YouTube

Spotify

Apple Podcasts

I write to you on the summer solstice, where it is 53 degrees, cloudy, and slightly rainy in the city of Seattle. An area of the world where Mother Nature seems to have a fetish of delaying summer until the latest date possible to punish its inhabitants.

The worst time of year in this area is April through June. Not because the weather is awful, per se, but because you keep anticipating sunny days are right around the corner, and it feels like they never arrive. One 75 degree stretch in May can be followed by weeks of lackluster weather.

That is how it feels looking at stablecoins (and cryptocurrency in general). A lot of talk about sunny days ahead. I am waiting for them to actually arrive.

This week, legislation was passed to formalize stablecoin regulation in the United States:

“The landmark ruling marks the first major legislation that deals with the digital currency industry that has been approved by Congress”

The legislation essentially treats stablecoin issuers like a bank, but with even more restrictions. Stablecoins need to be backed by liquid reserve assets (read: U.S. Treasury Bonds) and provide regular updates on the status of its reserves to regulators.

What happened to killing the evil banking system? Are we not revolutionizing finance by tearing down the old guard anymore?

Anyway, investors believe this is fantastic for stablecoin issuers like Circle:

The stock is up 126% in the last five days. IPO mania is back! You can feel the excitement permeating in the air (and landing in Citadel’s bank account).

Wait, what even is a stablecoin?

It is a fairly straightforward concept. I’ll let our friends at Coinbase and big backer of Circle explain it to you:

“Stablecoins are a type of cryptocurrency that seeks to maintain a stable value by pegging their market value to an external reference. This reference could be a fiat currency like the U.S. dollar, a commodity such as gold, or another financial instrument.”

USDC is a cryptocurrency that always maintains a one-to-one peg with the US dollar. Totally different from the US dollar, I have been told. When exchanging your dollars for stablecoins, you can use them to buy assets previously unavailable to you, like Fartcoin.

Issuers of stablecoins take your dollars and buy treasuries, earning a spread. Yes, like a bank. But, no, actually this is totally different from a bank! We are innovating, you just don’t get it.

Alright, enough rambling. I don’t really care if every part of the banking system gets replicated by stablecoins. Nothing about our economy will fundamentally change.

What does have my interest are announcements from fintech companies and merchants around stablecoins. Stripe just announced that it is helping Shopify merchants accept stablecoins. Wal-Mart and Amazon are “exploring” issuing their own stablecoins.

Merchant and merchant platforms want to pump out stablecoins to try and circumvent Visa, Mastercard, American Express, and Discover. They hate paying 2% - 3% on every credit card transaction. Retailers have constantly tried to get rid of them.

But they cannot.

Because the credit card networks have built an ecosystem that gives money back to shoppers with reinforcing competitive advantages that are virtually impossible to break. Governments have tried to disrupt them. Not even they are always successful.

Let’s go through an example. In the future, Amazon releases its own stablecoin (it won’t want to accept USDC because that defeats the purpose of eliminating a cost of your business). This stablecoin offers 5% back on all transactions on Amazon.

I already get 5% back on Amazon purchases with my Prime Visa credit card. This card is free for me to use. There is no improvement for me as a shopper to switch from this credit card, and I can use my Visa card anywhere in the world, while this stablecoin only works on Amazon. You are starting to understand the moat around Visa’s business.

All stablecoins would do is take cash back, points, and all the other perks you get with credit cards and turn them into profit for retailers. Prices on products are not coming down.

Retailers can accept stablecoins as a form of purchase, but that does not mean consumers will use them. Stablecoins need to off a better value proposition than credit cards for consumers before they get wide adoption. This value proposition is only possible because of the existing interchange fee system.

See the issue?

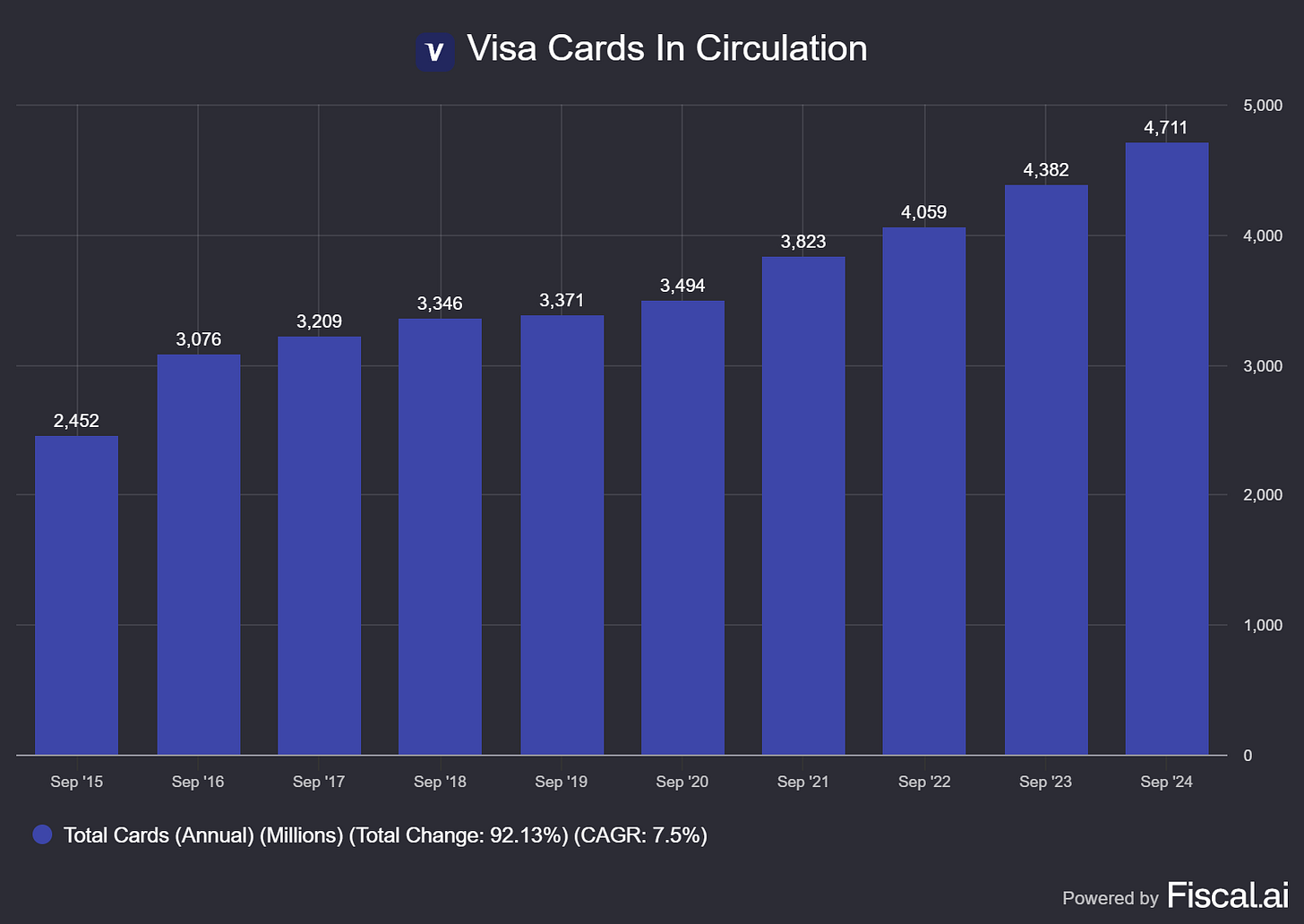

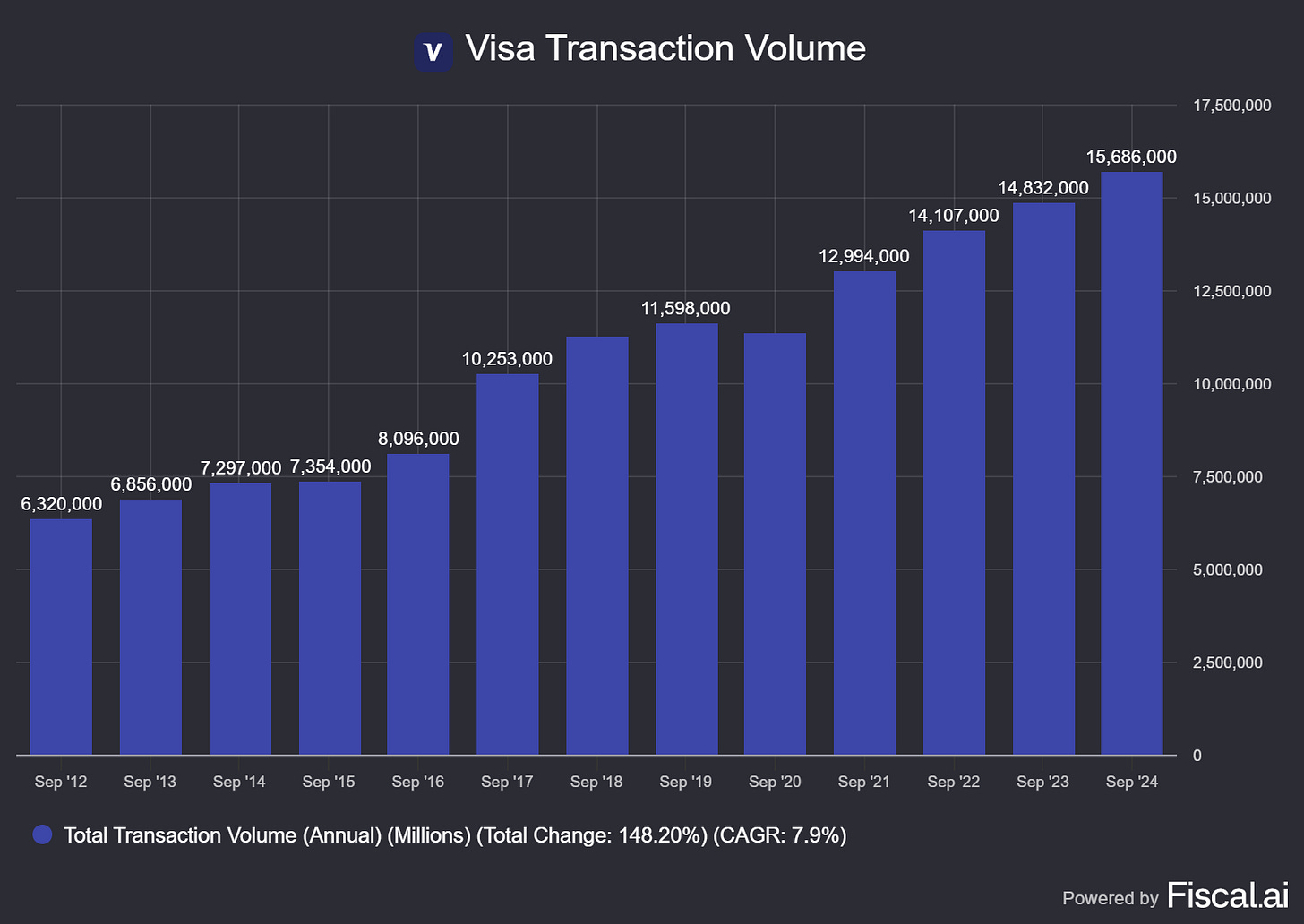

A lot of talk. Press releases. Partnerships. All the while, Visa’s cards in circulation and payment volume steadily climb.

I am still waiting patiently for cryptocurrency to actually improve on the existing financial system. Sunny days are just around the corner, I’m sure of it.

-Brett