Remitly Global: Why I Am Buying This Hidden Fintech Stock (Ticker: RELY)

A potential compounder at a profit inflection

YouTube

Spotify

Apple Podcasts

Today, we released a podcast on Remitly Global. It will be the next stock I buy in my personal portfolio.

Here are show notes outlining why.

What inspired the research on Remitly?

I was inspired to research Remitly for a few reasons:

Ryan’s episode on Wise. Wise is the Yin to Remitly’s Yang (the other leading disruptor in remittances and cross-border personal finance)

This thread from Mario Cibelli: https://x.com/mario_cibelli/status/1822607787911684136

Mario says Remitly has a chance to be the Booking.com of the remittance space. Using this analogy, Wise would be the Airbnb. Booking.com has posted a 24% CAGR for shareholders since 2002 after the dotcom bubble implosion.

I thought Ryan’s pitch was interesting and I respect Mario as an investor, so this may be a promising sector with some developing compounders to check out.

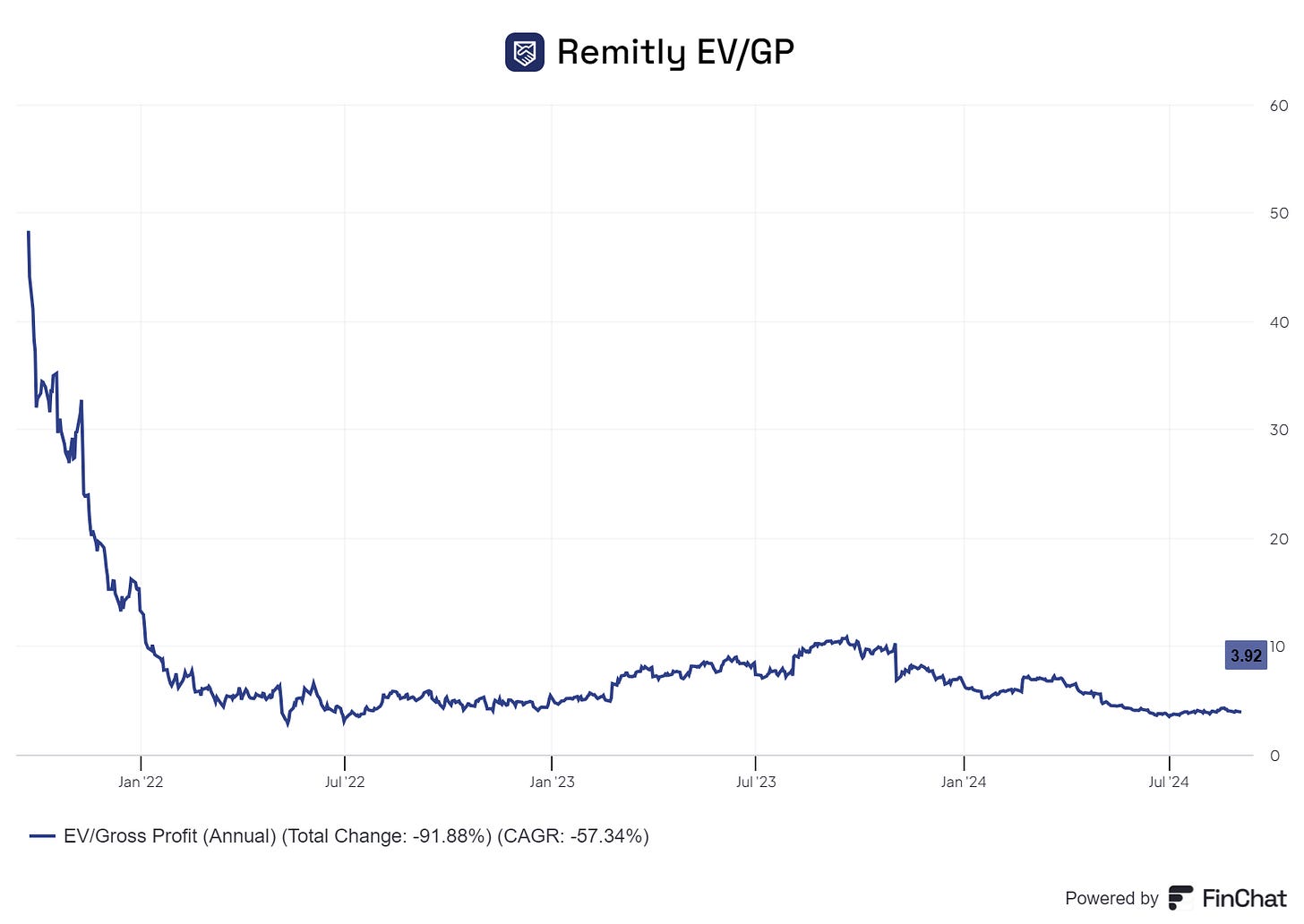

Remitly is in a 72% drawdown since going public in 2021. Since 2019, revenue has grown at a 61% annual rate. These two facts alone warrant an investigation into the business.

History of Remitly’s business

Matt Oppenheimer was working in Kenya when he noticed how frustrating it was for locals to receive money from out of the country. They had to pay a ton of fees, pick up at various locations in cash, and risk robberies picking up the money. There was a ton of friction and danger in the process.

As a younger person who worked at a bank (Barclays) Oppenheimer thought that smartphones and digital technology could help improve the remittance market. Thus, with two other people (Josh Hug and Shivaas Gulati) the idea for Remitly was born in 2011.

It is based in Seattle and has followed a fairly typical VC-backed path. It began by focusing on a few corridors (note: corridor in remittances means a specific country-to-country connection). These corridors were the U.S. to the Philippines, India, and Mexico.

These are three of the largest corridors where young professionals (i.e. digital natives) are sending money back to their families or friends. Remitly targeted these cohorts of people who wanted a seamless way to send money back to relatives while also giving them flexibility in pick-up options (not everyone is cashless back home, more on that later).

Today, it is the largest U.S.-based digital remittance company, competing with the likes of Wise, PayPal, Western Union, and banks in remittance payments.

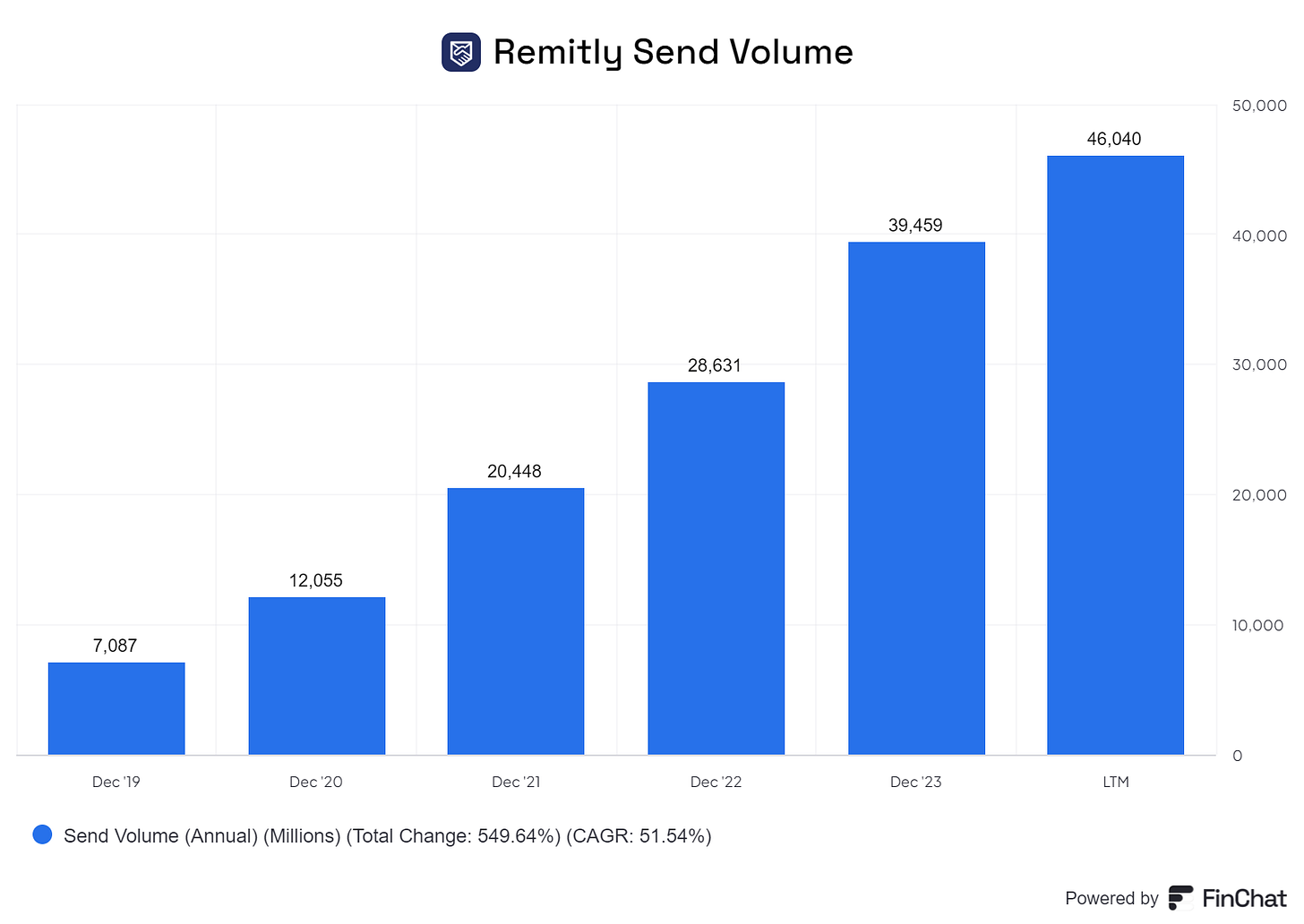

Over the last twelve months, send volume was $46 billion and has grown at a 51.5% clip since 2019. Management estimates it now has a 2.5% market share in remittance send volume compared to zero a decade ago.

What does Remitly offer? Why do people use it?

Remitly’s offering is simple. It offers people the ability to send money cross-border on their phones. Importantly – and this is the largest difference between Remitly and Wise – the company allows the receiver of money (i.e. grandma back home) to receive it in a variety of methods. This could be a cash pick-up, digital, or even cash delivery.

“Senders in 30 countries, including the U.S., can transfer money to recipients in more than 170 countries. Depending on the country, someone can send money via methods such as a debit card, credit card, or bank account. Money can be transferred to more than 3,000 banks and over 460,000+ cash pickup locations, and cash might be available to a recipient through mobile or home delivery”

A digital native in the United States (or other countries, there are now 5,000 corridors available) will download the free Remitly application. They then connect a bank account or debit card (funding method) and send it to the corresponding location in the other country.

At its core, there is nothing special about the remittance business. You simply have to follow the steps to get your business set up with the appropriate licenses, bank account partnerships, and the corresponding technology.

So why did Remitly win over other start-ups? Because it focused on what customers care about with remittances.

First, they care about trust and reliability. Oppenheimer repeatedly says that a brand is “a promise to a customer that is repeatedly delivered” and I think that is a great mantra for a remittance company. If you are sending $1,000 from the United States to grandma in India, you do not want this money to get stuck, lost, or stolen.

Second, they focused on specific corridors to perfect that product over time. Each country will have different cultural norms when it comes to banking and payments. So, Remitly tailored its business by setting up local marketing, banking partnerships, and payout partnerships. This made its customer experience much better.

Third, of course, it lowered fees vs. the legacy players. However, it is not necessarily focused solely on costs. They want to provide the best value for its core customer, which is someone in the United States sending money regularly to someone else abroad.

For anyone who follows Wise after our coverage on the show, I would note that the companies do not overlap as much as you think. Wise began in Europe and is focused on richer consumers sending digital-only (no cash pick-up) remittances or going beyond just remittances to international personal finance.

To stereotype it, Wise is going after the digital nomad living abroad. Remitly is going after the immigrant tech bro sending money back home.

I may argue the tech bro is the more reliable customer.

What is the company’s business model? How are they growing?

Unit economics for Remitly are easy to understand. Today, it makes almost all of its revenue from cross-border payment fees. It simply takes a cut of every transaction sent on the network.

To calculate a take rate, take the revenue and divide it by the total payment volume over a period. Over the last twelve months, I have a take rate of 2.35%. In 2019, the take rate was 1.79%.

You might think that this is a bit high for a remittance disruptor. Isn’t Wise at a sub-1% take rate? Yes, but remember that Remitly is offering cash pick-up and other solutions. This is more costly but improves the customer value proposition. This is why volumes are growing so quickly. If it solely focused on digital transactions, it might have a lower take rate. But then it would be tightening its addressable market for no reason.

Over time, Remitly will likely become entirely digital. As this occurs, along with the general scale of its operations, I hope it lowers fees for customers.

Below is a table of Remitly’s cost buckets from 2022 and 2023:

Notice anything? I see a few positive trends.

First, gross margins are expanding. If we look at transaction expenses (i.e. payment processing costs) they were 40% of revenue in 2022. In 2023, they were 35%. Customer support costs improved from 10% to 9% of revenue in 2023.

This is a gross margin of 55%, give or take, if you include customer support. Not bad. I think it can expand slightly but there will always be variable costs and customer support costs in remittances.

With these gross profit dollars, Remitly is spending a good chunk (equating to 25% of revenue) on sales and marketing. $234 million in 2023. It then spends a good amount on technology and corporate overhead costs today.

Remitly’s leverage will come from maintaining and scaling gross margins and lowering technology and corporate overhead costs as a % of revenue. It will likely maintain high marketing costs given its runway to attract new customers.

Operating margins are negative but moving in the right direction post-COVID. If gross margins eventually hit 60%, marketing stays at 25% of revenue, and tech/overhead costs are both 10% of revenue each, then Remitly will have a 20% operating margin. This sounds about right to me.

This gets to Remitly’s strategy for growth and why it has been so successful in attracting customers. It has a great marketing muscle that has won its target customer. Active customers have gone from 1 million to 6.9 million in five years. That is a ton of market share taken from legacy players. With only 2.5% market share, there is a lot of room to run.

And the growth playbook is simple: spend marketing dollars efficiently to tell customers about your improved remittance product. When they start using your improved remittance product, they become a predictable revenue stream (customers are generally sending money back home on a schedule). Marketing dollars are the upfront cost, which then gets recouped quarter after quarter.

Cibelli says the same in his tweet thread. It also shows the comparison to Booking Holdings:

“Over the past 15 years booking’s marketing expense as a percentage of revenue increased by ~50% while its operating margin about doubled. Importantly, ad spend was up something like 17x over this time period. This took a lot of the oxygen out of the room for competitors.”

“This type of dynamic is what’s most interesting about Remitly longer-term. With its rapidly increasing scale and superior product offering, can the company press the accelerator on marketing and accumulate a commanding share of the rapidly growing digital remittance space?”

If you think this is just spending money on Google search, it is not. Remitly has done some smart campaigns tailored to local regions in the United States. For example, it targets Hispanic-focused remittance billboards in places like the Miami airport and says it can see strong returns on these investments. It focuses on the details of what makes a customer happy (and how to acquire this customer) in each specific locality for both the sender and the receiver.

Over time, I think this leads to a competitive advantage.

Do you trust management?

I like Oppenheimer. He is ambitious but not a VC-backed founder where you start rolling your eyes when they talk. To be determined if he has entered “founder mode” though.

He owns 7,181,048 shares worth around $100 million. This may be the sweet spot of executive incentives. He does not have so much wealth where money is not a factor (if Remitly blows up, he is not set up for life I bet). But, he still has a lot of skin in the game and I think is plenty motivated to have Remitly succeed.

Management is not given bonuses or complicated payouts for compensation at Remitly. On the one hand, I like the simplicity. On the other, they do a lot of RSUs that are not tied to any performance metrics. I think compensation could be improved, but it is not a red flag.

More importantly, Oppenheimer, in my opinion, is on a mission to transform international money transfers. He wants to win market share in this space and has proven the skills to do it in the past. Why can't they get to 10% market share? 20%? I see a long runway for growth.

Is the stock cheap? (financial projections)

Below, I will go through my assumptions for Remitly and why I believe they are reasonable.

Analysts expect remittance volume to grow at 5% - 10% over the coming years. I think this is a fine assumption given overall GDP growth, inflation, and the growing number of immigrants and global citizens sending money to another country. This can provide a 5% durable growth tailwind for Remitly.

I expect Remitly to keep gaining market share in remittances due to:

Its proven strategy in customer acquisition

Gaining more scale and word-of-mouth

Big banks don’t care about this small (but bad customer experience) part of their business

Western Union, MoneyGram, and other legacy competitors are facing an innovator’s dilemma and tech debt

Digital remittances keep taking share

However, I expect the take rate to come down, which will be a headwind to revenue growth. Add and subtract everything together, and I think a revenue growth assumption of 20% makes sense for the next five years.

Okay, but what about margins? As I outlined above, margins can move to 20% over time. There will be operating leverage on tech and overhead costs, but they will still have to spend a lot on marketing each year. Marketing as a % of revenue may fall slightly, but it could be smart for them to maintain positioning and build a “moat” similar to Booking by keeping themselves at the top of search results and at the top of consumers’ minds.

If revenue grows on average at a 20% rate through 2030 and operating margin grows to 15%, that is around $500 million in operating earnings. Today, Remitly has a market cap of $2.7 billion, or only around 5.4x my 2030 earning estimates. As a note, there will be some SBC dilution but given they will be cash flow positive I think any buyback or cash pile-up on the balance sheet can negate this headwind.

Speaking of the balance sheet, it is not much of anything at all. They have $185 million in cash and $342 million in total liabilities. Most are customer liabilities for payouts and accrued expenses (nothing out of the ordinary). I like it. Keep it simple, keep it clean.

Clearly, the stock is cheap if these estimates prove correct or are exceeded. I think it would be a 3x - 5x return over the next five years.

Discussion question: Should I have confidence in these estimates?

Growth outside North America and Remitly Circle

I want to highlight two things that increase my optimism for Remitly’s growth. One can drive material growth over the next five years (and beyond), the other might not be material for five years but can expand its addressable market.

First, is revenue outside of North America. This is revenue from corridors that do not include North America (United Kingdom to Kenya, as an example). This segment has grown revenue at a 109% CAGR since 2019 and now has $242 million in revenue.

Second, I want to talk about Remitly Circle. This is a product in development that may not come out fully for a year or two. Instead of just “send” it will allow customers to “save, send, and spend” money internationally in a global account.

Sounds like a Wise account to me. Remember though that the Venn diagram of Wise and Remitly customers is thinner than you think, so I don’t think they will necessarily be looking to steal customers. It is an upsell to the existing customers. If you are living in an emerging market with currency woes, why not park some cash in a different currency and earn a safe yield? Just one example of the use cases here.

Gut check: does Remitly have a moat? Can it expand?

I believe Remitly has a weak moat with a chance to expand to a wide moat over the next 10 - 20 years. With that being the case, I have decent confidence that Remitly can hit or exceed my growth projections. Competitive advantages drive durability, and durability drives predictability for me, the potential investor.

In my opinion, Remitly mainly obtains a moat through economies of scale. It has economies of scale with the regulatory and corridors aspect. Some describe this as a network effect, but I’m not necessarily sure that someone sending U.S. to India cares if you open U.S. to Guyana. But, there is a lot of value in growing the payout methods. There is also a barrier to entry from all the regulations across all these countries. It is a slow process and similar to Wise, Remitly is one of if not the only other large digital-first player to obtain this network.

Remitly can obtain economies of scale through a marketing advantage, too. If it gets to 5% or even 10% market share in global remittances, it will have the gross profit firepower to maintain a high level of marketing spend and crowd out any other start-up trying to attack its niche.

When competing with legacy institutions such as banks or Western Union, the innovator's dilemma is at its side. I highly doubt these players will be able to replicate the seamless experience when using Remitly on a smartphone.

Western Union’s business is stagnating:

Add everything together, and I think Remitly has a growing competitive advantage in a growing industry with a long runway to gain market share.

Are you buying shares? Is it going on the watchlist?

I will be buying shares of Remitly. I think the stock is cheap, I trust management, and I think the company has a growing competitive advantage.

The upside over the next 10 years is that Remitly is a 10-bagger. With new projects such as Remitly Circle trying to expand beyond just remittances, there is potential for this to be a huge financial services company over the long haul. Although we don’t need that to succeed.

At $1 billion in revenue which is likely going to be close to $1.5 billion soon, I think we are protected to the downside at today's market cap given the reliability of existing customers and unit economics that could be printing profits if they stopped reinvesting into growth marketing.

Of course, the stock could fall over 50% in the next year. But over the long term, I think the value of the stock is protected by just the existing customers. Growth can come from acquiring millions more in the next few years.

A high upside but protected downside stock. I know this is funny to say for a company generating negative operating margins, but I have confidence in the value and predictability of Remitly’s remittance customers.

Risk to watch out for and why I would sell

There are a few risks to watch out for.

I worry the high current fees mask a risk over the long-term from competitors. One thing I like about Wise a lot more than Remitly is that they have a stated goal of bringing fees down. This creates a barrier to entry. Over time, I hope Remitly does the same or it risks losing customers to someone like PayPal or Wise.

Visa Direct (and whatever Mastercard has that is the equivalent product). I still get confused about what exactly this is, but Visa Direct says it is “helping transform global money movement.” It utilizes the Visa network and all its endpoints to help Banks enable their customers to send money. It has partners such as Adyen or Bank of America. Why is this a risk to Remitly? Because it could level the playing field for other banks. Something to watch out for in what is a market that has a lot of moving parts.

Overall, the simple risk for Remitly is that it has never had a positive operating margin. Look, I think it is clear that they can get to positive profitability, but if they don’t prove this out or show more progress over the next few years it will be a concern. I could be wrong about the unit economics.

If that happens, I will sell.

I do not plan on selling on valuation concerns unless it gets absolutely extreme, given the runway for growth.

Chit Chat stocks is presented by:

Public.com has just launched its BOND ACCOUNT. Lock-in interest rates of 6.9% (as of 8/28/24) through 2028 right before the Federal Reserve is set to lower interest rates!

With as little as $1,000, the bond account allows you to buy a diversified portfolio of bonds and lock in your yield even if the Federal Reserve cuts rates.

It only takes a couple of minutes, get started today at Public.com/chitchatstocks and open up a bond fund today!

A Bond Account is a self-directed brokerage account with Public Investing, member FINRA/SIPC. Deposits into this account are used to purchase 10 investment-grade and high-yield bonds. The 6.9% yield is the average annualized yield to maturity (YTM) across all ten bonds in the Bond Account, before fees, as of 8/28/2024. A bond’s yield is a function of its market price, which can fluctuate; therefore a bond’s YTM is “locked in” when the bond is purchased. Your yield at time of purchase may be different from the yield shown here. The “locked in” YTM is not guaranteed; you may receive less than the YTM of the bonds in the Bond Account if you sell any of the bonds before maturity, or if the issuer calls or defaults on the bond. Public Investing charges a markup on each bond trade. See our Fee Schedule.

Bond Accounts are not recommendations of individual bonds or default allocations. The bonds in the Bond Account have not been selected based on your needs or risk profile. You should evaluate each bond before investing in a Bond Account. The bonds in your Bond Account will not be rebalanced and allocations will not be updated, except for Corporate Actions.

Fractional Bonds also carry additional risks including that they are only available on Public and cannot be transferred to other brokerages. Read more about the risks associated with fixed income and fractional bonds. See Bond Account Disclosures to learn more.

Nice write up and analysis! I dabbled in fintech for a bit over the past 12 months and found two limiting factors: Lots of competition which then leads to cut-throat pricing and lower margins. As you write, there is a potential path to consistent profitability if they get SGA and operating expenses lower. One positive dynamic is growing immigration (legal or illegal does not matter) to developed countries in the Americas and Europe. These are RELY's potential prime customers of the future. Cheers!

this is a bit nit picky but technology/overhead would need to be reduced to 15% total, not 10% each to get to 20% operating margins.

gross margin 60%

marketing 25%

technology 10%

overhead 10%

operating income would be 15%