Why We Own Sprouts Farmers Market Stock (Ticker: SFM)

Consistent buybacks + a long reinvestment runway? Fire up the bat signal

Reminder: these are show notes that should be read in conjunction with the podcast. Do not expect these notes to be a polished research report. Enjoy the episode!

YouTube

Spotify

Charts

Chit Chat Money is presented by:

Potentially you! Reach out to our email chitchatmoneypodcast@gmail.com if you are interested in sponsoring our newsletter, podcast, or both.

Show Notes

(Brett) What does Sprouts offer to customers? What is the in-store experience like?

Sprouts Farmers Market (Sprouts for short) is a grocery chain focused on serving healthy and “attribute” based items at a reasonable price. It has a reversed store layout compared to traditional grocery stores. A large area for produce, bulk containers, and what it calls an “innovation center” (meaning just samples and unique items) in the middle of the store, while the grocery aisles are on the side. It only holds a small amount of grocery SKUs. Another important note is that it has a large vitamins/supplements section.

What are attribute-based items? Food items for dietary restrictions or for people focused on the diet fad of the day. They have dairy-free, gluten-free, vegan, paleo, vegetarian, you name it.

Overall, they want to cater to the Venn diagram of U.S. grocery shoppers who want to eat healthy and at an affordable price. I like to think of them as a cross between Trader Joe’s (in-house brands, low price-unique items) and Whole Foods (healthy, organic, dietary-focused foods).

Here is a store layout:

There are a few unique parts to the Sprouts business that I believe are underappreciated by investors:

Its e-commerce business has grown substantially in recent years, driven by partnerships with Instacart and DoorDash. In 2023 e-commerce is 12.3% of sales vs. 9.4% in 2020.

The in-house Sprouts brand now makes up 20% of sales, up from just 14% in 2019.

It doesn’t carry any major CPG brands. You will not find Coca-Cola or Goldfish in a Sprouts store.

The key takeaway from an investor perspective is that Sprouts has attributes that allow it to earn higher gross margins than a standard grocery store (no major CPG brands, in-house brand growth, outsourcing e-commerce) which will allow it to achieve operating leverage if comparable sales growth accelerates. It also gives it plenty of room to earn a sustainable margin while at a significantly lower price point than an upscale healthy food grocer such as Whole Foods.

(Ryan) How has Sprouts evolved over the years?

Going back to the early days, the first Sprouts store was opened in 2002 in Chandler, AZ. By 2011, they had 56 stores and were acquired by private equity firm Apollo Global Management. While under the Apollo umbrella, they were combined with two other fresh grocery chains called Henry’s and Sunflower Farmers Market. All the stores were eventually converted into the “Sprouts” label and layout, and Apollo took the combined chain public in 2013 when they had 157 total stores.

From 2013 to 2015 Doug Sanders was CEO who had been there for a while, and he did ok, but in August of 2015 Amin Maredia stepped in. He was the CFO prior, but he really had quite a rough stint as CEO. When he stepped in, Sprouts was doing $3.6 billion in revenue, $240 million in operating cash flow, and had $160M in LT debt. The year he left, they were doing $5.2 billion in revenue, had $453 million in debt, and earnings were pretty much unchanged.

During his time, Maredia levered up to expand store count nationally but did it without the necessary support infrastructure. The WA locations for example were nowhere near a distribution center. This led to a lapse in quality and higher fulfillment costs. Additionally, Maredia used mail coupons as a big driver of foot traffic. It worked, but it brought in low-value customers.

Once Sinclair stepped in, he really made it his focus to optimize the store base. So cut stores that weren’t working and add distribution centers to get every store within 250 miles of a DC. He also cut out all the mail coupons, and has been trying to shift the focus to fresh, unique, high-quality groceries. So far he’s done a great job of that. Margins are higher, comp sales are growing again, and they’ve opened stores in the right areas.

(Brett) Are there any long-term tailwinds that Sprouts can benefit from? How large can this business get?

The numbers are typically not solid and built on surveys, but I believe that Sprouts benefits from a steady tailwind of healthier eating in the United States that should continue over the next decade. If you look back at what people ate on a decade-by-decade basis, there is clearly a growing cohort of people looking to eat healthy food.

(Side note: Sprouts is definitely not at risk of decline due to Ozempic. They perhaps will benefit?)

Here are some quotes from studies done by the Food Institute:

“High-quality fruits and vegetables remains a top attribute for choosing a primary store among supermarkets and clubs, though it recently fell out of the top five for mass merchants. This makes strong produce selections a key differentiator for supermarkets at a time when competitors have taken a large amount of market share.”

“Health and wellness is one of the few purchase drivers that stayed consistently strong through this recent inflationary period,” said Justin Cook, CP research leader at Deloitte. “Most consumers say they want to eat healthy (84%), and even to use food as medicine (three in four), but they also say they need help identifying the foods that are best for them and want help cutting through confusing claims (62%).”

Grocery stores also benefit from inflation and do fine during recessions (restaurant spending is much more discretionary).

Today, Sprouts has 391 stores spread across the Southwest, Texas, and the Southeast of the United States. Over the next few years, it will be focused on the southern part of the country as well as the greater regions around New York City. From 2024 onward, they plan on growing store count by 10% a year.

I do not have an exact number on how many stores they can have, but I believe it is well north of double its current store count and likely more than 1,000 just in the United States. It is also likely that this store concept can succeed in the entire country given there are healthy eaters everywhere.

(Ryan) What are the unit economics like? How much do they generate in revenue & profits?

Today, Sprouts has 400 stores located predominantly throughout the Southwest and Southeast United States. Getting a new store up and running (in the newer format) costs Sprouts about $3 million upfront, and Sinclair estimates that each store at maturity should do about $16-$18 million in revenue a year with 8% EBITDA margins. That means at maturity, each location generates about 40% of its initial cost in cash each year.

Across the whole business, Sprouts generates ~$6.6 billion in revenue per year. Which on its current store base, implies about $592 in annual sales per square foot, much higher than bigger box retailers like Kroger and Walmart. And that number is even higher for the new, smaller store formats that Sprouts is rolling out. Beyond the better footprint efficiency, Sprouts’ focus on fresh, unique items allows them to win without having to be the low-cost provider. This helps SFM generate 37% gross margins, which is best in class for a grocer. And those high gross margins trickle through to help Sprouts sustain 6% operating margins.

Over the last 12 months, Sprouts generated $457 million in operating cash flow. It’s used about 37% of that for capital expenditures (new stores, retrofitting old stores, and just general maintenance capex) and plows most of the remainder into share buybacks.

(Brett) What’s the capital allocation strategy for Sprouts?

A great thing about Sprouts is that it has a simple stated capital allocation strategy that management has followed through with. Part of our thesis is that Sprouts can continue with this capital allocation strategy for the next 3 - 5 years (and likely much longer).

Generally, Sprouts plans to take its operating profits/cash flow and first reinvest to build more stores and improve its supply chain. Its guidance for 2024 onward is to spend 3.5% of sales on capital expenditures, around half of which is for new stores and half of which is for company infrastructure (supply chains, offices, etc.).

Over the last twelve months, the company generated $6.6 billion in sales, which would equate to $230 million in capital expenditures. The company spent less on expansion during the pandemic due to supply chains hurting its pipeline, as well as general conservatism from management.

Over the last 12 months, cash flow from operations was $457 million. What will management do with this excess cash (457 - 230)? Pour money into share repurchases. And a lot of them.

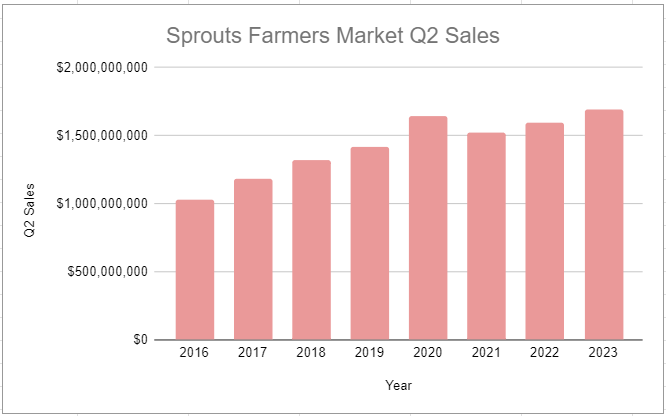

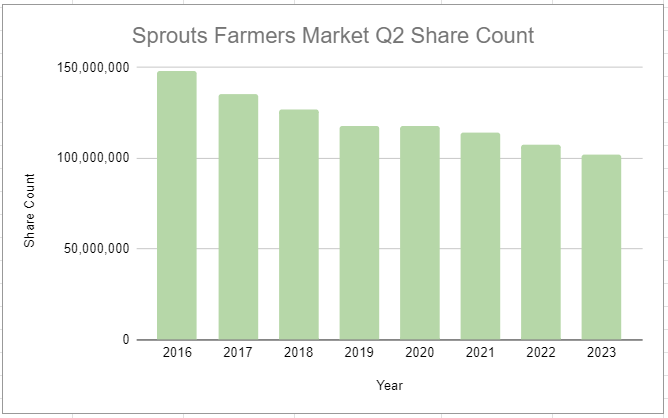

Since 2016, Sprouts has shrunk its share count at a 5.2% annual rate, bringing its shares outstanding from 148 million down to 102 million. With a market cap of $4 billion and hundreds of millions in cash to repurchase shares each year, Sprouts will have the ability to continue reducing shares outstanding in the years to come. This is one of the key parts of our thesis for the stock along with new store openings, durable comp sales, and operating leverage.

Of course, if the share price rises the buyback becomes less valuable. But that is a good problem for us to have as shareholders.

(Ryan) Valuation discussion: How much do we think Sprouts can earn? Why do we think it’s an attractive investment today? (Discuss the durability of grocery)

I ran some numbers and it really depends on what they choose to grow store count at. It sounds like Sinclair wants to get a little more aggressive and they’re targeting 10% store count growth for a while. If that’s the case, management estimates that they’ll be spending 3.5% of their revenue on capex each year. In that case, FCF growth probably won’t look quite as good just due to the change in FCF margin.

Here’s how I thought about it. Assumptions:

10% annual store count growth

3% comp sales growth

Steady operating margins

Capex jumps to 3.5%

5% annual share reductions

20x exit multiple. (This might sound crazy, but if they’re spending 3.5% of revenue on capex, that means if they stopped spending they’d earn a ton of money. So on an operating cash flow multiple it’s in line with historicals.)

All that gets you about a 15% IRR.

One of the things I also like about this is that it’s a little more predictable in the sense that spending on groceries isn’t going to go away in a recessionary environment.

(Both) What do we think of Jack Sinclair and the new management team?

(Ryan) Judging by his record at Sprouts, I think he’s pretty good. He’s done a good job pivoting what Sprouts is really about. Not your discount grocer, but a health-focused specialty chain. And it seems that’s the kind of customers they are attracting now. He’s been a little slow about adding new stores, but he’s been improving the results from the existing store base so I’m content waiting.

(Brett) I think highly of Jack Sinclair as a manager. He executed well in expanding margins after joining in 2019, has a consistent strategy that the team doesn’t deviate from, and has a fantastic capital allocation strategy. He (and the team, obviously not all his ideas) have done some wonderful things to improve this business at the margins such as lowering the store size, bringing in a better check-out experience (self-checkout, stuff like that), and improving the supply chain with the fresh distribution centers close to the store. As we get away from the pandemic bullwhip, I think Sprouts can start to play offense instead of defense by pushing for more store growth and improving the customer value proposition. This was not possible in 2019.

(Both) What risks are we watching for? When would we add to our position? When would we sell?

(Ryan) I think comp sales are a bit of a concern for me. Feels like they’re right around the inflation level or maybe even below it. So I share your concern a little bit here, that foot traffic isn’t growing much at all. That worries me that Sinclair may end up reverting back to some of Sprouts old habits of going after low-value customers to boost foot traffic. I don’t see any proof that he would, but it’s something to watch out for and that would show up in the gross margin line.

When would we add? I think it would need to be at a cheaper multiple assuming our estimates for the business don’t change. But if we start to think the business can grow store count at 10% and get maybe closer to 5%-6% comp sales growth, I’d be willing to add more at these prices.

When would we sell? Either a crazy valuation (>25x earnings) or if we notice something fundamentally wrong with the business.

(Brett) What keeps me up at night with Sprouts is a concern that inflation is masking stagnate foot traffic. Comp sales have accelerated in recent quarters but are still weaker than other mass merchants such as Kroger. Sprouts sacrificed traffic when Sinclair took over and got rid of low-margin shoppers, but eventually, we need to start seeing foot traffic increase if operating margins are going to expand. This wouldn’t be the end of the world but would hurt our forward returns.

The key metrics I track to see whether the business is deteriorating (the stock price gives us a margin of safety where I still think we make money as long as the business stays in place) are comp sales, operating margin, and operating income per store. They all relate together but I believe are the key drivers of cash flow growth over the long term. If one or all of these took a hit I would be looking to sell Sprouts.

From a valuation perspective, I wouldn’t want to sell Sprouts unless the valuation got extreme. With such a long runway for reinvestment, I think it would be a mistake to sell this because it got to a “market multiple” or some other arbitrary reason.

I think we should make this a significant position if the trailing P/E gets close to the trailing 12x - 13x range. That would make the formula of unit growth/comp sales/margin expansion/buybacks work wonderfully and could lead to a 20%+ stock price CAGR over the next five years, give or take.