in revenue in 2022 and $74 million in operating income. Since 2016, NBS's operating income has grown at a CAGR of 13.5% a year.

We also believe this segment is (slightly) underearning due to the reinvestments it is making. For reference, here is a quote from the 2022 annual letter to shareholders:

“FACTS continues to create consistent cash flow for the division while investing in new products and associates to further enhance the value we provide to our school customers. We strive to elevate the education experience for our schools, teachers, students, and families. Our customer retention rate has consistently been over 98%, illustrating our service commitment to our customers”

This also highlights why we like the NBS segment and think it deserves a high earnings multiple: It has low churn and minimal competition in its core software market.

Overall, we think a good estimate for the operating income NBS generates before reinvesting for growth is $100 million a year, a number that it could spit out year after year if it wasn’t trying to grow its topline revenue.

(Ryan) Nelnet Diversified Services (Loan Servicing):

As I mentioned earlier, Nelnet was formed with servicing at the core of its value proposition. To better explain what exactly this is, I’ll steal a quote from myself that I wrote a couple years back when researching Nelnet: “When a lender lends money to a borrower, there’s a layer of work being done under the hood that tends to go unnoticed. This layer includes the actual distribution and collection of money, maintenance of financial records, and a central dashboard for borrowers to interface with during the payback period. This layer is what’s referred to as loan servicing”.

By 2008, Nelnet was the 3rd largest loan servicer in the country (although at the time most of these were loans originated by Nelnet themselves). Just behind them was a company called Great Lakes, which Nelnet acquired in 2018. They are now the largest servicer by far with an estimated 40% share.

Nelnet is compensated in the form of monthly fees based on the number of unique borrowers they service. In total, Nelnet serviced 17.6 million borrowers in 2022 with 15.8 million of those coming from government loans. However, due to the CARES Act which was started in March 2020, all student loan payments have been paused. In November, the government notified Nelnet that this forbearance period would be extended again until October of 2023. According to CEO Jefferey Noordhoek that “led to NDS being significantly overstaffed by nearly 1,000 people”.

But even with the difficult year, they still looked alright financially. In 2022, they generated $535 million in revenue and roughly $65 million in operating income. In a normal operating environment like 2019, they generated 15% operating margins. Applied to this year’s revenue that’s more than $80 million a year in operating income.

(Brett) Nelnet Renewable Services:

This has historically been a small portion of Nelnet’s conglomerate but is something management indicated they will be increasing investments to, meaning it will become a larger portion of the story over the next three to five years. A lot of that cash flow from the student loan “melting ice cube” is going to be redistributed to this division.

Nelnet Renewable Services is a tax equity investor in solar energy partnerships. Simply, this means that Nelnet – along with its co-investors – invest money to develop solar energy projects around the country. In return, the company gets cash flow plus tax equity credits, equal to 26% - 30% of the project cost. Nelnet can use this to offset its total bill to the U.S. treasury.

In total, Nelnet has invested $175.6 million in these tax equity projects plus manages $102 million in outside investor capital. According to the shareholder letter, the company has $194 million in committed capital from outside investors waiting to get deployed.

What gets us excited about the solar division is the acquisition of GRNE Solar, which was made in 2022 for $34 million (they own 80% of the entity). GRNE Solar is a contracting company that builds solar projects for other people, and now on a consolidated basis for Nelnet Renewable Services.

Here is a quote from the 10-K on the rationalization for the acquisition:

“The acquisition of GRNE Solar provides technical know-how, customer relationships, a talented workforce, and revenue streams to Nelnet’s expanding renewable energy business. The acquisition gives the Company an ability to realize a diversified revenue stream by generating a fee-based service from its EPC and operations and maintenance (O&M) services, while also originating solar assets for the Company’s own balance sheet on a high-quality, cost-efficient basis. These assets are expected to earn revenue and generate a profit for up to 40 years based on energy production and energy sales to entities, such as utilities, governmental bodies, commercial companies, educational institutions, multi-family landlords, and healthcare groups”

There are a few things we like about the new Nelnet Renewable Services. First, the company is now vertically integrated, giving it an advantage over competitors. Second, it has a funnel of investors willing to put more and more money into these projects. Third, the new U.S. government bill around renewable energy will give the company government-supported returns. Fourth, these projects generate tons of cash flow over long lifespans while masking the earnings upfront through reported accounting losses.

This business unit will not generate tons of cash flow over the next 2 - 3 years but sets up Nelnet to start generating durable cash flow for the next few decades with almost unlimited room to reinvest further capital.

(Ryan) Nelnet Communication Services (Allo Communications):

Nelnet has a little over a 45% stake in a fiber business called Allo Communications. This business is fairly straightforward. Allo feeds broadband internet to communities in Nebraska, Colorado, and Arizona. Laying Fiber requires a significant initial cash outlay, but should reap a consistent stream of cash afterward.

In 2020, they sold a 48% stake in Allo for $197 million. Which I guess gives Allo a valuation of ~$400 million and that was before work-from-home was really popularized by COVID. From all I can tell demand seems to be pretty strong for Allo’s internet services, and in fact, in this year’s letter management said one of the biggest hiccups of 2022 was difficulty hiring. At the end of 2022, Allo could serve an estimated 410,000 households. Nelnet invested an additional $48 million into Allo this year.

It’s pretty difficult to value Allo. They have a non-controlling interest that was worth just under $200 million two years ago and it’s expanded a lot since. Also, it appears their ownership in Allo is mostly through preferred shares which pay out interest to Nelnet at 6.25% and could jump to 10%.

Per the 10-K: “However, if the non-voting preferred membership interests are not redeemed on or before April 2024, the preferred annual return is increased from 6.25% to 10.00%.”

(Brett) Nelnet Bank:

Nelnet Bank was given a charter to operate by the FDIC in early 2020 and was formally launched in November 2020.

Nelnet Bank is an industrial internet bank (their words), meaning it is not a bank looking to compete with deposits from consumers with Bank of America and Chase. It targets private education loans and the unsecured consumer loan market. The education loans are straightforward and will be easy to attach to Nelnet’s already established network in the education industry.

The consumer loans are still in their infancy, and it looks like the company aims to go slow here. Quote from the 10-K:

“Nelnet Bank plans to begin offering unsecured consumer loans, primarily refinance loans, in 2023 for consumers to consolidate credit card and other general-purpose debt as well as financing home improvements.”

As of the end of 2022, the bank’s loan portfolio was valued at $420 million, has $790 million in deposits, and has $900 million in assets. Only two years after launch, the bank generated $13 million in net income after provisions for loan losses, up from $5.4 million a year ago.

We’re not going to pretend to be expert banking analysts, but we trust a company that has decades of experience lending to consumers – specifically the education market – with fantastic long-term financial results to do well with a banking charter. We will be tracking deposits, loan portfolio growth, and net interest income over the next few years to see how large this unit can become for Nelnet. There is an easy path to $100 million in net income generated each year for this division, possibly within the next five years.

(Ryan) Other Investments: Hudl/Real Estate/VC

We’ve lumped these ones in together, but I’m really most optimistic about Hudl here. For those who don’t know Hudl, it’s a performance analysis platform used by sports organizations to review film, build highlight tapes, scout competitors, and plenty more. We really only get limited information on this business, but they run pretty much a national monopoly on high school sports and they’re also expanding globally through acquisitions. Here’s a list of the recent companies they’ve acquired (they’ve acquired 12 in total):

Wyscout: An Italian-based scouting platform that works with professional soccer (or football as they say abroad) teams.

Krossover: This used to be a college (and I think even professional in some use cases) basketball video analysis platform. It doesn’t exist anymore as they’ve now integrated the customers into Hudl.

Blueframe Technology: Allows sports teams to monetize and enhance their game live streams, by enabling the option to make games pay-per-view and add broadcast-level graphics to their stream. This should pair well with Hudl’’s camera units that they’ve installed all around the country.

Realtrack Systems: Developed in association with FC Barcelona’s Innovation Hub. Realtrack GPS sensor data with video performance to track and monitor athletes.

Instat: This is an Irish-based stats and video analytics platform that has a big presence in soccer, ice hockey, and basketball.

I really can’t find much info on Hudl’s financials, but Nelnet has now invested more than $100 million into Hudl since its founding and I suspect that will continue to grow. I believe the latest estimate had their ownership of Hudl at greater than 20%.

On top of the Hudl investments, management also invests opportunistically in real estate and early-stage private companies. The VC bets are fairly standard and have a total carrying value of $250 million but more than half of that is Hudl. Within the real estate portfolio, they have 31 real estate investments and they are typically in commercial properties such as multi-dwelling units and storage facilities. They made sure to emphasize that these are not commercial offices.

(Both) What do we think of the management team? Why are we optimistic about their ability to successfully deploy capital moving forward?

(Brett) I like the management team. The quantitative track record speaks for itself, which we have covered in the above sections. But the qualitative is just as important. Nelnet thinks long-term, has long-term tenured management, doesn’t mess around with “bullshit” earnings, and could care less about Wall Street. Plus, when they do communicate with investors, they do so clearly each year with the annual letter and annual report. These letters are not as eloquent as Buffett, but I believe they have the same mindset, morality, and ethics when considering all stakeholders in the business.

(Ryan) Similar to Brett, I like and trust the management team. I think I’ve owned it for long enough now to believe them when they say that their GAAP financials understate their earnings potential. Also, it gives me some confidence to know that Michael Dunlap owns 42% of the shares outstanding and Jeff Noordhoek owns basically $50 million worth of stock, which I’m assuming is a huge chunk of his net worth.

On the deploying capital part, as Brett said, the capital allocation track record speaks for itself. But I also like the fact that there are now a number of greenfield investment opportunities under their umbrella. Solar, fiber, Nelnet bank, etc., are places where they can really put as much capital to work as they want. Additionally, they’re kind of at the peak of their cash runoff right now and it happens to coincide with a time when asset prices are coming down. I like that combination.

(Both) What segment are we the most optimistic about?

(Brett) Over the next five years, I am most optimistic about the growth of Nelnet Renewable Services (my second choice would be the bank, but I would actually be concerned if that was growing too quickly). The inflation reduction act should provide a nice tailwind to new project development, and the company now has a competitive advantage after the GRNE acquisition.

I wouldn’t be surprised if the company could deploy billions of capital into solar development over the next five to seven years, earning steady cash flow for decades into the future on these upfront investments.

(Ryan) I like that the bank gives them an easy place to allocate some cash and they have the underwriting track record so we can at least have some sense that they know how to lend responsibly there. I also like solar, but you’ve taken that one so I’ll go with Hudl. I know this might sound like pie-in-the-sky thinking, but I could truly see Hudl being a global leader in sports analysis. They already have more than 200,000 teams as customers across 40 different sports and 150 countries. To get a sense of the size here, there are reportedly only 16,000 high school football teams in the US, which is their core market and where they have more than 95% market share. That tells me they are having success across other sports.

Management also seems really reluctant to mark up the value of their Hudl stake, which makes me feel like it’s much larger than what’s stated on the balance sheet.

(Brett) How are we valuing the company?

One way to think about the value of a stock is to look at how much cash it will generate over five years, how much it can reinvest over that same period, and at what rate of return it will earn on this reinvestment. For Nelnet, it is hard to sum up all the cash available for reinvestment, but I think we can make some estimates.

Over the next five years, Nelnet will receive $970 million cumulatively from its FFELP portfolio, let’s round that up to $1 billion. From NBS (education/payments processing), we think it is reasonable to expect $100 million in annual operating income, equating to $500 million in total operating income. Add in renewable energy, the bank, and its other loan portfolio, and you could tack on $500 million in cash flow available to the parent company (cumulatively, and before reinvestment/growth investment decisions). That is $2 billion in total cash flowing up to the parent company that can be redeployed into new investment opportunities or redistributed to shareholders.

Do we have any concerns Nelnet can deploy $2 billion in five years? No. It spent $667 million just on its “other” investment category (shown in the table above) in 2022.

What sort of return should we expect on this capital deployment? Historically, when an investment passes Nelnet’s hurdle rate they are able to return 15%+ to shareholders over time. We believe assuming this will continue is rational.

Today, the company’s market cap is just $3.3 billion.

(Both) Pre-mortem: Why could we be wrong about Nelnet? How would we know to sell?

(Ryan) Honestly, it’d be difficult to know. It’s always difficult to tell on the lending side of things. But if we started to see clear deterioration in the earnings power of their operating segments over multiple years, then perhaps that would be my tell. The problem is we would’ve probably already lost money by that point. I guess that’s where now getting diverse revenue streams is helpful. As we saw with the loan servicing segment this year, one business can have a tough year and Nelnet as a whole will still be fine.

(Brett) The only concern I have with Nelnet is that it is a financial business making loans. This always has some level of risk. If the company is making terrible loans today, we would not know until years into the future when the majority of the current book value of the business is destroyed. We are trusting the management team and their track record with this one, which will make it difficult to analyze any reason to sell before the business results suffer. That is the biggest risk here.

Stock for next week: Bumble

Sources and Further Reading

Nelnet Annual Letters: https://www.nelnetinvestors.com/financial-information/annual-reports/default.aspx

Michael Dunlap interview with Mindset Value: http://www.mindsetcapital.com/wp-content/uploads/2022/05/Mike-Dunlap-Questions-and-Comments.pdf

Thanks a lot for the good write up.

Regarding solar energy business, other than the tax credits that worth 30% of total investment, 5 year expedited 100% depreciation for income tax benefit, I could not find any remarks from the management team on how the business will look like once the initial heavy CapEx phase is over. Will they operate the solar farms and sell the electricity? What is the projected annual revenue and profit?

They invested $175 million on solar projects and $34 million on acquisition. How will we value this business without knowing the future cash flow?

Once you get how our income-based labor force really works (that high profits depend on low wages), you will finally see and understand all the reasons why a global system that can match people to jobs, resources to communities, and everyday needs and demands to local production, consumption, and recycling operations is more sustainable and ethical than monetary methods practiced today, mainly because scientific-socialism, compared to scientific-capitalism, is actually more democratic; it values and views this very basic, very intuitive belief “universal protections for all” as both a human and environmental right.