YouTube

Spotify

Apple Podcasts

We had a fun time on this week’s Investing Power Hour podcast (links above) discussing whether we have entered “founder mode.” Give the Chit Chat Stocks podcast a follow if you haven’t already! It’s a good time and also informative (I hope).

Now, let’s discuss if we are fishing where the fish are.

This was an interesting tweet:

This pretty much describes my strategy. I want a management team I can trust, a reasonable price, and a wide moat. Of course, I want these three criteria to be as high as possible for each company, but they are different weighing factors.

For example, if the moat and management team are meh but the stock is at 3x cash flow and returns cash to shareholders, that is a better opportunity than a 30x low-growth wide moat stock with best-in-class management. Price matters.

Like Yannis, I do get worried that the wide moat strategy is crowded. Are we in the nifty fifty era? Are “compounders” about to go through a bear market?

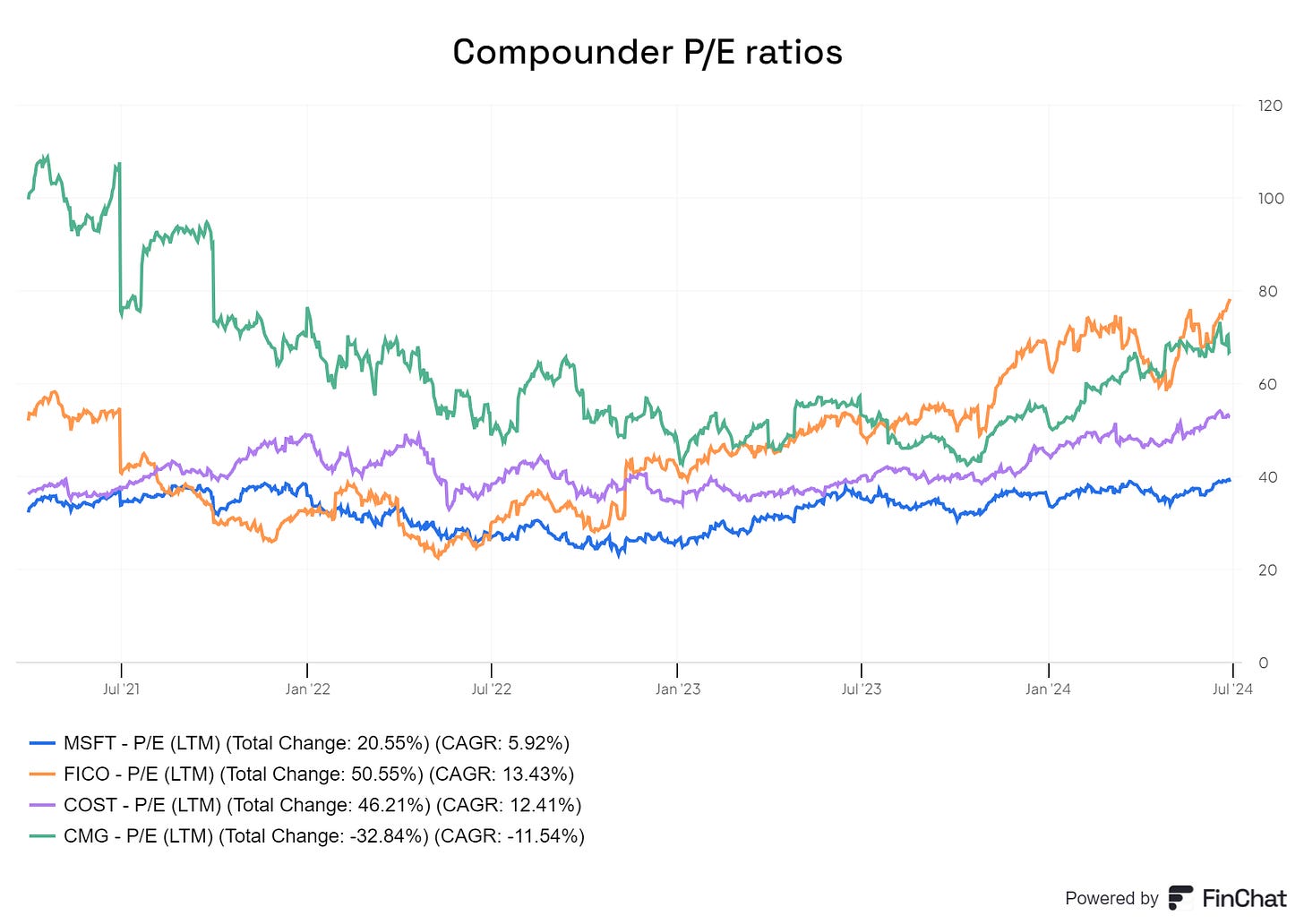

Perhaps. There are definitely some high-quality businesses I would be weary of buying today because they trade at 40x, 50x, or even 100x earnings.

(chart from our friends Finchat.io)

But just because some compounder stocks are overvalued today does not mean all of them are overvalued. You shouldn’t switch your entire strategy because Chipotle never trades below 40x earnings.

I would caution anyone trying to make a broad takeaway from the vibes you get from an online community like Twitter. On fintwit, you are curating your feed to like-minded individuals, and the algorithm reinforces things you are interested in. This is the well-known filter bubble phenomenon.

Don’t think anyone is interested in gold miners, deep value, or technical analysis? Pull up YouTube and do some exploring. I get constant ads from charlatans pumping their services on the channel. I’m sure a place like TikTok is similar.

There is also an easy way to answer the crowding-out question:

Are you finding compelling opportunities with this strategy?

If yes, then there are still fish to catch. If not, then flow to another strategy for a while. It’s simple. This is what the greats do who we have studied on the podcast.

I think we have plenty of opportunities in compounder land, though. However, opportunities are not going to look like opportunities for everyone else. That’s what makes it an opportunity.

Phillip Morris traded at an EV/EBIT of 15 earlier this year and can easily grow EPS at a 10% annual rate this decade. As the price has risen, more people have come around to the story (as it goes). If it rises a bit more, I would say it is almost a consensus compounder. It was clearly not earlier this year.

Was that not an opportunity in high-quality land?

“Empty your mind, be formless. Shapeless, like water. If you put water into a cup, it becomes the cup. You put water into a bottle and it becomes the bottle. You put it in a teapot, it becomes the teapot. Now, water can flow or it can crash. Be water, my friend.”

- Bruce Lee

Bruce is saying you should go to where the investment opportunities are. I still see plenty of opportunities in high-quality land right now. So why should I change my strategy?

Brett

Chit Chat stocks is presented by:

Public.com has just launched its BOND ACCOUNT. Lock-in interest rates of 6.9% (as of 8/28/24) through 2028 right before the Federal Reserve is set to lower interest rates!

With as little as $1,000, the bond account allows you to buy a diversified portfolio of bonds and lock in your yield even if the Federal Reserve cuts rates.

It only takes a couple of minutes, get started today at Public.com/chitchatstocks and open up a bond fund today!

A Bond Account is a self-directed brokerage account with Public Investing, member FINRA/SIPC. Deposits into this account are used to purchase 10 investment-grade and high-yield bonds. The 6.9% yield is the average annualized yield to maturity (YTM) across all ten bonds in the Bond Account, before fees, as of 8/28/2024. A bond’s yield is a function of its market price, which can fluctuate; therefore a bond’s YTM is “locked in” when the bond is purchased. Your yield at time of purchase may be different from the yield shown here. The “locked in” YTM is not guaranteed; you may receive less than the YTM of the bonds in the Bond Account if you sell any of the bonds before maturity, or if the issuer calls or defaults on the bond. Public Investing charges a markup on each bond trade. See our Fee Schedule.

Bond Accounts are not recommendations of individual bonds or default allocations. The bonds in the Bond Account have not been selected based on your needs or risk profile. You should evaluate each bond before investing in a Bond Account. The bonds in your Bond Account will not be rebalanced and allocations will not be updated, except for Corporate Actions.

Fractional Bonds also carry additional risks including that they are only available on Public and cannot be transferred to other brokerages. Read more about the risks associated with fixed income and fractional bonds. See Bond Account Disclosures to learn more.

A very thought provoking post!

I recommend removing the words "moat" and "mission critical" from one's investing process. There are no real moats and nothing is mission critical (aka everything is replaceable). Investors get complacent with their stocks when these terms are applied to them and then they are surprised when the company's business goes down because customers are buying less. e.g. SNOW, MDB, ZS to name a few. Cheers!

I like big moats, and I cannot lie…