YouTube

Spotify

Apple Podcasts

“Now this is not the end. It is not even the beginning of the end. But it is, perhaps, the end of the beginning.” - Winston Churchill

The Dollar Index keeps sliding. Whether this was the intent of the current administration or due to foreign countries dumping their dollars (or both), the result is the same.

I cannot tell you what this chart will do over the next three months. But I believe over the next three years, the major entities that can influence its value will drive it lower.

Foreign holders will dump dollars as a safe haven if the U.S. government keeps getting into trade wars with them. Investors will swap dollars because they fear U.S. hegemony is over. The U.S. government wants a weaker dollar to make manufacturing cheaper in America.

Look, are we macro forecasters? No. I would leave that to the wonderful newsletters that write about this topic in much more detail, such as Citrini Research:

However, all year, it has been obvious that incentives call for a lower dollar. Just listen to what the people in power are saying they will do.

Today, I think we are near the end of the beginning of this move. Predicting what the Trump administration will do on a day-to-day basis is futile, as one may get perplexed at what inspires a dog to start barking when you take it for a walk.

Over the next four years, the one constant should be a weakening dollar. This is what the Trump administration wants. It is what tariffs and trade wars will inspire asset holders to do (Get their eggs out of the USA basket).

As Li Lu says, I want to grow my purchasing power in the country I reside and spend money in. That is US dollars.

If I have high conviction that the US dollar will keep declining, the trade is simple: diversify outside of the United States. Forget the Nasdaq 100 clones and Magnificent Seven portfolios. Stop with these slow-growth “stalwarts” like Wal-Mart trading at a P/E of 38.

The Mexican airport stocks are back near all-time highs in US dollar terms:

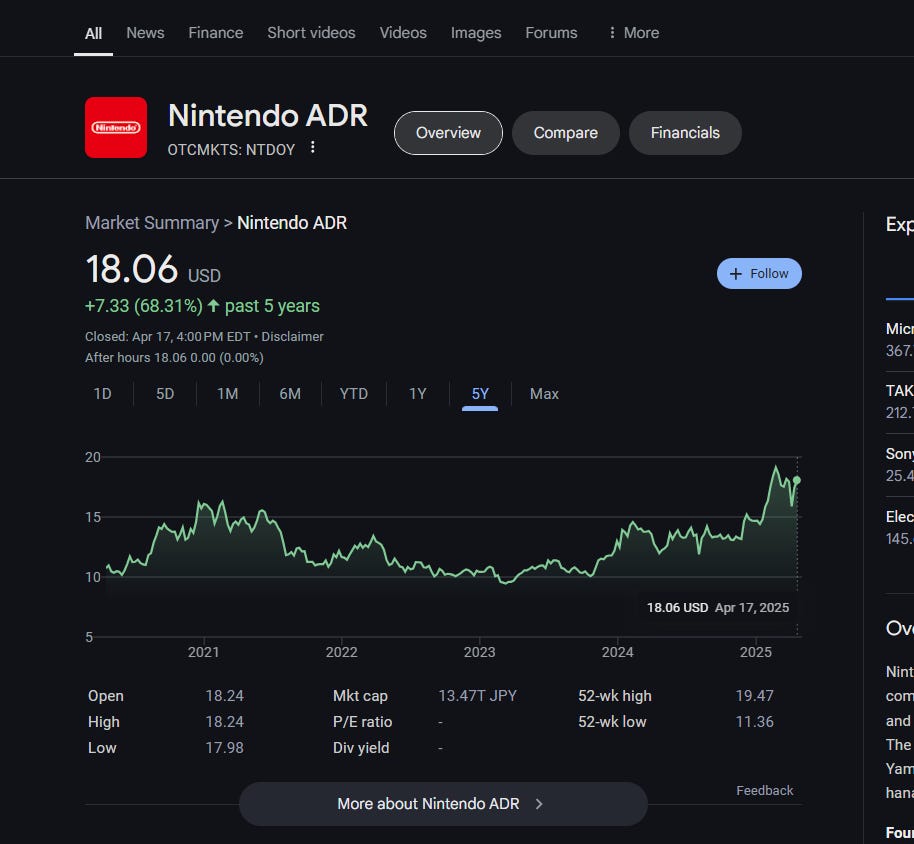

Nintendo has barely felt this market downturn:

Coupang has struggled a bit, but I think it is a slam-dunk buy here given how much the Korean Won has appreciated vs. the U.S. dollar (and the overall business quality):

I am not saying you need to clone my portfolio. Please do not, if I am being honest. Everyone invests differently, and you cannot borrow conviction.

But consider that sometimes the macroeconomics matter. And it can stare you right in the face, waiting for you to take action.

Here’s the best part of this strategy, too: my portfolio will do just fine if I am wrong on the US dollar devaluing. This is the type of low downside, high upside idea I love when looking at individual stocks.

So why not also use this framework in overall portfolio construction?

-Brett

P.S. upcoming newsletters will focus more on earnings such as American Express, Portillo’s, GoGo, and other stocks I follow. Expect less macro.

You're spot on about it being intentional by the administration. They want to bring the dollar lower. Bessent has said it consistently over the past few years. Many smart portfolio managers loaded up in Latin America because they saw it coming. $ABEV is a good example in Brazil.