YouTube

Spotify

Apple Podcasts

Can you hear that? Yes, that is the music slowly starting to turn back on. Mr. Market is officially out of his chair and ready to boogie.

I can confidently say the IPO market has begun to dance. Are we at the drugged-up raver levels of early 2021? Not a chance. It feels more like a folk concert at your local winery. A couple of people may be too inebriated and bumbling around like idiots, but most everyone is in a relaxed mood and having a good time.

We thought listeners would appreciate an update on some recent hot IPO stocks. It can be tough to track all these new entrants to the public markets (170 so far this year!), but I believe it is important for investors to keep tabs on these companies as they can develop into buying opportunities once the post lock-up stock dip eventually happens.

To do so, we brought on Tyler Crowe from Misfit Alpha to talk four IPO stocks. He covers these companies on a regular basis on his newsletter.

We decided to talk CoreWeave, Chime Financial, eToro Group, and Circle Internet Group for this episode.

Here is a link to Tyler’s newsletter:

And here is a link that gets you a discount on any paid plan specifically for Chit Chat Stocks readers and listeners.

I hope you enjoy this episode. Utilizing our friends at Fiscal.ai, here is one intriguing chart from each of these stocks.

CoreWeave

CoreWeave went from zero to over $8 billion in trailing capital expenditures. It plans to spend over $20 billion in 2025 to capture more of the AI cloud computing market.

I would be scared out of my mind to buy CoreWeave stock right now. If the AI spending trend stalls out, this company could be left out to dry. You cannot deny how fast it is growing and the massive $25 billion backlog, though.

Chime Financial

Chime’s active members have grown at a 22% annual rate since 2022. As one of the neo banking apps, it is convincing people to switch to its service for fast direct deposit, high interest rates on deposits, and convenient money transfers.

I’ll be curious to see if Chime eventually wants to get its own banking license similar to SoFi. It is on the right side of history when it comes to mobile-only banking, but I worry that it is a subscale player vs. SoFi, Ally Financial, Robinhood, etc.

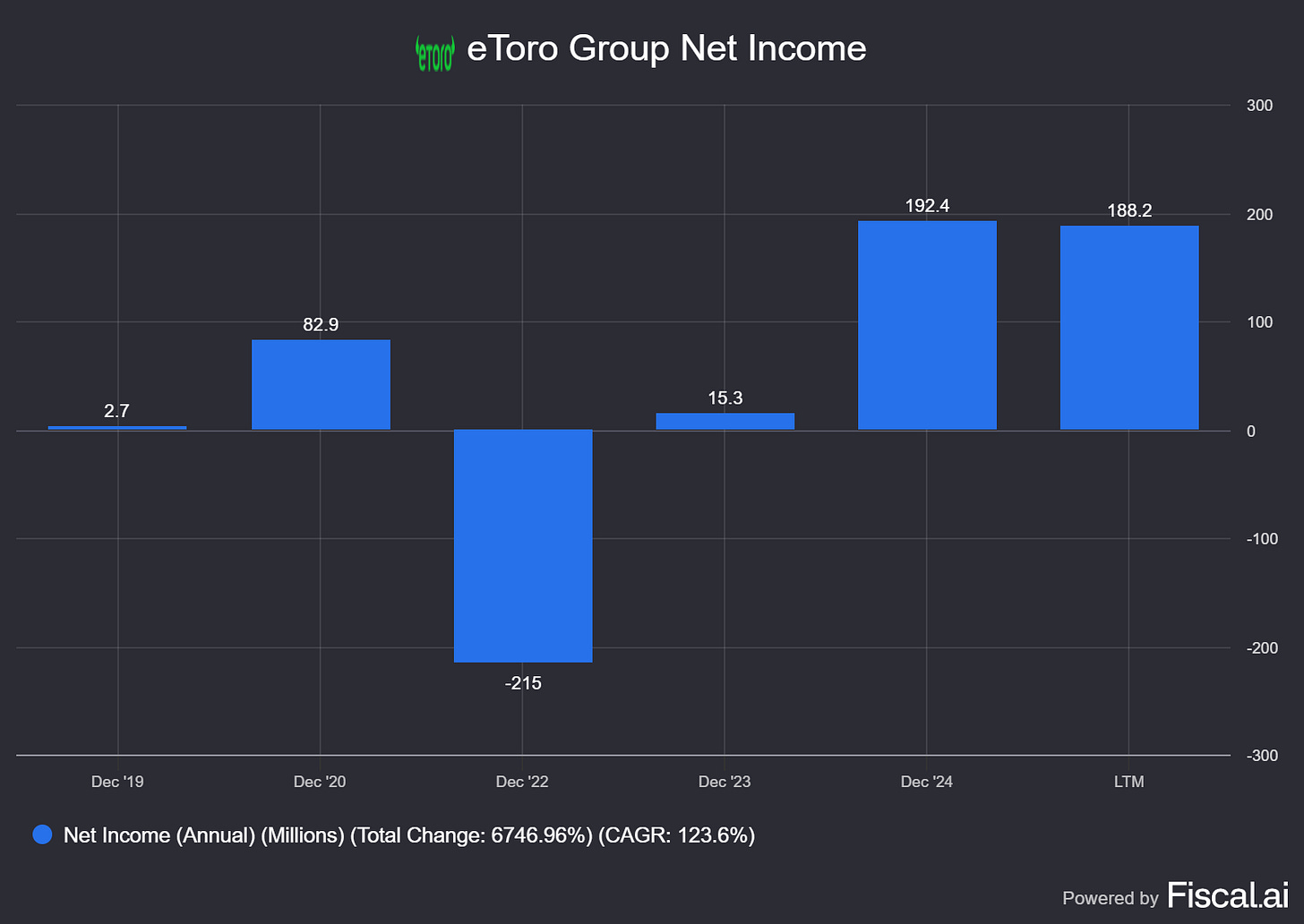

eToro Group

eToro serves as an investing brokerage and financial services application, focused on the European market.

It is now profitable per the chart above, with over 3.58 million active accounts. I like a brokerage that is taking market share a la Interactive Brokers because of the high switching costs for users. If management can run the business well, these 3.58 million users likely have high lifetime values.

Circle Internet Group

I think it is fascinating how much USDC was taken out of circulation in 2023. Circle is the largest stablecoin company that is operating within United States law, and people are excited about them.

Personally, the point of stablecoins escape me. I have yet to hear an argument for why it is any different than how I use regular US dollars today.

Still, it will be important to follow this company closely if you are interested in the financials/payments space. Maybe they gain rapid market share and disrupt the whole shebang. You don’t want to get caught flat-footed and willfully blind while it is happening.

If I was to rank my interest in these four businesses, I would choose:

eToro Group

CoreWeave

Chime Financial

Circle Internet Group

However, in all honesty, eToro is the only one that truly intrigues me. I will be keeping tabs on this company as it goes through its post-IPO process.

-Brett