Why I Own Nintendo Stock: Round Two (NTDOY)

Short, medium, and long-term catalysts. What's not to like?

YouTube

Spotify

Apple Podcasts

This week, we published an episode updating my thesis on Nintendo. With a new console coming out within a year, I think it is a perfect time to discuss the idiosyncratic gaming giant.

Here is the first report:

Why We Own Nintendo Stock (Ticker: NTDOY)

Reminder: these are show notes that should be read in conjunction with the podcast. Do not expect these notes to be a polished research report.

Investors have fallen out of love with Nintendo. Cathie Wood doesn’t own it anymore. It has trailed the S&P 500 and Nasdaq 100 over the last five years:

And yet, I think the story is as good as ever. The thesis is slowly materializing.

Below, you will find my full show notes on the stock. The short of it is, I think Nintendo is a perfect set-up for the next five years.

You have:

A short-term catalyst with the new console release

A mid-term catalyst when the company has massive amounts of cash to return to shareholders while ALSO maintaining its rules for a conservative balance sheet

A long-term catalyst (if you could call it that) of a great culture of entertainment franchise development and preservation

Full Show Notes

I own Nintendo stock, purchasing shares earlier this year. According to my Finchat portfolio tracker, it is 10% of my account.

Here is what I wrote in my personal journal as justification for buying the stock earlier this year:

“Why do I own Nintendo? It’s simple:

The business has a wide moat and is high-quality

I can trust the management team

I believe the stock is cheap

Nintendo has a wide moat due to its well-loved entertainment IP. Nobody can replicate Mario, Zelda, Pokemon, and these other popular entertainment brands. It does not have a monopoly on family-friendly video games, but it is damn near close to it. It has built trust with families over decades that kids can safely play Nintendo games. This trust cannot be replicated by a random company overnight.”

“I think Nintendo’s stock is cheap if the new console is successful. They likely trade at an earnings yield of 10%+ if the new console maintains or grows the user base. There is also some upside if the entertainment expansion strategy is more profitable than I am thinking. Either way, the theme parks and movies are a moat expander.”

Back in May of 2023, we posted a podcast called “Why We Own Nintendo.” You can listen to the first episode wherever you get your podcasts. Here is the YouTube link:

Let’s explore an update on the thesis, why I still own shares today, and what I expect for the stock in the coming year.

History of Nintendo

Here is an excerpt on the history of Nintendo from our first podcast:

“Each console was different in one way or another. And some of them were hits, some of them were flops, but ultimately there was one common trend. None of them stuck. So you’d have these massive shifts in cash flow. When hardware was selling like crazy, there was more eagerness to produce games both from Nintendo themselves and third-party developers, and with more options for games there were naturally more game sales. This created wonderful operating leverage and profit margins in good times, but really difficult periods when consoles evolved. This led to a culture that prioritized conserving cash for a rainy day.”

Nintendo’s business model is to build innovative gaming hardware, sell the hardware at close to the cost of production, and then make money by selling first-party games exclusively on the hardware. It owns popular gaming franchises such as Mario, Zelda, and Splatoon. It has a partial stake in the Pokemon Company, which produces exclusive games for Nintendo systems as well.

While it has been a long 30+ years in the gaming business, the short story investors need to know is that Nintendo’s gaming business model went through a boom and bust cycle for many years.

When it launched new innovative hardware, at first consumers loved it because of the new form factor (example: motion sensors with the Wii). Then, they would think of the hardware as a gimmick and fall out of favor with the system. Since it makes most of its money through exclusive game sales, losing hardware players meant a collapse in profits.

My main thesis is that Nintendo has improved its business model by emphasizing longevity and player durability with its new hardware system called the Nintendo Switch.

Earnings durability means the stock deserves a higher earnings multiple, growing cash on the balance sheet can be returned at a healthy rate to shareholders, and new entertainment form factors can help grow the earnings pie.

Let’s dive into each part of the thesis.

The Nintendo Switch: durable active users and profits (so far)

The Nintendo Switch was launched in 2017. It combined Nintendo’s handheld and console hardware divisions. The main innovation of the product was the fact that you could play on the go or on your TV at home. Consumers love the flexibility.

Unlike prior consoles that saw sales peak after a few years and quickly collapse, Nintendo’s hardware and software sales for the Switch have remained strong into year eight of the system.

In fiscal year 2020 – ending in March of 2020, Nintendo does not operate on a calendar year – the company sold 21 million gaming hardware units and 169 million software (game) units.

In fiscal year 2023, Nintendo sold 18 million hardware units and 214 million software units. Remember, software unit sales drive profits.

In fiscal year 2024 (ended in March of this year), Nintendo sold 16 million hardware units and 200 million software units. Its new Zelda game sold over 20 million copies at a $70 price point.

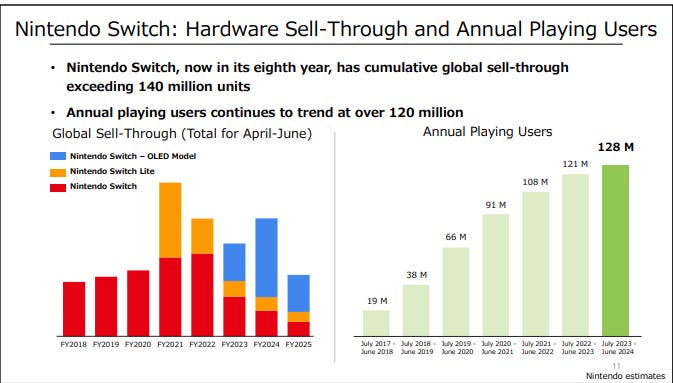

Active players have steadily grown since the Switch launch, per this chart:

The company has close to 120 million active players eight years after the Switch launch, a massive improvement from other products.

You can see this on the income statement. Profits are stable from fiscal year 2020 in U.S. dollar terms and up massively in Japanese Yen terms. The Yen has depreciated against the dollar, which is a headwind to profits in US dollar terms because of how much of its sales come from Japan.

Here are the charts in both Yen and USD. Note that the pandemic was an abnormally profitable period.

So, why did this happen? A few reasons:

Success of Nintendo Switch Online and the Nintendo Account

Reinvestment into flagship games/franchises years into console releases

Updating the hardware with improved form factors (Lite, OLED models)

Embracing third-party development (which drives software sales)

Now, management has announced the “successor to the Switch” will be released sometime this fiscal year. So, we should expect new hardware to be released by March of 2025.

Expectations for Switch 2, stock catalyst

The new console – which I will call Switch 2 for this podcast – is reported to be a similar form factor to the Switch but with updated capabilities. This means a better screen, faster processing, stuff like that.

Compared to last year, we now have confirmation on a release date. The year following the new Switch launch is important because it will prove or disprove the durability of active players, software sales, and profits.

My expectations for the Switch 2 are as follows. First, I expect it to drive growth in hardware sales as the core Nintendo customer refreshes its console. This year, Nintendo is guiding for 13.5 million hardware unit sales. I expect around 20 million or higher for the next few years after the Switch successor is launched.

Second, I expect a surge in software sales. Not only will new hardware be in the hands of players, but Nintendo will likely launch new software titles. For example, it has been years since an updated Mario Kart has been released. This is Nintendo’s most popular and profitable title.

This year, Nintendo is guiding for 165 million units of software sales. I expect software sales of 200 million or higher in the years following the new console.

Both these developments should drive the active users chart to steadily grow. Or, at least remain stable.

If all this occurs, I think Nintendo’s gaming profits can grow from around $3.5 billion over the last 12 months to an average of $5 billion in the first three years following the new console launch. Perhaps even higher if the Yen finally recovers vs. the USD.

Of course, these are not exact predictions. However, if I am directionally correct, the stock will do well. Full valuation work can be found in the second-to-last section.

Growing conviction on other entertainment segments

In last year’s podcast, we discussed Nintendo’s investments outside of gaming to drive an entertainment flywheel with its family-friendly franchises. Or, you might think of it as a hub-and-spoke model with gaming at the center.

Management harps on this chart a ton:

Over the last year, we have seen a lot of improvement for this strategy, especially in movies.

The Super Mario Movie launched last year and is now one of the best selling animated films ever. Here is how the film impacted Nintendo’s “IP and Other” segment:

Can you guess when the movie was launched? The movie itself is not a profit driver today, but just the beginning of a new segment for Nintendo I think can drive profits in the coming decade.

In the last twelve months, Nintendo has announced the production of a Zelda movie and another movie related to the Mario universe. The Mario movie is coming out in early 2026.

As Nintendo’s movie catalog steadily grows, it will earn more box office and licensing revenue. On top of direct movie revenue, Nintendo has shown that a movie can drive franchise sales from existing gaming titles. This would be abnormal without, and the only explanation is the Mario movie.

Let’s not forget the Nintendo World at Universal theme parks, which should all be fully operational within five years.

Five years from now, I expect direct movie revenue, indirect gaming revenue, and theme parks to drive $1 billion in earnings for Nintendo.

Analyzing the balance sheet

At the end of last quarter, Nintendo had $18 billion in cash and equivalents on the balance sheet. This huge net cash position is 30% of the stock’s market cap of around $60 billion.

Investors wonder why Nintendo keeps such a high net cash position. Japan’s central bank keeps interest rates close to zero. Wouldn’t the company be better equipped to special dividend billions of dollars to investors?

Well, yes. But, I understand where Nintendo is coming from. They want a sturdy balance sheet that can survive a multiyear downturn. And they have it.

Investors seem to take this information and put a huge discount on Nintendo’s management team. However, I think more positively about this balance sheet strategy. Here are two things investors should consider with Nintendo:

The company already returns cash to shareholders. It pays a dividend and has bought back stock periodically. Shareholder yield was once over 4%. Today, it looks quite low but that is because they are reinvesting into the new console launch.

If the new console is successful, cash will start pouring in. The company already has its overly robust balance sheet, so it can return this cash back to shareholders.

Valuation: What is the stock worth?

Today, Nintendo has an enterprise value of ~$40 billion by just taking the market cap and subtracting its net cash. There could be hidden value in its investment portfolio that I am valuing at zero. If we ever get value from these investments, that can be a cherry on top of the stock returns.

If the company can grow gaming earnings to $5 billion and then movie/theme park earnings to $1 billion, consolidated annual earnings will be $6 billion.

$6 billion vs. an EV of $40 billion is attractive. $6 billion in annual earnings for multiple years vs. an EV of $40 billion is even more attractive. I think Nintendo is capable of generating its entire EV in cash flow over the next 7 - 10 years.

So, what does that make the stock worth? I have no precise answer. I think the U.S. ADR is worth at least $25 vs. around $12 as of this recording. So, close to a double.

For some of the best entertainment assets in the world, I think this is a great risk/reward at current prices.

When would I sell?

I would sell Nintendo stock if the new console is a clear flop. A clear flop means weak hardware sales AND weak software sales. It is almost certain that this would lead to weak profits. A scenario such as this would prove my thesis wrong, meaning I should sell.

The second reason I would sell is if the stock got a premium valuation. For example, let’s say the stock shoots up to 30x my $6 billion earnings estimate. I have concerns that Nintendo can or is even willing to grow its earnings that much higher.

I don’t want to own a no-growth stock at 30x earnings. Unlike other stocks that may have a long runway for reinvestment, I think selling a stock such as Nintendo at a huge multiple of earnings does not present a huge “error of omission” risk.

Of course, the stock would do wildly well under this scenario. Honestly, it is the situation I am hoping for. Profits inflect higher, leading Wall Street to aggressively bid the stock up and get the earnings multiple from below-market to above-market. You could get a multibagger within five years.

Here’s to the next decade of owning Nintendo stock. The next year will be exciting as we see whether the Switch 2 thesis plays out.

Brett

Chit Chat stocks is presented by:

Public.com just launched options trading, and they’re doing something no other brokerage has done before: sharing 50% of their options revenue directly with you.

That means instead of paying to place options trades, you get something back on every single trade.

-Earn $0.18 rebate per contract traded

-No commission fees

-No per-contract fees

Options are not suitable for all investors and carry significant risk. Option investors can rapidly lose the value of their investment in a short period of time and incur permanent loss by expiration date. Certain complex options strategies carry additional risk. There are additional costs associated with option strategies that call for multiple purchases and sales of options, such as spreads, straddles, among others, as compared with a single option trade.

Prior to buying or selling an option, investors must read and understand the “Characteristics and Risks of Standardized Options”, also known as the options disclosure document (ODD) which can be found at: www.theocc.com/company-information/documents-and-archives/options-disclosure-document

Supporting documentation for any claims will be furnished upon request.

If you are enrolled in our Options Order Flow Rebate Program, The exact rebate will depend on the specifics of each transaction and will be previewed for you prior to submitting each trade. This rebate will be deducted from your cost to place the trade and will be reflected on your trade confirmation. Order flow rebates are not available for non-options transactions. To learn more, see our Fee Schedule, Order Flow Rebate FAQ, and Order Flow Rebate Program Terms & Conditions.

Options can be risky and are not suitable for all investors. See the Characteristics and Risks of Standardized Options to learn more.

All investing involves the risk of loss, including loss of principal. Brokerage services for US-listed, registered securities, options and bonds in a self-directed account are offered by Open to the Public Investing, Inc., member FINRA & SIPC. See public.com/#disclosures-main for more information.

We currently own NTDOY as well and have an article about it if you want a read. https://open.substack.com/pub/schwarcapital/p/nintendo-ntdoy-equity-research-report?r=2m1atw&utm_medium=ios

I have a feeling it will probably play out as you expect: earnings inflect higher and Wall Street extrapolates this trend with a high multiple.

However, in the long-run do you think 20x earnings is a fair multiple for a low to no growth company (once it hits the $5-$6bn earnings level)? I'd expect it to be closer to 10x, especially for a non-US company.