Grupo Aeroportuario del Centro Norte: Stay Patient, an Inflection Is Coming (Ticker: OMAB)

Full year 2024 review

YouTube

Spotify

Apple Podcasts

A long but straightforward title on this one. If you want to hear us discuss Celsius, Portillo’s, and Coupang, listen to the podcast at the links above.

Now, let’s talk about Grupo Aeroportuario del Centro Norte’s (OMAB) Q4 results.

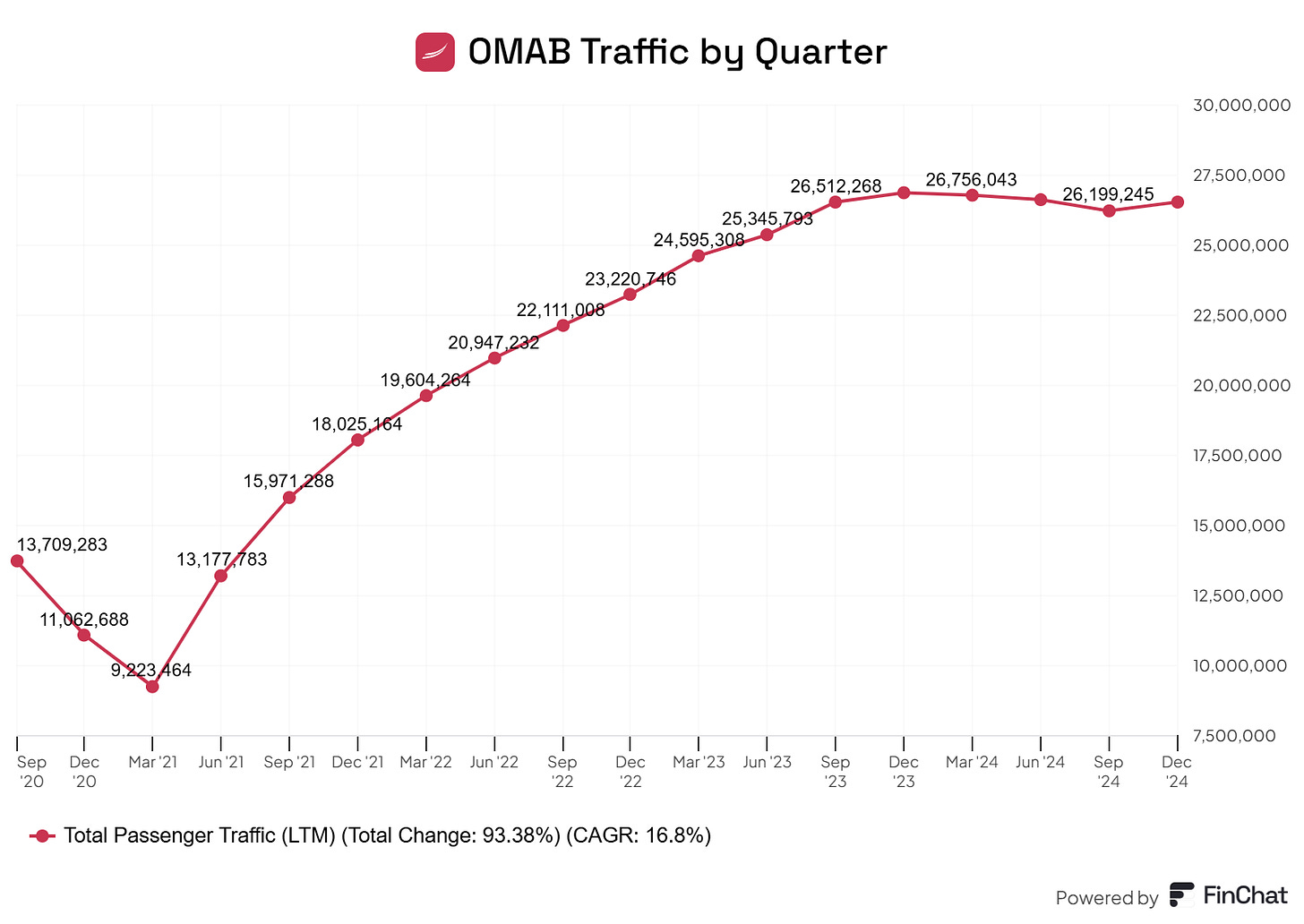

You may recall from my stock report on OMAB that traffic is the one metric we care about:

Traffic growth means more fees charged to airlines visiting and leaving its airports. More people in the airports means more commercial revenue. Higher traffic forecasts can mean a more aggressive upcoming master development plan (MDP) with the Mexican government.

At the end of the day, traffic growth is all that matters. Everything financially for OMAB flows from more passengers visiting its airports.

In Q4 of 2024, passenger traffic grew 4.6% year-over-year to 7.1 million. This is an acceleration in growth from the beginning of the year as more routes open up with the Pratt & Whitney engine beginning to end.

Aeronautical revenue grew 11.1% in the quarter, outpacing traffic growth. Commercial revenue grew even faster, up 21.7% year-over-year. Generally, revenue is going to grow slightly faster than traffic growth.

As discussed in detail in the stock report podcast, OMAB is negotiating its new MDP this year. It will become operational in 2026. In all likelihood, this will lead to a step-change in the fees OMAB can charge on flights to its airport, which will lead to a step-change in revenue.

Combine this with growing traffic and we will get a huge boost to revenue in 2026. Over the next five years, we could see a doubling of revenue for OMAB. If it falls short of that, we still make money of course.

Two quotes stood out to me on the earnings call.

First:

“On the capital expenditure front, in 2024, we continued to invest in our long-term infrastructure development, particularly at the Monterrey Airport. During the year, we inaugurated the East Public Area expansion of Terminal A, adding over 6,000 square meters of new facilities, including additional check-in counters, commercial spaces, and airport services, This expansion, combined with the previous developments at the airport, has substantially increased passenger capacity, now reaching almost 14 million passengers per year. These efforts further reinforce Monterrey’s position as a leading hub in Northern Mexico and ensures its readiness for future growth. Looking ahead, we continue advancing with Phase 2 of the Monterrey Airport expansion project. This next stage focuses on significantly expanding airside areas of Terminal A. Once completed, this project would optimize passenger flows, enhance commercial offers and services and further increase the airport’s capacity to almost 16 million passengers annually. The new areas are expected to be operational in early 2026.”

Monterrey airport did 13.5 million passengers in 2024, about half of OMAB’s overall traffic. This should grow to 16 million in 2026, right when the new MDP will be implemented.

Management wants to position Monterrey as the big hub of Northern Mexico. With traffic to Mexico City stuck at current levels, we should see more and more routes bypass Mexico City and go straight to Monterrey.

Second quote:

“For full year, we are expecting around mid-single-digit growth year-over-year. And regarding the Monterrey network, we believe that there is plenty of opportunity to continue developing it. We’re just positioning it as a connecting hub. A lot of the routes Ricardo mentioned during his opening remarks were opened in the second half of last year and they have still to mature. So I believe that going forward, Monterrey will continue to consolidate as a major connecting hub in Northern Mexico.”

While it won’t be as explosive as 2026, OMAB’s traffic is slated to grow in 2025.

Valuation work

According to our friends at Finchat, OMAB currently has a market cap of 73 billion Mexican Pesos. As of the Q4 release, it has net debt of approximately 10 billion Pesos. So let’s assume an enterprise value of 83 billion.

In 2024 — a down year for traffic, two years before a revised MDP — OMAB generated 8 billion Pesos in operating income.

OMAB is trading at around 10x trailing earnings, or a 10% earnings yield. This earnings yield could rise to 15% in 2026. Management’s policy is to pay out most of its cash flow out as a dividend. I think we can get a good chunk of the market cap back in cash within five years.

Traffic growth is already accelerating, up 10% year-over-year in January.

As for me, I like the stock.

-Brett

Chit Chat stocks is presented by:

Public.com has just launched its BOND ACCOUNT. Lock-in interest rates of 6% or higher (as of 9/30/24) by signing up today!

With as little as $1,000, the bond account allows you to buy a diversified portfolio of bonds and lock in your yield even if the Federal Reserve cuts rates.

It only takes a couple of minutes, get started today at Public.com/chitchatstocks and open up a bond fund today!

A Bond Account is a self-directed brokerage account with Public Investing, member FINRA/SIPC. Deposits into this account are used to purchase 10 investment-grade and high-yield bonds. As of 9/26/24, the average, annualized yield to worst (YTW) across the Bond Account is greater than 6%. A bond’s yield is a function of its market price, which can fluctuate; therefore, a bond’s YTW is not “locked in” until the bond is purchased, and your yield at time of purchase may be different from the yield shown here. The “locked in” YTW is not guaranteed; you may receive less than the YTW of the bonds in the Bond Account if you sell any of the bonds before maturity or if the issuer defaults on the bond. Public Investing charges a markup on each bond trade. See our Fee Schedule. Bond Accounts are not recommendations of individual bonds or default allocations. The bonds in the Bond Account have not been selected based on your needs or risk profile. See https://public.com/disclosures/bond-account to learn more.

![[PODCAST] I Bought The Highest Quality Stock In Mexico (And It Trades At 10x Earnings)](https://substackcdn.com/image/youtube/w_728,c_limit/j7JwL8DoWhM)

Love this company. I think there’s so much to like.

However, not a position for me because I don’t think it’s got the high growth potential or the quality of a core stock like AMZN GOOG. It’s nice diversification away from the US though and I think has some great potential