Why We Own Nintendo Stock (Ticker: NTDOY)

Why we believe The "Disney of gaming" is being severely underestimated by Wall Street

Reminder: these are show notes that should be read in conjunction with the podcast. Do not expect these notes to be a polished research report.

YouTube

Spotify

Charts and Graphics

Chit Chat Money is presented by:

Potentially you! Reach out to our email chitchatmoneypodcast@gmail.com if you are interested in sponsoring the newsletter, podcast, or both.

Show Notes

(Ryan) Give a brief overview of Nintendo’s history: What’s important? How is it relevant to the investment today?

I’ll make this somewhat brief since there are other good podcasts out there on this and not all of it is that relevant to the thesis today, but Nintendo has been around for a long time. They were initially founded in 1889 in Kyoto, Japan as a playing card game. However, it really wasn’t until around the ’70s and 80’s that the modern Nintendo company began to take shape. This is when they began their push into gaming, initially starting with arcade-like games and slowly moving into more advanced electronics.

Their consoles have included the following:

1980: The Game and Watch

1985: The NES (Nintendo Entertainment System)

1989: The Game Boy

1991: The Super NES

1995: The Virtual Boy

1996: The Nintendo 64

2001: The GameCube

2004: The Nintendo DS

2006: The Wii

2010: The Nintendo 3DS

2012: The WiiU

Each console was different in one way or another. Some of them were hits, and some of them were flops, but ultimately there was one common trend: none of them stuck. So you’d have these massive shifts in cash flow. When the hardware was selling like crazy, there was more eagerness to produce games both from Nintendo themselves and third-party developers, and with more options for games, there were naturally more game sales. This created wonderful operating leverage and profit margins in good times, but really difficult periods when consoles evolved. This led to a culture that prioritized conserving cash for a rainy day.

That was until about 2017 when Nintendo launched the first Switch. And we’ll discuss why that is below. Sidenote: In 2015, Satoru Iwata died while he was the President of Nintendo. He was quickly replaced with an interim president and then finally replaced with the now-current president Shuntaro Furukawa. Furukawa is only the 6th ever president of Nintendo.

(Brett) What are Nintendo’s revenue drivers today? How does the integrated hardware model work?

Nintendo’s business model is to sell dedicated gaming hardware at a small profit and then make money developing its own games and selling them exclusively on its gaming hardware. So when you see a Mario, Zelda, or another game from a Nintendo IP available for purchase, it will always be made by Nintendo (or with Pokemon, the Pokemon Company) and almost always exclusively sold on Nintendo hardware. You can’t play a mainline Mario or Zelda game on Xbox or PlayStation. Nintendo’s culture is to keep extremely tight control over how people can view/interact with its entertainment characters.

To give context for the rest of the episode, Nintendo’s guidance for its latest fiscal year (ended in March) is for $12 billion in revenue and $3.6 billion in operating profit. This is using the current Yen-to-USD conversion.

First-party game sales have incredibly high incremental margins, so driving higher unit volumes for first-party games (what Nintendo calls “software unit sales”) is vital for profit generation. Take a look at the correlation between software unit sales and operating profit since the Switch launch (chart above). Operating profit has declined a bit this fiscal year in USD terms because of the appreciation of the USD vs. currencies like the Yen and Euro.

With the Nintendo Switch system, Nintendo has expanded its offering for 3rd-party game publishers (something it hasn’t embraced since the 1990s) and is now offering an online live services subscription called Nintendo Switch Online (NSO). Nintendo – like other gaming platforms – takes a ~30% cut on 3rd-party game sales. According to Nintendo’s latest earnings, 8 different 3rd-party games have sold over a million copies so far in fiscal year 2023. However, a lot of the popular games from other publishers have low selling prices below $20, so they are not nearly as important financially compared to a first-party game going for $60 a pop. I would argue they are important in keeping people engaged with their Nintendo hardware since an individual customer might only buy a mainline first-party game from Nintendo once every two years, if not longer.

As of September 2022, Nintendo Switch Online had 36 million subscribers. Let’s say that has grown to 40 million today. NSO has two tiers, one that costs $50 a year and one that costs $20. The $50 tier gets you access to more legacy titles from past Nintendo hardware and in-game add-ons like the Mario Kart 8 Booster Pass series. We do not have an ARPU figure, but splitting it down the middle at $35 equates to $1.4 billion in recurring revenue for Nintendo. Even if that ARPU figure is high right now, this is becoming an increasingly important revenue generator for Nintendo, much more important than 3rd-party sales, at just over 10% of revenue under this estimate.

“Memberships have grown alongside an increase in users playing Nintendo Switch and the release of titles that support online play. This service offers more than just the ability to play compatible games online. It also provides access to an expanding list of other benefits, such as the growing collection of classic titles. By expanding the range of available play options like this, we believe we can create opportunities for users to continue playing Nintendo Switch for a long time”

Since profit generation from software sales is tied to hardware sales and software sales generate all the profits, Nintendo’s financials are tied to its hardware sales and active users, which Ryan will cover in the next section.

(Nintendo also makes a small amount of money outside of its own gaming ecosystem right now, but not enough to matter financially. We will address the potential growth of this category in later sections)

(Ryan) Why do we think the Switch has staying power? How will we know if it doesn’t? Why is that important for stable earnings?

I think this is probably the most important question to the Nintendo thesis and one we continue to examine on a regular basis. Before I get into some of the supporting evidence, let me talk about the Switch itself.

The Switch is a very different console from Nintendo’s previous generations. Most importantly, users are no longer tied to their specific piece of hardware. Instead, users have a Nintendo Online account that can save progress and allow users to access games across other devices. This means the upgrade cycle to new generations of the switch is much more seamless. You don’t have to restart from square 1. And we’ve already seen that play out in some capacity. To date, the Nintendo Switch has seen essentially 3 different evolutions – The Switch, The Switch Lite, and The Switch OLED Model. As of the most recent quarter, you can see how the mix of hardware sales has shifted to the newest model the OLED (graphic above).

While it still hasn’t been officially confirmed, a more advanced version has been rumored to release sometime within the next year. If you really want to get into the weeds, there are obscure online chat rooms with people from inside Nintendo that have confirmed this, as well as patent applications from Nintendo for a more advanced electronic device.

But it’s not just in the hardware that we see proof of the platform staying alive. The level of usage and volume of software titles continues to trend upward, which is very different from past cycles.

We’re now officially 6 years past the launch of the original Switch and the number of software titles being released (both first-party and third-party_ is at an all-time high and continues to move up. In all of Nintendo’s previous console cycles (Wii, WiiU, DS, 3DS, Game Boy, and GameCube), the number of software titles peaked between years 3 to 5 after launch and then trended downwards. We aren’t seeing that.

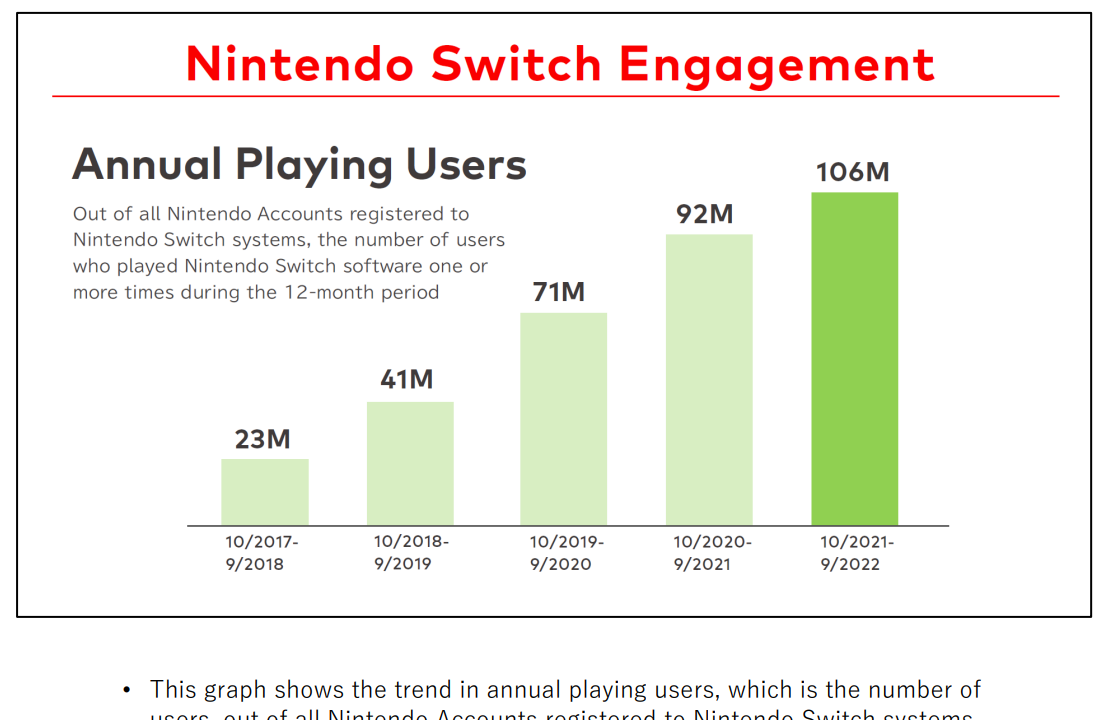

Additionally, Nintendo gives out an annual playing user number each quarter which I think is helpful in assessing the ongoing engagement with the platform. And as you can see from the chart, despite skyrocketing to 71 million in 2020 due to the stay-at-home orders, Nintendo has still grown its annual playing users beyond that. As of the most recent quarter, Nintendo currently sits at 112 million annual playing users.

So although people might look at Brett’s chart from above on Software Unit sales and say it’s decreasing or flatlining, it’s important to remember that people usually buy more games when they first purchase a console. And console sales have really dropped following 2020 (there are several reasons for this – chip shortage, accelerated demand in 2020, no Switch 2 announcement), but what’s important to understand is that if hardware sales are dropping precipitously and game sales are basically flat, this means users that have been around for a while are still buying new games.

(Brett) Covering expansion outside of video games. What has Nintendo said about its expansion? What gives us confidence that they have made an overall philosophical change?

As we will undoubtedly discuss throughout this episode, Nintendo management is notoriously secretive, vague, and confusing when discussing any future plans. However, over the last decade, they have repeatedly talked about expanding outside their core gaming business and are finally starting to succeed here.

Starting a year or so after the Wii U disaster, Nintendo’s executive team started exploring an entrance into new modes of entertainment. This was spearheaded by President Tatsumi Kimishima in 2015 and continued with current President Shuntaro Furukawa. It started looking for a partner to make a film (landing with Illumination) and invested a lot in making smartphone applications. The smartphone applications have been a bit of a disappointment so far, but they are now trying to get a lot of “shots on goal” outside of gaming, which I think is smart. Some will stick, while some will end up flopping. This is the entertainment business, you can’t bat a thousand.

There are a lot of “reading to tea leaves” you can do to see that Nintendo is making these new investments a priority, but I think two things stand out to me. One is that Miyamoto (the Walt Disney of Nintendo, who we’ll discuss in the next section) is leading the charge here. Second is this slide Nintendo repeatedly shares with investors. Maybe I am reading too much into it but I believe this sums up its entire business strategy for this decade and likely beyond (graphic above).

I would also take a good look at this (unsurprisingly) confusing slide covering how much Nintendo expects to invest in its expansion strategies. The line that pops out to me is the 50 billion Yen (close to $500 million in USD) going to visual content R&D. They just bought a small studio and renamed it Nintendo Pictures.

(Ryan) The potential impact of movies and visual content:

This is a spot where the long-term and the short-term financial implications have been hotly debated, but I’ll try to run through it the best I can. As many people now know, Nintendo just released a first-of-its-kind Super Mario Brothers Movie. This was the best-selling animated movie of all time on its opening weekend (although it had a 5-day opening weekend), and as of April 26th (21 days after release), it has crossed $900 million in box office sales globally.

That’s a really strong first 3 weeks, and estimates for total box office sales now range anywhere from $1.2 billion to upwards even of $1.5 billion. However, it’s important to remember that today, box office sales only account for 20%-30% of a movie’s total revenue. They also earn money from at-home sales, TV distribution, and streaming deals. If we are conservative and assume they only reach $1.2 billion at the theaters, that means they could do potentially $4-$5 billion in total gross sales.

But Nintendo obviously doesn’t get all of that. On average theaters get 50% of box office sales, Nintendo reportedly paid $100 million to make the movie and $50 million on marketing, plus I believe they split the revenue with Illumination/Universal. Not sure what the revenue split is but to be safe, I’m going to assume 50/50. At a 50/50 split on $1.2 billion in box office sales, Nintendo would generate around $200-$300 million in earnings. However, the streaming and at-home portion is a much higher margin, so estimates have it that they could do at least $1 billion in earnings from the movie. For context, they did $3.5 billion in net income over the last 12 months.

Where this gets a little more interesting is in thinking about the long-term. Immediately following the release of the Mario movie, game sales for all the hit Mario titles jumped significantly week over week. This movie/gaming combination gives fans a new way to experience and interact with Nintendo characters. A la “Flywheel Effect”.

While at first, it was just hinted that there would be more of these movies, last week Shigeru Miyamoto confirmed to a Japanese news site that there is “no doubt” he will make another film based on Nintendo franchises. In my opinion, there are tons of places they can go with their IP too – Mario Bros sequels, other Mario character spin-offs (Luigi, Donkey Kong, Yoshi, etc.), Zelda, Splatoon, and several others.

Ultimately, I think the movies can not only contribute to the bottom line for Nintendo but can also help serve as a retention tool for gamers and a new way to attract fans to the brand.

(Brett) The potential impact of parks:

Nintendo, like with visual content, has partnered up with Universal Studios to bring its entertainment characters to four Universal theme parks around the globe (Singapore, Japan, California, and Florida). On the current timelines, these parks will be fully operational by 2025.

With theme parks, Nintendo (led by Miyamoto) has collaborated with Universal in designing the theme park land, but Universal is putting in all of the capital investment. This makes it less expensive on Nintendo’s end, but they will earn a smaller chunk of the ticket/merchandise/food sales.

The economics and revenue share for the theme parks is not clear, but in talking to an investor who talked to someone that works with Universal, it looks like Nintendo will earn a 4% take rate on all ticket sales plus a flat annual fee for each park. This could equate to around $250 million in high-margin revenue each year for Nintendo. By 2025 we will know for sure if this is an underestimation or overestimation. I have no idea what it is. It should be noted that Nintendo officially announced an expansion for the Japanese theme park already, bringing a Donkey Kong-themed area sometime in 2024. With dozens of different family-friendly characters, there is room for Universal to expand these theme parks for many years into the future if Nintendo allows them to.

While not game-changing for Nintendo financially, this earnings stream will diversify Nintendo’s income statement and hopefully smooth out its earnings this decade compared to the previous two.

But more importantly, the theme parks are profitable marketing products to convince Nintendo customers to buy more games, which is where they make the majority of their earnings. Remember, Nintendo's first-party titles have incredible incremental margins (especially digital sales). So if the theme parks drive 1 million more people around the world to spend $60 on Mario Kart 8 (or insert any Nintendo game), that is $60 million in extremely high-margin revenue added to its income statement.

Lastly, interacting in person with an entertainment character at a theme park can make a young child a fan of that character for life. If you are a listener to the podcast with a child between the ages of 5 - 12, imagine how much fun they would have meeting Mario/Luigi at Super Nintendo World. Or Yoshi, or Kirby, or any other of the dozen Nintendo characters. Now imagine it is November and you are thinking of a perfect gift for the family this Christmas/holiday season. After turning your kid into a fan of Nintendo characters, I think it is much more likely you will buy a Switch this holiday season than if you didn’t go to Super Nintendo World. And if you already have a Switch then you will want to buy another Nintendo game (one that you know will be family-friendly!) for your kid to play.

Millions of gamers who are now 30 - 50 years old became fans of Nintendo when they were kids. Now, a lot of them have young children. Do you think they will want to take them to Super Nintendo World? (the answer is obviously yes).

I think the competitive advantages are clear, but maybe we can discuss that here as well.

An added plus is that it will be much more affordable for a family to go to Super Nintendo World than Disney World. I don’t know how much that matters but I wanted to mention it.

(Ryan) Merchandise, stores, mobile applications (everything else):

Not a super important segment financially, but I think it adds to the ecosystem. On the stores’ side of things, Nintendo is trying to roll out additional touchpoints for customers all around the globe. They have a number of official stores as well as pop-up stores that primarily sell merchandise – clothing, legos, collectibles, etc.

They also offer a variety of mobile apps for smartphone users that are typically free-to-play, limited versions of Nintendo’s IP. These include things like Mario Run, Mario Kart, Pokemon Unite, and several others. Despite having more than 800 million downloads across these apps, they really haven’t leaned into the mobile business much at all. It’s meant to be yet another way for non-Switch users to have a way to experience the brand.

(Brett) How are we valuing the stock?

Before going into our simple valuation framework for Nintendo, any listener should note that its financial guidance is in Japanese Yen and therefore a bit tougher to forecast if the Yen is depreciating or appreciating rapidly vs. the U.S. dollar (as it has over the past few years). I would also note that we are excluding the value of Nintendo’s stake in the Pokemon Company for this valuation work. They are rumored to own around 33% of the business but it is unclear if it will ever be monetized. The value comes from Nintendo’s exclusive releases of Pokemon games on its hardware, which will show up on the income statement.

Regardless, let’s go through a simple valuation framework and why we think Nintendo’s stock is cheap. As of this recording, Nintendo has a market cap of $49 billion (USD). It has around $13 billion in cash and no debt, which moves its enterprise value down to $36 billion. Subtract out its stake in Niantic (we estimate that to be $1 billion), the Seattle Mariners baseball team, and the DeNa and Bandai Namco gaming studios and we get an enterprise value of $34.5 billion.

When looking at this year’s guidance for $3.6 billion in operating profit (one that will rise if the Yen and Euro stop depreciating), Nintendo is already trading at around a 10% earnings yield.

So the first question we asked is: Do we think Nintendo’s earnings are durable?

Given what Ryan discussed in the Switch/hardware section, we think Nintendo’s earnings are much more durable than the market is thinking. This gives us a margin of safety on the stock at its current enterprise value. As long as the earnings don’t fall, we think it will be hard to lose money owning Nintendo over the next few years, and it is likely the stock re-rates to an earnings multiple of at least 15x forward earnings. That would be a $54 billion enterprise value today vs. the $34.5 billion it is trading at, or a 50% bump from here.

Of course, there is a lot more to Nintendo than just the status quo. If they continue to move to digital sales, add-on content, and grow NSO subscription revenue, earnings from the gaming business could rise by around $5 billion a year (again, subject to change depending on FX movements).

But if they hit on visual content, theme parks, and other IP expansion? We think Nintendo can add $2.5 billion in annual profits through direct sales and the indirect uplift to its gaming business. That would bring its annual earnings to $7.5 billion. We don’t need to run the math to show that the stock would be much higher at 15x earnings under this scenario.

Taking a longer view, Nintendo is one of the few businesses we think our time horizon can extend out over a decade. This may be a…frank way to look at things but think about the lifetime value of a kid who becomes a Nintendo fan at the age of 10. Over the next 40 years, they will consistently spend money with Nintendo as long as the company produces quality games and quality gaming hardware. And then when they grow up and have their own kids, they will want to share in the experience of playing a Mario game together as a family. It is a beautiful, non-zero-sum game where Nintendo can make boatloads in profits while simultaneously bringing enjoyment to tens of millions of kids, families, and adults around the globe each year.

I am comfortable betting that Nintendo will generate its entire enterprise value in cash flow that can be returned to shareholders over the next 7 - 10 years.

And yes, they do return capital to shareholders. We will address that in the next section.

(Both) What do we think of management? Do we think they’re becoming more shareholder-friendly? What do we think of Nintendo’s culture?

(Brett) I love Nintendo’s culture when it comes to brand management, game development, and overall creativity. The proof is in the pudding with the unique family-friendly game characters they have come up with.

I do wish they were more upfront with investors about their plans, although the secretiveness adds to the allure and free marketing they get whenever doing a product announcement. It is the company closest to Apple in this regard, maybe even just as popular. For example, they will get 1 million concurrent viewers on YouTube for big product reveals, which is unheard of.

So there are no issues with how they manage the brand. Some investors may have an issue with the pace of product releases. When will the next movie come out? How close is the newest hardware going to release? When is the next Mario Kart going to launch? They are not “shareholder friendly” like Disney where they look to juice as much of their IP or content supply each year. I think about it a different way. This patience in between large product releases and the resistance to juicing IP are actually more shareholder-friendly over the long term because it assures investors that Nintendo will keep its brand relevant in the eyes of consumers without angering them through price hikes or a flood of content.

You also hear complaints about the conservative balance sheet and returning cash to shareholders (or lack thereof). Yes, Nintendo has a very conservative balance sheet with over $10 billion in cash and no debt. I think this is suboptimal but not a huge concern as it makes the company more antifragile if the global economy goes into a tailspin. They will survive through to the other side without facing bankruptcy, which is something not every entertainment company could say.

And they do actually return cash to shareholders. Since 2014 they have paid out between $5 billion - $6 billion in dividends (it depends on how you want to use the exchange rate from Yen to USD) and repurchased $1.8 billion in shares. Dividends also increase in proportion with income generation, so if Nintendo is able to maintain or grow its current earnings power its dividends will grow as well.

(Ryan) I agree with pretty much everything Brett said. I like the culture, I love the creativity, and I like the longevity of executives there. However, I still wish they were better communicators to shareholders. I think they could be more direct about what trends they are seeing. Annual playing users feel like a misleading number.

(Both) What are the key risks we are watching? Why would we sell our stake?

(Brett) There are two risks I am watching for Nintendo. One is the glaring, flashing sign that every investor can see, and the other is more over the long term.

First, I am worried like everyone else that the next hardware device will be a flop. I am confident the chances are high that they will succeed due to all the things we addressed in this episode, but there is always a small chance Nintendo will get weird with this new hardware and try to sell another funky device to consumers. If they don’t sell enough hardware devices the high incremental margins on game sales won’t flow through to the bottom line and earnings will sputter for the next decade.

Second, I am worried about what happens to the company when Miyamoto retires/passes on (he is 70 years old). He is the Walt Disney of Nintendo and has been the key driver in their success over the past few decades. The leadership transition once he leaves presents some uncertainty.

As a follow-up, there was an interesting interview he did with the New Yorker that we linked below.

(Ryan) I really just have one overarching concern and it’s that the Switch platform slowly fades away. Perhaps the Switch 2 or Switch Pro whatever you want to call it flops and people play less and less. That’d certainly lead to profits fading away. But I think at this point, I really don’t see any indication of that.

Sources and Further Reading

Miyamoto interview: https://www.newyorker.com/culture/the-new-yorker-interview/shigeru-miyamoto-wants-to-create-a-kinder-world

Investor Presentation: https://www.nintendo.co.jp/ir/pdf/2022/221109e.pdf

Latest earnings presentation: https://www.nintendo.co.jp/ir/pdf/2023/230207_4e.pdf