Recession Indicators: September 2024

Don't bet explicitly on a recession. Prepare for how you will allocate your portfolio if one occurs

YouTube

Spotify

Apple Podcasts

We discuss this topic on last week’s Power Hour. For those who don’t know, we record these live on YouTube every Wednesday at 1:30 PM EST. Follow our show on YouTube, Spotify, or Apple Podcasts to never miss an episode.

Recession indicators seem to be increasing. I even heard it discussed on the latest Focused Compounding podcast. They are super sharp and I respect what they have to say.

Here is what I had to say earlier this year about current calls for a recession:

Does that mean a recession won’t happen in the next twelve months? No. It is possible one might occur. I would never take a hard stance that a recession will not occur within any 2 - 3 year period. There are just too many variables at play.

But don’t let anyone who was banging the drum for a recession back in 2022 tell you they “called it” if one occurs in late 2024 or 2025.

I still stand by this take. I have zero respect for the opinion of people who have been bearish every quarter for the last 15 years (yes, those people exist).

But we are seeing some signs that the economy weakened in late summer of 2024.

For example, Ally Financial said that delinquencies for its consumer automotive loans rose by 10 - 20 basis points above their expectations in July and August. While not a huge trend, this is concerning for the health of consumer spending. Car loans are some of the first things people pay off each month. If you can’t pay back your car loan,

Or, perhaps there were just some bad loans made by the automotive lenders in 2022:

(link is a TikTok Investors Twitter video of an absurd auto loan customer)

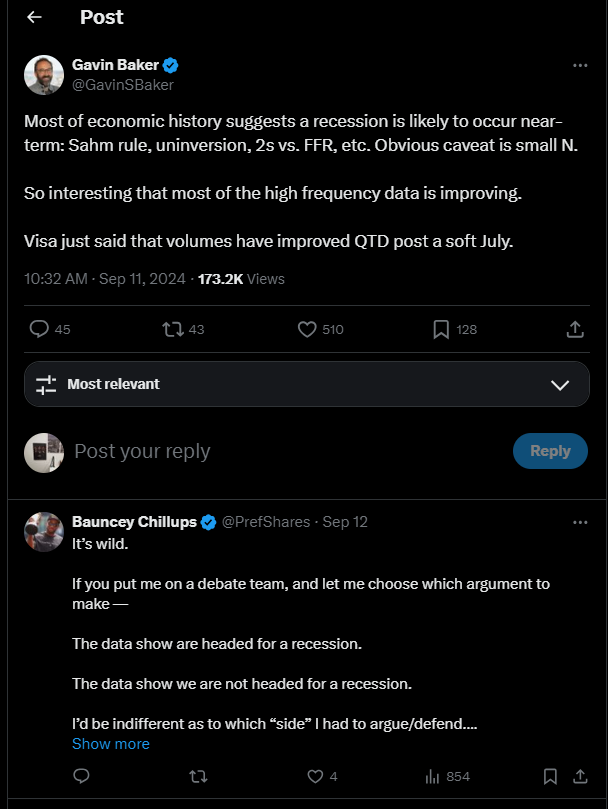

The data is very conflicting:

I would not take a hard stance either way.

But you know what I AM doing? Researching stocks I would want to own if they tanked during a recession. You need to prepare before a recession and/or stock market crash occurs. The opportunities can come and go quickly with a lot of emotions at play.

My list includes the likes of Ally Financial. A stock that remains on the watchlist but has now moved up my ranking of potential additions after dropping 20% on this recent update.

We have talked about them on the podcast before:

I would recommend looking at the TSOH Investment Research Service for premium research on Ally Financial:

Other quality stocks I have on my “would buy during a recession” watchlist include Airbnb, Adyen, American Express, and Visa. All are inflation-protected and high-quality network effects (Adyen I guess isn’t too much of a network effect but has a different moat).

If we get into a deflationary recession and these stocks tank, I would love to fade Mr. Market. Not sure if it will happen anytime soon, but I will be keeping tabs on the four companies in case they get cheap.

I think any reader is in the same position as me. You have a bunch of stocks you’d love to own if they get cheaper. I mean, the S&P 500 is about to hit a P/E of 30. There ain’t much out there. A deflationary recession is an obvious catalyst for that changing.

Make preparations now — not after stocks have fallen 30% — in case it does.

-Brett

Chit Chat stocks is presented by:

Public.com has just launched its BOND ACCOUNT. Lock-in interest rates of 6.9% (as of 8/28/24) through 2028 right before the Federal Reserve is set to lower interest rates!

With as little as $1,000, the bond account allows you to buy a diversified portfolio of bonds and lock in your yield even if the Federal Reserve cuts rates.

It only takes a couple of minutes, get started today at Public.com/chitchatstocks and open up a bond fund today!

A Bond Account is a self-directed brokerage account with Public Investing, member FINRA/SIPC. Deposits into this account are used to purchase 10 investment-grade and high-yield bonds. The 6.9% yield is the average annualized yield to maturity (YTM) across all ten bonds in the Bond Account, before fees, as of 8/28/2024. A bond’s yield is a function of its market price, which can fluctuate; therefore a bond’s YTM is “locked in” when the bond is purchased. Your yield at time of purchase may be different from the yield shown here. The “locked in” YTM is not guaranteed; you may receive less than the YTM of the bonds in the Bond Account if you sell any of the bonds before maturity, or if the issuer calls or defaults on the bond. Public Investing charges a markup on each bond trade. See our Fee Schedule.

Bond Accounts are not recommendations of individual bonds or default allocations. The bonds in the Bond Account have not been selected based on your needs or risk profile. You should evaluate each bond before investing in a Bond Account. The bonds in your Bond Account will not be rebalanced and allocations will not be updated, except for Corporate Actions.

Fractional Bonds also carry additional risks including that they are only available on Public and cannot be transferred to other brokerages. Read more about the risks associated with fixed income and fractional bonds. See Bond Account Disclosures to learn more.

Thanks for the shoutout guys!