Grupo Aeroportuario Centro Norte: I Bought The Highest Quality Stock In Mexico (Ticker: OMAB)

.

YouTube

Spotify

Apple Podcasts

Look, you get it by now: I like Mexican stocks. The economy is set to rip and you can scoop up some beneficiaries trading at 10x earnings.

Wait, what about Trump tariffs and cartels? Are you telling me these gangs don’t actually run the country?

I have recently purchased shares of Grupo Aeroportuario del Centro Norte (ticker: OMAB) for my retirement portfolio.

I outline my thesis on the stock in the podcast released this morning (links above). Here are my detailed show notes from the episode.

Today, we are talking Grupo Aeropuertario del Centro Norte, or OMAB for short. It has the ticker OMAB on both the US and Mexican stock exchanges, investing in either will get you a stake in the company. Shout out to Ian Bezek from Ian’s Insider Corner for putting the name out there.

So why OMAB in my portfolio? Why have I started to build a position? Because it is a monopoly trading at 10x free cash flow, should grow earnings at a double-digit rate for the next decade, and consistently returns cash back to shareholders.

Below, you will find a detailed research report on OMAB. Let’s go through its business model, relationship to the government, growth prospects, and valuation.

How was OMAB formed, and what do they own?

In 1998 the Mexican government opened up its airports for private investment. We investors should be ever grateful. We have the opportunity to invest in a government-sanctioned monopoly that looks like it is well on its way to 100 bagging (it is already a 15 bagger since going public in 2006).

In 2006, the Mexican government sold around half of its stock to investors and listed the stock on the United States and Mexican stock markets (the money went to the Mexican government, which is why they did it).

OMAB operates 13 airports that we can separate into categories:

Major hub: Monterrey (half of traffic)

Tourist hubs (Zihuatanejo, Acapulco, Mazatlan)

Seven smaller cities in the north of the country

Two border towns (Juarez and Reynosa)

Since 2006, OMAB has focused on growing its volumes, commercial sales, and any sort of profits it can make from adjacencies to airports. Shareholders have appreciated a 16.8% annual total return since 2006, making it one of the best-performing stocks of the last two decades:

Relationship with government, MDP, and long-term operation contract

OMAB doesn’t actually own these airports. They have a contract with the Mexican government to manage them until 2048.

More details from the annual report:

“Pursuant to the Mexican National Assets Law, all real estate and fixtures in our airports are owned by the Mexican government. Each of our concessions is scheduled to terminate in 2048, although each concession may be extended one or more times for up to an aggregate of an additional 50 years. The option to extend a concession is subject to our acceptance of any changes to such concession that may be imposed by the Ministry of Infrastructure, Communications and Transportation and our compliance with the terms of our current concessions. Upon expiration of our concessions, these assets automatically revert to the Mexican government, including improvements we may have made during the terms of the concessions, free and clear of any liens and/or encumbrances, and we will be required to indemnify the Mexican government for damages to these assets, including any improvements thereon, except for those caused by normal wear and tear”

The key points:

The existing operating contract goes until 2048

The contract can be renewed for another 50 years

I see this as no reason to stay out of the stock. The Mexican airports grease the wheels of the Mexican economy and have been doing a great job (unlike the Mexico City airport, which is run by the Mexican Navy for some reason?). They make the government a lot of money. Why change what has been working well?

Look, there is a nonzero chance the contract will not get renewed in 2048, but it is still a low number. And even if that happens, we still make money. There is a chance that Apple will be a zero in 2048, a lot can happen in 25 years. If this is the biggest risk facing the terminal value of the business, I am happy to take that risk.

The second thing investors need to understand is the cycle of the master development program (MDP). Every five years, OMAB is required to submit an MDP to the Mexican government. An MDP outlines traffic forecasts, capital expenditure plans, and maintenance for the following 15 years.

Once the MDP Is finalized, OMAB is given the right to raise its fees charged at the airports for plane traffic. Like a regulated utility, the more OMAB invests in an airport, the more it is able to earn in fees. The Mexican government enjoys this because it can earn more in taxes and has airports that are run well (unlike Mexico City).

Looking at the 2023 annual report, OMAB has invested and is slated to invest a total of 15 billion Mexican Pesos (about $750 million USD) into its airports from 2021 - 2025.

The new MDP will come into effect in 2026, which OMAB management will negotiate and finalize this year. What has happened in the last five years? Inflation. We should see this take into effect with price increases on the slotting fees for planes.

We can already see this with the Pacifico Airports company, which just negotiated its updated MDP for 2025 - 2029. It saw huge increases in its slotting fees.

More specifics from the press release:

“The maximum tariffs per workload unit for each airport were determined by the AFAC, based on projections for traffic, operating costs, and capital investments included in the Master Development Program, as well as the Reference Values and discount rate, following the parameters established in Annex 7 of the Concession Agreements, that contain the Rules for Tariff Regulation in force since October 19, 2023”

So, the revenues that OMAB’s brethren got were determined by traffic projections and increasing operating costs and capital investments.

I would guess OMAB’s take rate will grow with the new MDP. This tells me we need to answer one fundamental question about OMAB:

Will passenger traffic increase over the next five years?

If so, earnings will rise.

Business model: how exactly does an airport make money?

After understanding the government concession and MDP agreements, the business model for OMAB makes a lot more sense.

Here is a snippet from the annual report:

“As operator of the 13 airports under our concessions, we charge fees to airlines, passengers and other users for the use of the airports’ facilities. We also derive rental and other income from commercial and diversification activities conducted at our airports, such as the leasing of space to restaurants and retailers, the operation of parking facilities, the operation of the OMA Carga business, the Terminal 2 NH Collection Hotel and the Hilton Garden Inn Hotel at the Monterrey airport, among others.”

OMAB makes money when a plane uses its airport (aeronautical revenues), when a retailer like Duty Free rents space in the terminal (commercial revenue), and then some adjacent businesses like cargo holding and a hotel.

Let me note that there is technically another revenue line called “construction revenue.” However, these are just the cost of improvements to concessioned assets and are equaled out to costs on the income statement. They will not generate a profit, but I think are put in to outline exactly what was spent on construction improvements in the period.

On another note, international revenue is collected in U.S. dollars:

“International passenger charges are currently U.S. dollar-denominated but are collected in pesos based on the average exchange rate during the month prior to the flight, and the value of our revenues from those charges is therefore affected by fluctuations in the value of the U.S. dollar as compared to the peso.”

Again, this all comes down to increasing traffic to the airports. If you get more passengers, you get more fees paid by the airlines for departures. If you get more people in your airport, you get more commercial revenue.

Here is what segment revenue looks like for OMAB going back to 2012:

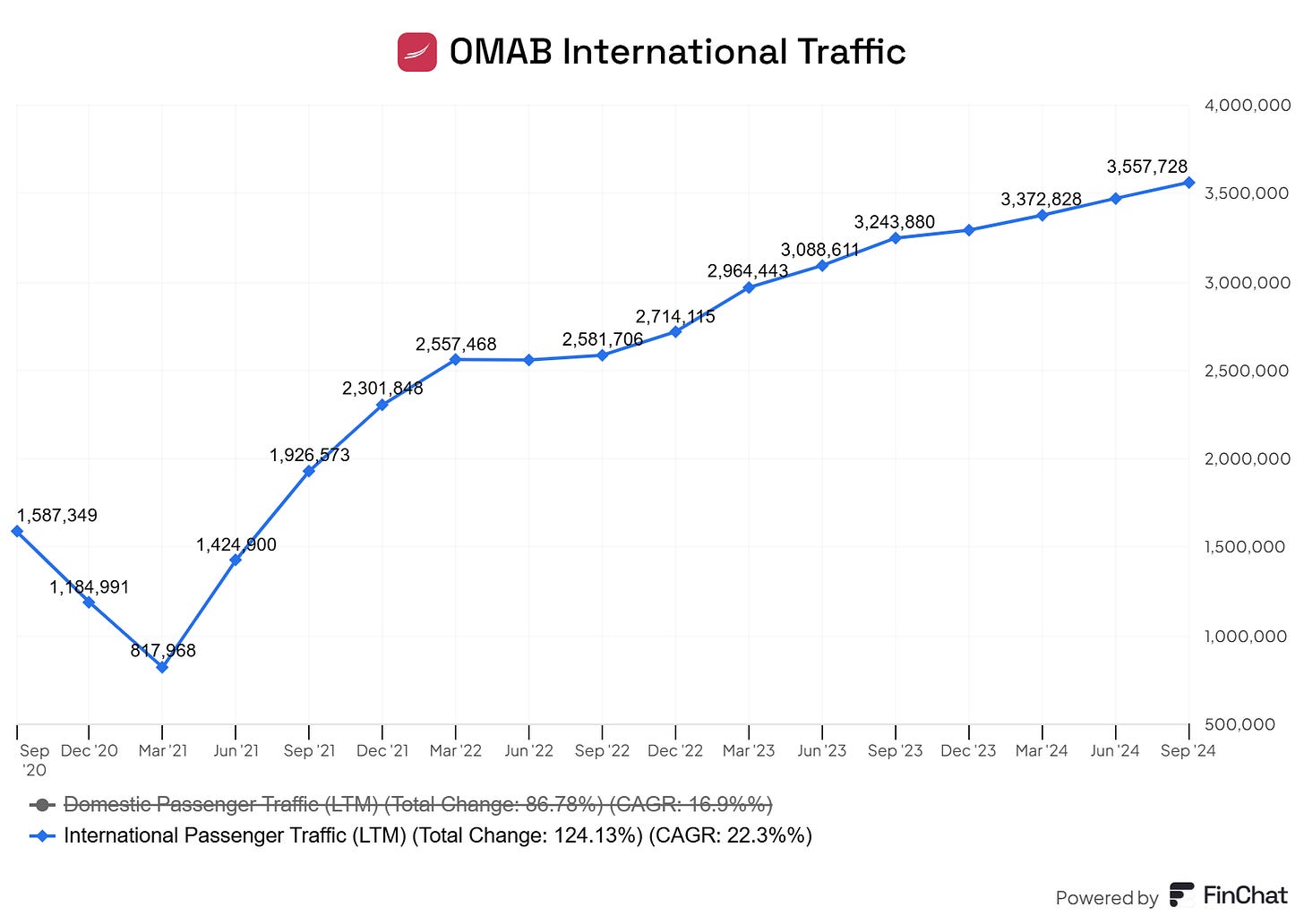

Both have grown at around 13% per year in Mexican pesos. Not bad. However, I would expect non-aeronautical revenues to grow faster once Monterrey becomes a hub (more on that later) and a step change to adjust for inflation with the new MDP. This should mean revenue grows much faster than traffic growth in the coming years.

What about costs? As we mentioned above, the construction costs are excluded by negating them with construction revenue. This creates a little bit of confusion when looking at the profitability of OMAB.

In 2023, OMAB generated 14.46 billion Pesos in revenue and generated 8.1 billion Pesos in income from operations, or a 56% operating margin. However, if we exclude the construction revenue/costs, operating margin rises to 70%.

Regardless, this is a highly profitable business that is able to generate profits well in excess of its maintenance, operational, and overhead costs. This also includes the concession tax paid to the government.

I will be watching closely to see if the new MDP or any amendments lead to lower profit margins, but OMAB was able to maintain a 70% operating margin during a period of higher inflation, engine slowdowns affecting volumes, and the government amending the MDP to cut the extra fees earned during COVID. I think we can expect them to continue earning a 70% operating margin at a much larger scale in the coming years.

An easy-to-understand competitive advantage: guaranteed high ROIC?

A great business is one that can easily raise prices in the face of inflation, face no customer pushback, and maintain a good return on invested capital (ROIC). Oh, and it would be nice if it had no competition.

This is OMAB (and the Mexican airports) in a nutshell. The government has gifted them a monopoly business in the form of airports, and we have the chance to go along for the ride. Customers do not have much choice when it comes to which airport to fly to (as opposed to the airline they fly, which is hypercompetitive).

The government contracts explicitly protect them from inflation! It is truly a beautiful situation.

OMAB has a strong ROIC of above 20%. Take a close look at this chart. Even during 2020, the company had a positive ROIC. During the worst headwind perhaps in its history the company still generated a profit.

I call that a good business.

The question remains: How much incremental capital can be invested into OMAB? A lot. We will be covering the growth potential at OMAB and then modeling its financials in the last sections of this report.

Mexico City mismanagement, engine/volume issues

There are multiple reasons to believe OMAB can invest a lot of incremental capital (relative to its size) while simultaneously seeing traffic growth in the years ahead.

Mexico City’s airport is at full capacity. In fact, the government recently knocked its takeoffs per hour from 52 down to 43. I was a part of this mess once, seeing in person how overcrowded the airport was. The AMLO government canceled a new airport because of environmental reasons, so now the city is stuck.

Again, there are going to be no new net routes in Mexico City anytime soon. Where will new routes form? I would guess in Guadalajara and Monterrey, the two largest metros besides Mexico City in the country. OMAB operates the Monterrey airport.

Mismanagement at Mexico City will be Monterrey’s gain. Last quarter, direct flights from Tokyo and Seoul were added for AeroMexico. More airlines will be skipping the hassle at Mexico City and flying directly to Monterrey (which means more money for OMAB). I will say that again: you can fly directly from Tokyo to Monterrey! This isn’t a small town in Northern Mexico.

Another reason traffic will benefit is the relieving of a recent headwind: the Pratt & Whitney engine recalls. These recalls hit some of the discount Mexican airlines hard, which has meant stagnate traffic growth for domestic passengers in 2024.

International passengers have grown and I expect them to continue growing. However, in the next few years, domestic passengers should bounce back once supply unlocks. Combined with a new MDP agreement, revenue growth should accelerate nicely for OMAB.

Betting on Mexico and specifically the city of Monterrey

Long-term, a bet on OMAB is a bet on the continued growth of air traffic in the country of Mexico. This will come from continued tourism and economic growth in the country. You either have rich foreigners flying into your country or a rising amount of your own citizens flying around the country.

International travel to Mexico will likely grow unabated in the years to come. It is centrally located to the United States (as well as other countries), has a ton of capacity for tourism across many different regions, and already has tourism infrastructure built up. Why would growth stop now?

My bet is that the rising Mexican middle class will accelerate domestic passenger growth for OMAB over the next 5 - 10 years, making it more important to the thesis.

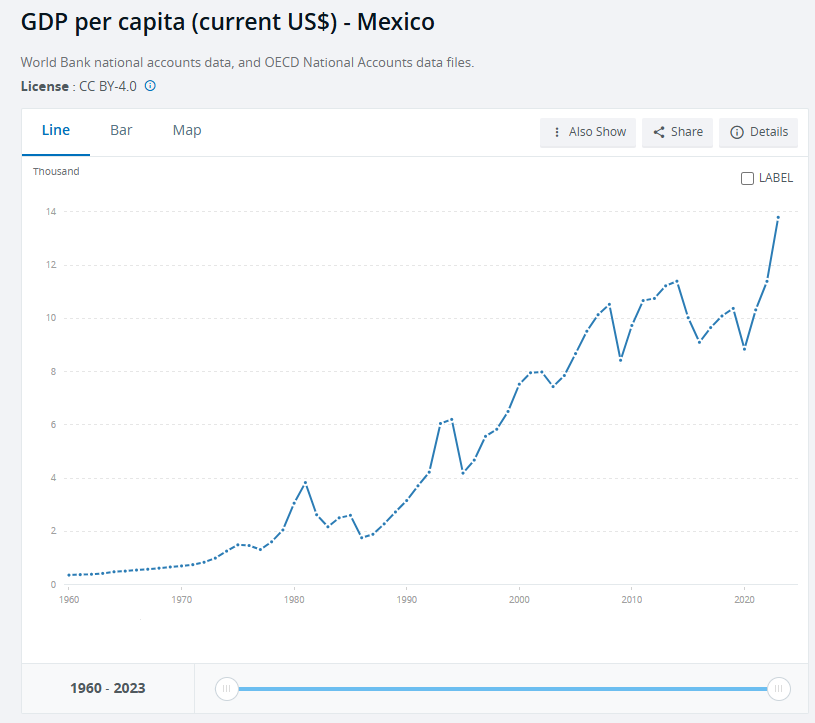

The reshoring boom has arrived in Mexico in full force. Companies from the likes of Amazon, Foxconn, and plenty of less famous names are planting their flags in Mexico to invest in manufacturing/industrial capacity. In turn, this means Mexican workers are earning higher wages:

GDP per Capita is soaring:

Mexico is on the verge of breaking out of the middle-income trap and launching its GDP per Capita out of the $10k band it has been in for decades.

Where is a lot of this manufacturing centered? Monterrey. What I like to call the new Detroit, it has a population of 5.3 million people, is close to the Texas border, and is the bedrock of the wealthiest Mexican state.

More companies putting operations in Monterrey means more business travel from inbound flights. More manufacturing means more citizens in Monterrey with higher wages.

What will they do with these higher wages?

Fly on vacations to tourist spots across the country. It costs around $100 - $150 for a roundtrip flight from Monterrey to Cabo, Puerto Vallarta, or Cancun. As the citizens of Monterrey get richer (which they are), there will be more demand for flights out of the Monterrey airport, which will increase passenger volumes for OMAB.

Modeling OMAB’s financials

It is easy to value OMAB stock. Management generally takes all of its excess cash flow and returns it to shareholders in dividends.

I plan on valuing the stock by estimating how much in dividends I can get back over the next five and ten years. If we wanted to be more precise, we could target out to 2048 when the contract ends, but listeners will get the picture.

Today, OMAB trades at around $200 a share (the Mexican listing). From 2016 - 2024, the company returned around $58 (in pesos) in dividends cumulatively to shareholders. That is with a pandemic in the middle of things, remember.

In late 2016 you could get OMAB at around $90 a share. Investors have already gotten close to the entire market cap back in dividends since then.

Free cash flow per share has grown at a 15.6% annual clip since 2014. This is with the pandemic throwing a wrench into things and the current supply shortage for Pratt & Whitney engines depressing earnings.

For the reasons outlined above (new MDP agreement accounting for inflation, growth at Monterrey, reshoring, Mexico City mismanagement, and alleviating of engine shortage) I think OMAB can grow its free cash flow per share at at least 15% per year for the next five years.

This should give it plenty of firepower to grow its dividend payouts to shareholders. Given that management takes most of its cash flow and pays out dividends to shareholders, I think that OMAB can return around $75 in dividends over the next five years.

Over the next 10 years, I believe we can get $200 in dividends paid out to shareholders. After that, the rest is gravy.

In five years, we could see OMAB paying out $20 a share in dividends per year, or a 10% yield compared to the current price. Do you think the stock would be higher then? I think so.

What I am trying to get at is that this is a low risk investment with a lot of upside. That is the situation I want to play in, and why I am confident betting on OMAB at a full position in my portfolio.

Why the stock is dirt cheap today and risks to the thesis

OMAB stock is cheap at the moment due to the Pratt & Whitney engine supply shortage and the concerns around the new Trump administration’s combative approach against Mexico.

I am not concerned with either. The engine shortage will end soon, and even if the Trump administration slaps on tariffs, they will only last a few years. The incentives for both Mexico and the US are to work together, as they can get much richer by using each other’s strengths. I think it is possible that the US decouples from Mexico, but unlikely. China and other places are the true decoupling targets (and it has already happened and benefitted Mexico over the last decade).

Over the long-term, the risk to the thesis is that Mexican foreign tourism stops growing and the Mexican consumer stops getting richer. While it is possible we hit a saturation on tourism, I like both to grow over the long term. And if they don’t, we probably still make money with a slow-to-no growth company at these valuations.

-Brett

Chit Chat stocks is presented by:

Public.com has just launched its BOND ACCOUNT. Lock-in interest rates of 6% or higher (as of 9/30/24) by signing up today!

With as little as $1,000, the bond account allows you to buy a diversified portfolio of bonds and lock in your yield even if the Federal Reserve cuts rates.

It only takes a couple of minutes, get started today at Public.com/chitchatstocks and open up a bond fund today!

A Bond Account is a self-directed brokerage account with Public Investing, member FINRA/SIPC. Deposits into this account are used to purchase 10 investment-grade and high-yield bonds. As of 9/26/24, the average, annualized yield to worst (YTW) across the Bond Account is greater than 6%. A bond’s yield is a function of its market price, which can fluctuate; therefore, a bond’s YTW is not “locked in” until the bond is purchased, and your yield at time of purchase may be different from the yield shown here. The “locked in” YTW is not guaranteed; you may receive less than the YTW of the bonds in the Bond Account if you sell any of the bonds before maturity or if the issuer defaults on the bond. Public Investing charges a markup on each bond trade. See our Fee Schedule. Bond Accounts are not recommendations of individual bonds or default allocations. The bonds in the Bond Account have not been selected based on your needs or risk profile. See https://public.com/disclosures/bond-account to learn more.

Great episode, I’m thinking about this one. Any concerns with tariffs?

Thanks for the insightful write-up. Very helpful.

Can you explain what happened in October of 2023 when the stock lost 50% of its value? thank you.